Following the Federal Reserve’s 50 basis point interest rate cut, investors are closely watching to see if a ‘soft landing’ has been engineered or if a recession is on the cards.

Markets have been worried about an economic downturn for some time, with a summer slump hitting risk assets when the data soured. These fears eventually eased and stocks started moving higher again.

The first period, which spanned 11 July to 5 August, saw the MSCI AC World index slide by 7.1% as investors fretted that the Fed was behind the curve and had missed its chance to stave off a recession.

In the second period (from 6 August to now), the MSCI AC World has gained 4.9% thanks to more robust economic data and the prospect of interest rate cuts.

It must be noted that this is a very short time frame to review performance. However, the data might suggest how funds could react if there is a recession or if rate cuts come against a benign economic backdrop.

So, although these periods reflect opposing outlooks on the economy, did any global equity funds manage to outperform through both?

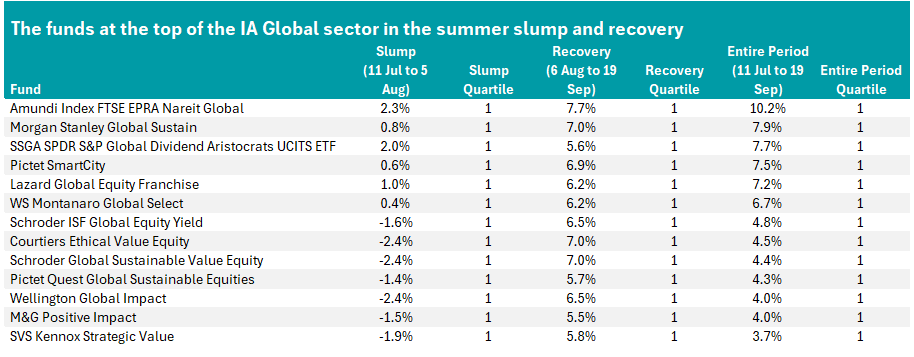

There are 13 funds that were in the first quartile of the IA Global sector over both periods and they can be seen in the table below, ranked by their total return over the entire period (11 July to 19 September 2024).

Of course, past performance is not a guide to future returns and there are any number of fund- or stock-specific reasons why any trends in this research might not hold up in the coming weeks and months.

Source: FE Analytics

Amundi Index FTSE EPRA Nareit Global came out on top, making a 10.2% total return since the start of the summer slump. This is down to a 2.3% positive return during the slump itself, followed by a 7.7% return in the time since.

This exchange-traded fund (ETF) is not a typical member of the IA Global sector as it offers exposure to real estate companies and REITS worldwide, rather than conventional global equities like most of its peers.

Looking at the conventional global funds, one common trend on the table is sustainable investing, through the inclusion of Morgan Stanley Global Sustain, Schroder Global Sustainable Value Equity, Pictet Quest Global Sustainable Equities, Wellington Global Impact and M&G Positive Impact.

Value investing is also represented by Lazard Global Equity Franchise, Schroder ISF Global Equity Yield, Schroder Global Sustainable Value Equity, Courtiers Ethical Value Equity and SVS Kennox Strategic Value.

The latest Bank of America Global Fund Manager Survey found that most investors think value investing will outperform growth over the next 12 months.

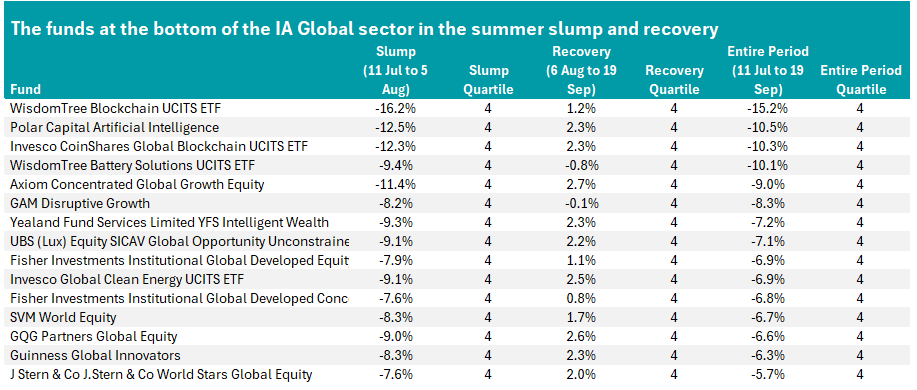

The reverse dynamic can also be seen in the data, however, with 15 funds posting bottom-quartile returns in both the summer slump and the subsequent recovery. They can be seen in the table above, ranked from largest to smallest losses over the entire period.

Source: FE Analytics

Four funds are down more than 10% since mid-July, all linked to the tech theme: WisdomTree Blockchain UCITS ETF, Polar Capital Artificial Intelligence, Invesco CoinShares Global Blockchain UCITS ETF and WisdomTree Battery Solutions UCITS ETF.

Several of the other funds in the fourth quartile for both periods are growth strategies, which tend to favour the tech sector.

Tech stocks dominated the market for an extended period but have come off the boil more recently amid concerns over the valuations of some of the more popular companies.

Some fund managers have argued that the next leg of the market rally will need to broaden out from the narrow leadership of tech if it is to be sustained in the long run.

Expanding this research beyond the global sector, there are 23 IA UK All Companies funds that made top-quartile returns in both periods. Invesco UK Equity High Income, Invesco UK Equity Income, Trojan Income and BlackRock UK are some of the bigger funds achieving this.

No IA UK Equity Income funds won in both the slump and recovery. Fidelity Global Dividend and AXA Global Equity Income were the only two funds leading the IA Global Equity Income sector over both periods.

Only nine funds in the four main mixed-asset peer groups made the cut, among them Invesco Distribution, MFS Meridian Global Total Return, AXA Lifetime Distribution, EdenTree Responsible & Sustainable Managed Income and Baillie Gifford Sustainable Income.