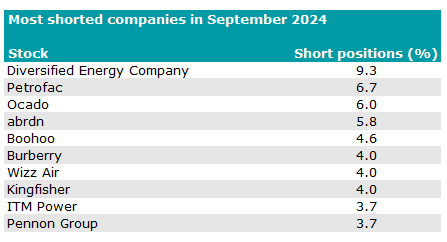

Diversified Energy Company is now the UK’s most-shorted stock, knocking Petrofac off that perch for the first time since November 2023.

Investment firms that bet against the natural gas company last month included Arrowstreet Capital, Bridgewater Associates, JPMorgan Asset Management, Millennium International Management, Point72 Asset Management and Qube Research & Technologies, according to the Financial Conduct Authority.

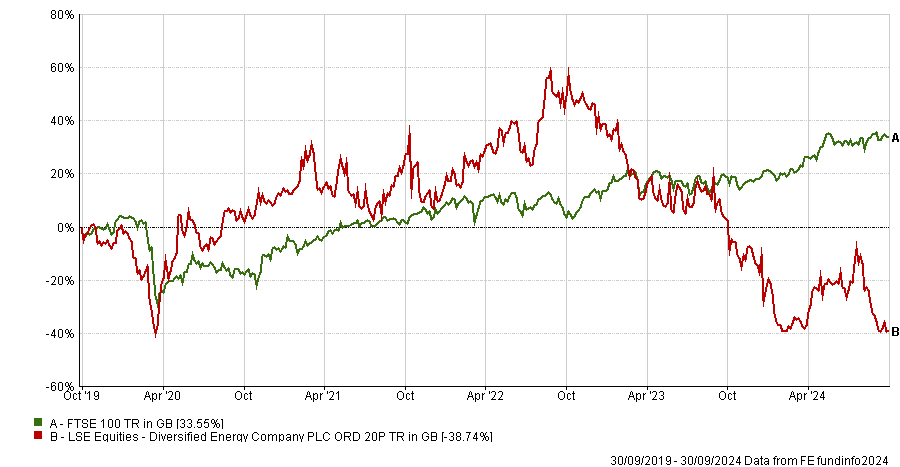

Diversified Energy's share price has fallen dramatically from £12.85 on 31 July 2024 to £8.44 on 30 September. It has almost halved (down 47.2%) in the 12 month period ending 30 September 2024 and is languishing close to five-year lows.

Performance of Diversified Energy Company vs FTSE 100 over 5yrs

Source: FE Analytics

Diversified Energy specialises in the production, marketing, transportation and retirement of natural gas and is the largest owner of oil and gas wells in the US.

Last December, four Democratic members of the US House of Representatives Committee on Energy and Commerce wrote to the company requesting information about how it stops methane leaks from its mature gas wells.

The letter, addressed to chief executive officer Rusty Hutson Jr., stated: “Diversified Energy is responsible for remediating a substantial share of the country’s ageing oil and gas wells, but we are concerned that your company may be vastly underestimating well cleanup costs.”

A significant number of the company’s wells are low-producing, marginal wells, which are expensive and difficult to maintain, the letter noted. “Reports suggest that many of your company’s marginal wells may be leaking a substantial amount of methane.”

This enquiry caused Diversified Energy’s share price to tumble, prompting a public response from the company, stating that it had “dramatically reduced its reported Scope 1 emissions by more than 25% compared to 2020” and was deploying “emissions best-in-class detection equipment and protocols, which includes completing emissions detection surveys on all its natural gas wells”.

Diversified Energy also said it had achieved a gold rating from the Oil & Gas Methane Partnership and Project Canary, two independent emissions monitoring programs.

Furthermore, it has partnered with several states within the Appalachian region of the US to retire state-owned orphan wells “in a cost-efficient and environmentally sound manner”.

The gas company has been one of the UK’s most shorted stocks since February but the recent spate of bets may have been triggered by its interim results for the six month period to 30 June 2024, released on 15 August.

Diversified Energy’s net income of $16m fell dramatically compared to $631m for the first half of 2023. Total revenue of $369m decreased 24% versus $487m for the same period of last year, primarily due to a 16% decrease in the average realized sales price and a 12% slump in sold volumes.

Elsewhere, the list of the UK’s 10 most shorted stocks, below, remains similar to recent months.

Source: Financial Conduct Authority

Just outside of the above list, in eleventh place was Domino’s Pizza, following a disappointing set of results in early August. AJ Bell investment director Russ Mould said those results were “about as soggy as day-old pizza, guiding for full-year performance at the lower end of expectations after a slower-than-anticipated start to the first half”.

Domino’s has been passing on the benefits of lower food costs to its franchise partners: “presumably to help sustain a positive relationship given historic issues with franchisees”, said Mould.

“The company has tried to signal some confidence in the outlook with a £20m share buyback programme but the market appears unconvinced.”