The UK equity market has performed strongly this year and has plenty more gas in the tank to propel it forward, according to Dzmitry Lipski, head of funds research at interactive investor.

He thinks UK-based investors should take a closer look at their home market, not least because it houses so many well-established global companies that derive much of their revenue from overseas. This means that investors can gain exposure to international markets without taking on currency risk.

The UK may have fallen behind the US in relative performance terms lately because it has far less exposure to the high-growth tech sector, but its larger weightings to finance, energy and mining offer diversification benefits that might appeal to investors who are concerned about the high valuations of tech stocks, he continued.

Since the Brexit referendum in 2016 and ensuing political uncertainty, the UK became an unloved laggard, which pushed down valuations to attractive levels, he observed. That dynamic has reversed since Labour’s victory and the UK is now seen by many as a haven of political stability.

The FTSE All Share is cheap on both a price-to-earnings (P/E) and a price-to-book basis, relative to the rest of the world and especially to the US, Lipski said. Even after this year’s strong run, the UK’s P/E ratio remains at an attractive level of around 16x. Interest rate cuts are set to provide a further tailwind.

The UK also offers compelling opportunities for income-seeking investors, with a 4% dividend yield forecast for the next 12 months.

For investors looking to increase their domestic exposure, Lipski suggested a pair funds: JPMorgan UK Equity Core and Artemis Income.

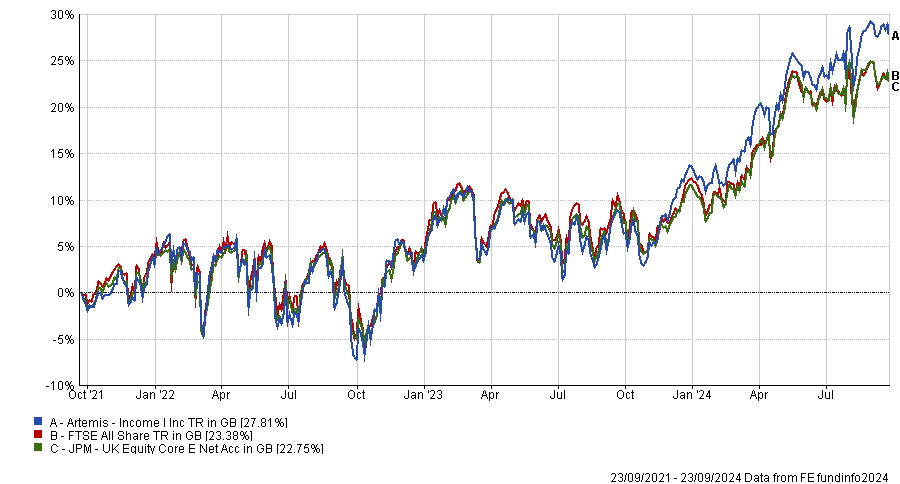

Performance of funds vs benchmark over 3yrs

Source: FE Analytics

JPMorgan Asset Management’s core UK fund might be suitable for risk-conscious investors because it is benchmark aware and only takes marginal stock and sector overweight and underweight positions, he explained.

The portfolio is constructed using both fundamental and quantitative analysis and it is managed by Callum Abbot and Christopher Llewelyn. The yield is above 3% and the fund is competitively priced with an ongoing charges figure of 0.30%.

Artemis Income should appeal to investors seeking a steady and growing income stream as well as longer-term capital growth. The fund holds 50 to 70 stocks, focussing on stable, well-established businesses with the financial strength to pay solid dividends.

FE fundinfo Alpha Manager Adrian Frost has helmed the fund since 2002 and his co-managers, Nick Shenton and Andy Marsh, also have many years of experience running income strategies. The fund’s yield is 3.4% and it charges 0.80%.