Large parts of the US market will be affected by the looming presidential election but Hargreaves Lansdown thinks most investors are best off ignoring the noise and focusing on value and small-cap opportunities.

The US will go to the ballot box in less than a month, choosing either Democrat vice president Kamala Harris or Republican candidate Donald Trump as its next president. Harris remains the favourite with a national polling average of 49% compared with Trump’s 46%, according to the New York Times’ poll tracker.

However, Hargreaves Lansdown investment analyst Aidan Moyle said “all is still to play for” and noted that the policies of each candidate could create different opportunities and challenges for investors. He pointed to several key areas of interest, including regulation, taxes and tariffs.

“Continued focus on deregulation and lower taxes under Trump could bolster large banks and investment companies, while Harris could pursue stronger financial regulations, emphasising consumer protection and reducing systemic risk,” Moyle said.

Trump's policies are also likely to favour fossil fuels, promoting deregulation in the oil, gas, and coal industries. This could benefit companies in the traditional energy sector as it might lead to a surge in new drilling projects and infrastructure development.

On the other hand, Harris is expected to push for an aggressive transition to clean energy, which would benefit companies in the renewables sector and associated areas.

On taxes, Trump has said he will build on tax cuts he implemented when he held the Oval Office between 2017 and 2021, while cutting corporation tax to 15% (from today’s 21%).

“Trump believes these tax cuts can be funded from increasing tariffs. Economists have said that both tax cuts and tariffs could put upward pressure on inflation,” Moyle explained.

Harris wants to keep the tax cuts implemented by the Trump presidency for some taxpayers, although anyone earning over $400,000 a year will go back to a higher rate. She has also pledged child tax credits and support for first-time home buyers.

Tariffs have been another big topic for the Democrat and Republican nominees, with both Harris and Trump projecting a protectionist stance and trying to protect American jobs and manufacturing from overseas competitors.

Harris was part of a decision by the Biden administration to increase tariffs on $18bn worth of Chinese imports earlier this year.

Goods such as Chinese-made electric cars, solar panels, steel and aluminium were hit with higher tariffs after current US president Joe Bien said he would not let China "unfairly control the market" for electric vehicles and key goods such as computer chips, batteries and basic medical supplies.

Trump has said he wants to take this even further by imposing a 60% tariff on all Chinese goods entering the country and 10% for goods from the rest of the world. “While it might be a boost for US production, it could come with higher costs to the US consumers. This could have an impact on not just the US market, but global stocks too,” Moyle said.

But when it comes to investing around the US election, the Hargreaves Lansdown investment analyst said investors should ignore the political noise and focus on valuations.

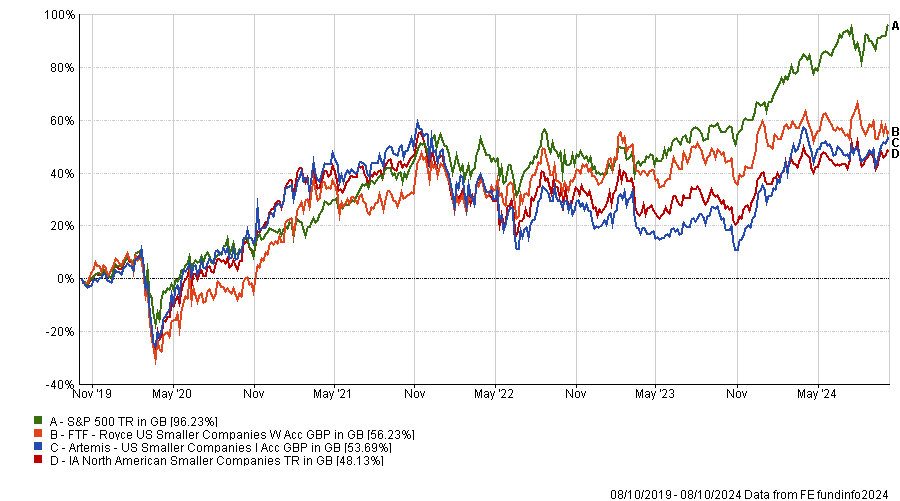

As many investors will probably have plenty of exposure to US mega-caps – the largest and most expensive parts of the market – through a typical US or global strategy, they should consider adding to value-biased and smaller companies funds instead. Two that Hargreaves Lansdown likes are Artemis US Smaller Companies and FTF Royce US Smaller Companies.

Performance of funds vs sector and S&P 500 over 5yrs

Source: FE Analytics

The £851m Artemis US Smaller Companies fund has been run by Cormac Weldon since launch in 2017, with Olivia Micklem becoming co-manager in 2022. The process behind the fund combines top-down and bottom-up analysis, with a bias to companies that the managers think can grow in any economic environment.

“We like his disciplined approach to investing which leans towards growth-orientated companies,” Moyle said. “Weldon sees many quality smaller companies in the industrials sector, where he invests around 30% of the fund.”

The £271m FTF Royce US Smaller Companies fund, on the other hand, is managed by Lauren Romeo and uses a value approach. A key element of this is minimising downside risk.

Romeo has close to 30 years of experience, with Moyle saying: “She has a strong support network of analysts and we like her disciplined approach focussing on quality companies trading at attractive valuations.”