In 2023, many investors expected that the Federal Reserve’s (Fed) aggressive monetary policy tightening would lead to a potential recession and a pick-up in defaults in the high yield market.

Given this backdrop, the broad market consensus was for investment grade to outperform high yield and, within high yield, higher quality BBs to outperform lower quality CCCs.

This consensus was wrong. Despite continued volatility in the US treasury market, the high yield market has benefited from a healthy fundamental backdrop and resilient US economy. US high yield companies have, despite diverging trends across sectors and issuers, performed better than anticipated.

Technical factors have also remained very supportive and, over the past couple of years, the market has seen a wave of rising stars to investment grade. This has surpassed the number of fallen angels. Alongside this, there has been less new issuance in the primary market, creating more demand for new deals when they do come to market.

Looking across the high yield market, lower-rated credit has outperformed higher quality in 2023 and 2024 year-to-date, while short duration has continued to look appealing relative to longer duration due to the inverted yield curve and prolonged rates volatility.

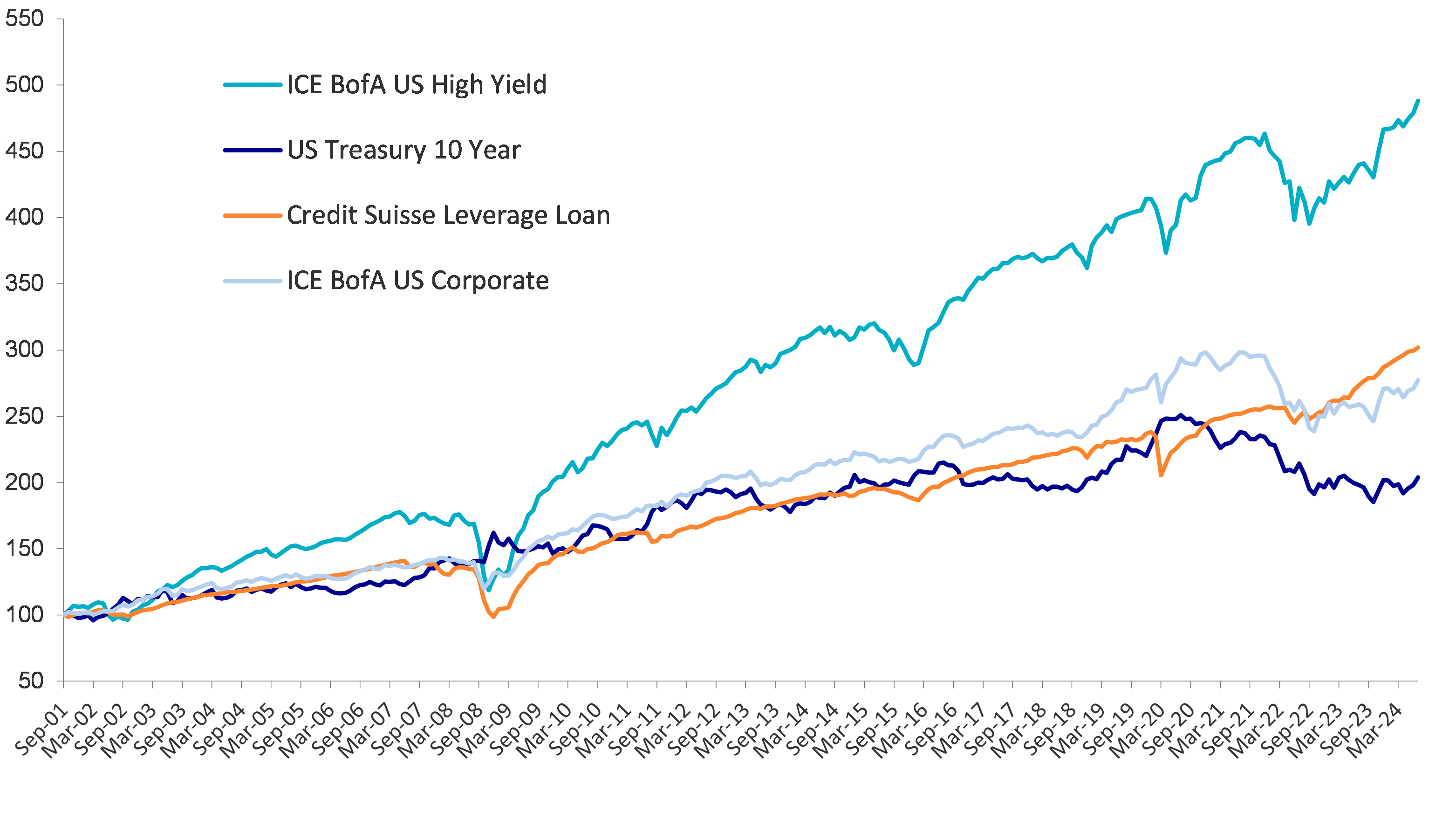

The US high yield market has outperformed investment grade, government bonds and cash over this timeframe.

Is there still room to run from here?

Looking at previous cycles, the high yield market tends to bounce back strongly after a sell-off. This is because, as bond prices recover and coupons reset at higher levels, the level of income that bondholders receive increases.

This is reflected in the all-in yield, which in the US high yield market moved from around 4% in 2021 to 9% at the start of 2023 and is now slightly below 8%.

The sell-off in 2022, however, was unusual as the rise in yields was driven mainly by interest rate increases, not by credit spreads widening. This means that bond prices today remain discounted as the outlook for interest rates has been uncertain.

That could now be all about to change as we expect the Fed to start moderately easing policy. As such, there is still significant upside potential for the high yield market through a combination of higher income and continued bond price recovery.

It is worth bearing in mind that rallies in high yield can happen very quickly: in the fourth quarter of 2023, the US high yield market delivered a 7% total return as the market priced in rate cuts, with the average high yield market dollar price increasing from $88 in September to $93 by year-end, remaining at $94 today.

Timing such market moves can be challenging and the only way to ensure full participation in rallies is by being invested, whilst also benefitting from the higher carry now on offer.

We expect high yield spreads to continue to be supported by broadly healthy corporate fundamentals and any potential spread widening to be met with buyers, providing further technical support.

That said, dispersion is increasing as high yield companies adjust to a higher-rate environment. That is why prudent fundamental analysis is critical to identify companies that are well positioned to pay coupons on a timely basis and pay back, or refinance, principal.

Carry

Over the long term, the high yield asset class has proven its ability to outperform other parts of the fixed income market. This is principally due to the attractive carry component that compounds through time. High yield also has the potential to compete with equities from a return perspective but with less volatility.

US Debt Index Returns

Source: AXA IM. Dara 30th September 2001 – 31st July 2024.

Since the financial crisis 15 years ago, the high yield asset class has matured significantly in terms of the quality and diversity of companies that make up the market. Many of these are household names and global leaders in their lines of business, that feel very comfortable using the high yield market to access capital.

Due to these characteristics and developments, high yield has become much more of a core part of investors’ portfolios. As well as the high income available relative to other asset classes, high yield also offers diversification qualities within a balanced portfolio.

With a risk/return profile that sits somewhere between the fixed income and equity markets, high yield can be used in a variety of different ways to suit different risk appetites and outlooks. It is an asset class that, even today, can continue to surprise to the upside.

Jack Stephenson is a fixed income investment specialist at AXA IM. The views expressed above should not be taken as investment advice.