European equities have lagged their US counterparts in recent years, but as a result, valuations in the region look comparatively more attractive.

One example of a cheap and cheerful European company is Irish airline Ryanair, which Marcel Stötzel added to his £4.4bn Fidelity European fund in the past 14 months.

“Ryanair stocks are much like Ryanair flights”, he said: both exceptionally cheap but quite turbulent. Indeed, the stock has a current price-to-earnings (P/E) ratio of 14.8%, with a share price of just €16.58.

Ryanair’s share price YTD

Source: Google Finance

Ryanair remains one of the lowest-cost providers in the highly commoditised short-haul flight industry. Its low prices are one of its strongest competitive advantages because many customers will still buy Ryanair flights despite negative perceptions of its performance and customer experience.

“It’s the only product I’ve ever seen that has conditioned its customers to expect a poor experience, yet the customers keep coming back. The implication is that they can get away with things that competitors such as British Airways cannot,” Stötzel said.

Moreover, Ryanair is taking advantage of the supply and demand crisis facing airlines in the post-pandemic market. Several flight providers either went bankrupt or scaled down capacity during the pandemic, and the sector is yet to recover fully.

As a result, there is a dissonance between subdued supply and high demand leading to many businesses ramping up prices. Consequently, the price gap between Ryanair and competitors such as British Airways is widening.

“If you’re a player like Ryanair, if everyone else is keeping pricing high, you can make even more money because your costs are going down and your prices are going up,” he added.

Ryanair is far from the only unloved company in Stötzel’s fund. He is also investing in beneficiaries of the artificial intelligence (AI) boom that he believes the market does not fully appreciate.

Legrand, a French electrical plug and socket provider, is the third-largest holding in his portfolio. Legrand distributes less sophisticated products than industry leaders such as Schneider and its products are used at a much later stage in the data cycle. Nonetheless, it is still a crucial enabler for AI so has considerable growth potential. Despite that, Legrand is trading on a P/E ratio of 20x compared to 34x for Schneider.

Legrand’s share price YTD

Source: Google Finance

On the other hand, Stötzel does not share the broader market’s enthusiasm for European industrials, particularly capital goods companies. Their earnings forecasts are above long-term margins, even though macroeconomic data suggest that international markets such as the US are facing an economic slowdown.

In other words, there is a dissonance between the market backdrop and what industrial stocks are reporting. “What we know is happening for sure is bleak, but margins and multiples don’t reflect that,” he said.

European industrials that serve the US market expect to benefit from US government stimulus such as the Inflation Reduction Act, but Stötzel thinks the forthcoming presidential election could delay government spending and said decisions at the state level may take longer to get approved. “The market is underestimating the potential for pain in the short-term and overestimating how quickly long-term trends can ramp up,” he said.

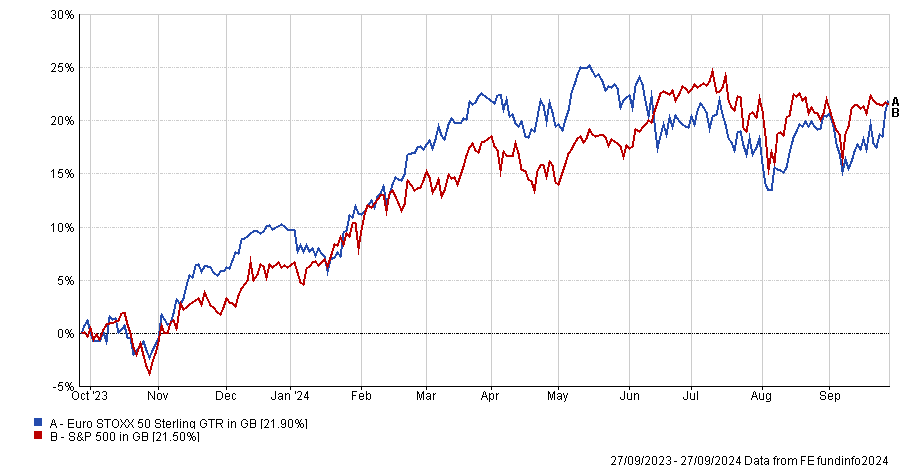

Nevertheless, Stötzel remains cautiously optimistic about European equities. Despite all the volatility that has characterised Europe this year, not least due to the turbulent French election campaign, the Euro STOXX 50 has gained ground and at some points, even surpassed returns from the S&P 500.

Performance of European and American indexes over the past year

Source: FE Analytics

Companies like Ryanair and Legrand are poised to take advantage of growth opportunities in popular and globally relevant sectors, yet they have retained consistently lower valuations. Consequently, while there is a lot of “doom and gloom” around Europe, it is far more than a “graveyard index”, with attractive opportunities to make supranormal gains. “If you pick stocks correctly, you can even outperform the mighty S&P 500,” he concluded.