Bestinvest has added seven strategies to its Best Funds List and removed eight since its last update in March 2024. Alliance Trust, which is undergoing a merger with Witan, is among the new entrants alongside three regional equity funds: Liontrust European Dynamic, M&G Japan and JPM UK Equity Core.

Two exchange-traded funds also made the grade: SPDR MSCI ACWI ETF and Xtrackers S&P 500 Equal Weight ETF.

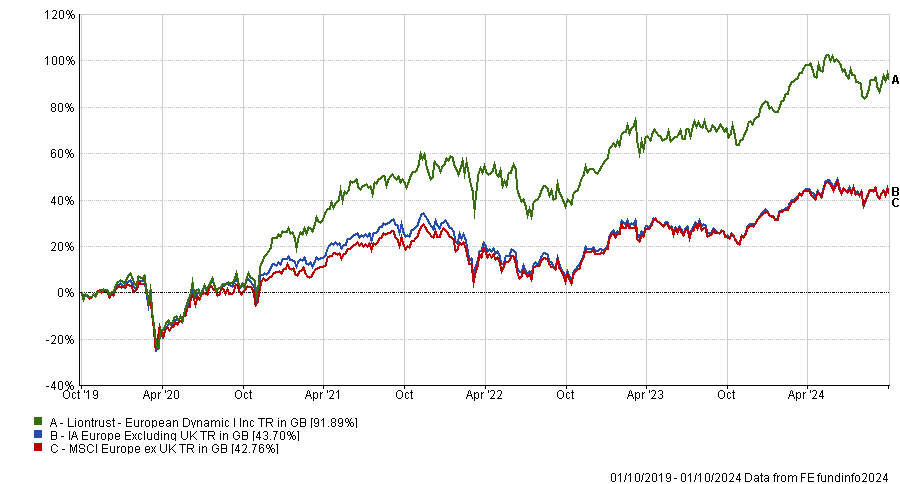

Liontrust European Dynamic is managed by James Inglis‑Jones and Samantha Gleave, who invest in companies with strong cashflows. Jason Hollands, managing director of Bestinvest, said: “Their process allows them to switch between growth and value stocks depending on the market environment.”

It is the best-performing fund in the IA Europe Excluding UK sector over five years to 1 October 2024 and sixth over three years. The £1.6bn fund has struggled in relative terms during the past 12 months, however, dropping to the fourth quartile within its sector.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

M&G Japan, helmed by FE fundinfo Alpha Manager Carl Vine, and JPM UK Equity Core also have top-quartile three and five-year numbers but below-average one-year track records.

The Best Funds List does not use past performance as a primary selection criterion, however. “Using it to predict the future is about as accurate as rolling a dice,” said Hollands.

Instead, investment professionals at wealth manager Evelyn Partners (Bestinvest’s parent company) look for “a manager that invests their own money into the fund, someone who has a clear set of objectives, or a manager that adopts a high-conviction approach rather than hugging the benchmarks,” he explained. Being prepared to limit the size of the fund is also a key consideration.

M&G Japan was added to fill a gap in the Best Funds List for a core-plus Japanese option. “The fund is benchmark aware when it comes to sector exposure but takes risk at the stock specific level. It therefore avoids the style bias that typically drives the performance of many other Japanese funds,” Hollands explained.

“Similarly, JPM UK Equity Core is a low cost, index plus strategy, which takes incremental overweight and underweight positions relative to the benchmark. The investment process is highly quant driven.”

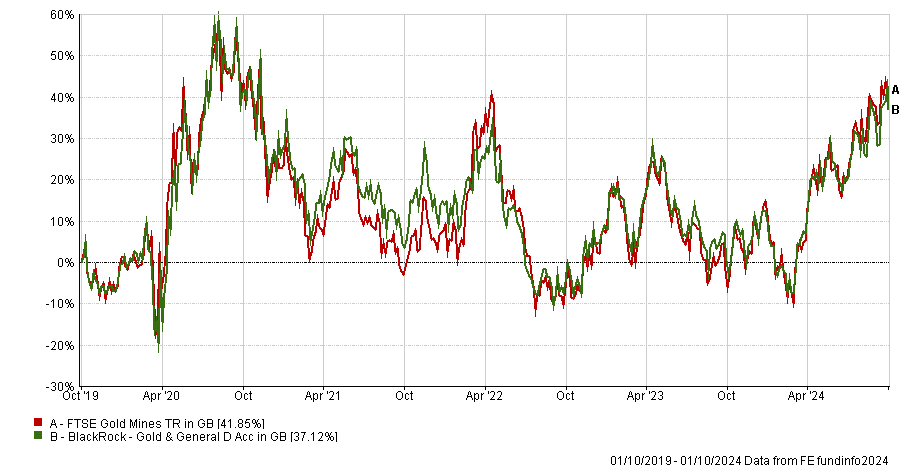

Also added to the list was Evy Hambro’s BlackRock Gold & General, which was included after the gold price hit fresh highs in sterling terms at the end of last month. The fund invests in equities that derive a significant proportion of their income from gold mining or commodities, such as precious metals. Its performance is closely correlated with gold mining stocks, which can be volatile but have risen sharply since March 2024.

Performance of fund vs benchmark over 5yrs

CHART 20241002_Bestinvest_3

At the other end of the spectrum, Janus Henderson Strategic Bond was removed ahead of co-manager John Pattullo’s retirement in March 2025.

LXI REIT was expelled following its merger with LondonMetric Property in March, while CT UK Commercial Property also lost its place.

Two ethical strategies followed suit: CT Responsible Global Equity, which suffered outflows of £175m during the first half of this year, and JPM Global Macro Sustainable.

Two long/short funds, Amundi Sandler US Equity and CIFC Long/Short Credit, were shown the door, as was Ashmore EM Local Currency Bond.

Generally speaking, funds are taken off the list if “a manager changes and we feel the replacement is unproven, or we believe changes in fund size mean the fund will need to be managed differently,” Hollands said.

Bestinvest’s latest Best Funds List contains 137 funds, including 30 investment trusts, 34 low-cost passive funds and 18 strategies focusing on environmental, social and governance (ESG) considerations.