Stock markets are up close to 15% since the start of the year but have become more volatile in recent weeks. Despite this, BlackRock is sticking with a risk-on stance thanks to its “investment anchor”.

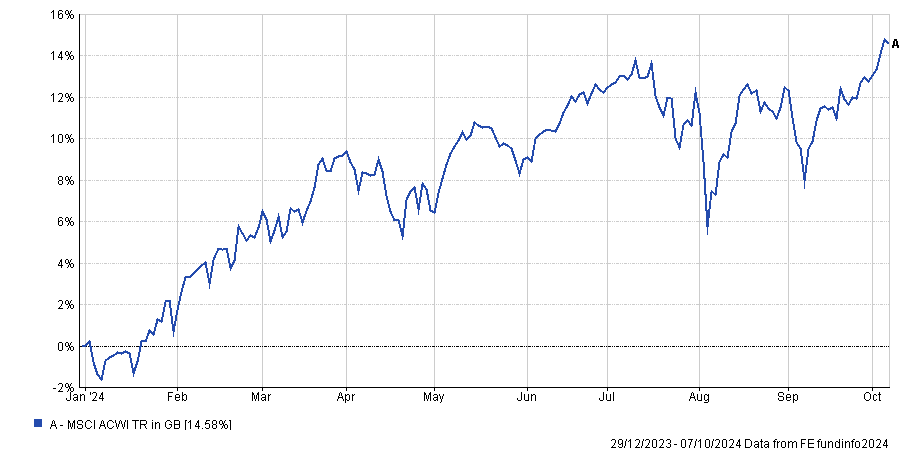

As the chart below shows, the MSCI AC World index has made a 14.6% total return over 2024 so far but the journey has been far from smooth and it has only just passed the peak it hit before the summer slump.

While global equities rallied in the opening half of the year on the back of the hype around artificial intelligence (AI), they sold off in July and August when investors became worried about the health of the US economy.

Performance of MSCI AC World over 2024

Source: FE Analytics

The main area of concern was rising US unemployment and the risk this heralded a looming recession that would require deeper than expected rate cuts to tackle. This worry has since moderated.

Natalie Gill, portfolio research director at the BlackRock Investment Institute, said: “Market narratives have flipped this year: from buzz over artificial intelligence to concerns about big tech spending, and from recession fears to comfort in the US economy’s resilience.

“Our anchor in these choppy markets: viewing this as a world shaped by supply – not a typical business cycle.”

Gill explained this meant BlackRock thought the recession fears and rate cut pricing several months ago was overdone, allowing the firm to maintain its risk-on positioning.

In contrast, the market’s pricing of deep rate cuts reflects the “misplaced” expectations of what would occur in a typical business cycle. This led others to move to a risk-off stance.

BlackRock’s ‘anchor’ – that supply constraints are the current driving force in the global economy rather than more traditional factors – gave it a different take on the macroeconomic picture.

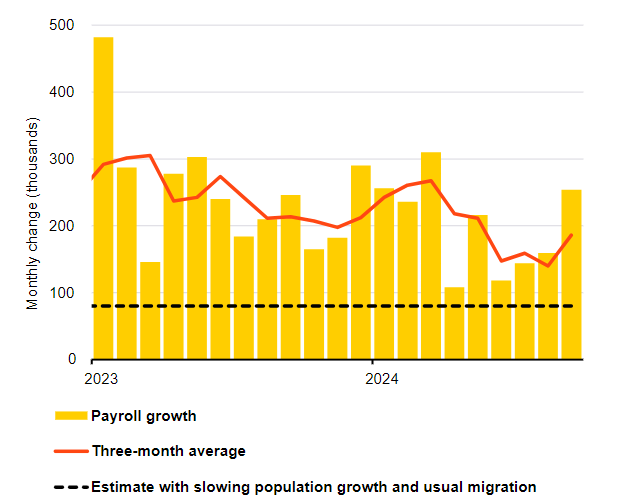

For example, the asset management house viewed the recent rise in US unemployment as reflecting elevated immigration expanding the labour supply, not being driven by lay-offs.

Last Friday’s US jobs data showed US employment growth is still “robust”, Gill noted, backing up the firm’s view that recession worries were overdone.

US payroll growth, 2023-2024

Source: BlackRock Investment Institute, US Bureau of Labor Statistics, with data from Haver Analytics, Oct 2024

“The unemployment rate has fallen again and markets have somewhat scaled back Federal Reserve rate cut expectations. Wage growth has cooled, bringing down inflation,” she added.

This near-term confidence on the macro means BlackRock is comfortable leaning into risk moving forward.

“Cooling inflation has allowed the Fed to cut rates and growth is not slowing sharply. We see this resilience reflected in corporate earnings strength expanding beyond the tech sector and stay overweight US stocks on a six- to 12-month horizon,” Gill continued.

LSEG Datastream data shows analysts expect earnings to grow 20% for tech and a “solid” 8% for the rest of the market over the next 12 months, she pointed out.

In addition to the US, BlackRock is running tactical overweights to UK, Japanese and Chinese stocks but is underweight European equities due to political uncertainty. It has recently trimmed its Japanese overweight, however, as the drag on earnings from a stronger yen has been compounded by mixed policy signals from the Bank of Japan.

On UK stocks, BlackRock said: “Political stability and a growth pickup could improve investor sentiment, lifting the UK's low valuation relative to other developed market stock markets.

Meanwhile, in China, "major fiscal stimulus may be coming, [which could] prompt investors to step in given Chinese stocks are at a deep discount to developed market shares. We stay ready to pivot but are cautious long term given China’s structural challenges.”

In fixed income, BlackRock thinks long-term bonds may struggle to offer consistent protection against risk-asset volatility in a supply-driven environment, as inflationary shocks could lead to rising yields. It favours quality and income in bonds.

The firm sees opportunities in European bonds, particularly in short-term credit with wider spreads and government bonds, where yields align more closely with policy expectations compared to the US. In the US, BlackRock prefers medium-term bonds, as the market is pricing in significant Federal Reserve rate cuts.

Gill finished: “We remain nimble as we eye the US election, geopolitics and big policy shifts globally.

“Iran’s strike on Israel and Israel’s promise of retaliation mark a major escalation in the Middle East. Its market impact has been limited but might grow if there’s further escalation. We stay pro-risk for now. Such events underscore that geopolitical risk is structurally elevated.”