The weather is on the turn and investor sentiment may just be following suit. After a barnstorming run, the so-called Magnificent Seven have hit somewhat of a rocky patch as the lack of tangible returns from the billions of dollars poured into artificial intelligence (AI) have started to test investor patience.

While tech funds have dominated buy lists this year, August’s turbulence saw a retreat to safer pastures, with Kepler Trust Intelligence’s analysis of the most bought shares by UK investors in August (across four of the mainstream platforms) throwing up some interesting results.

Yes, Nvidia topped the list as investors with severe FOMO from its stellar year-to-date gains pounced on the near-15% dip, but FTSE 100 behemoths accounted for eight of the 10 most popular shares. With the base rate heading downwards, it’s perhaps no surprise that investors are starting to look elsewhere for income and flocking to the 9%-plus yields offered by the likes of Vodafone, Legal & General and M&G (with BP, BAT and Aviva not too far behind).

But it’s not just about the income: with UK equities staging a comeback from the doldrums of the past few years, there’s potential for some capital upside as well. In fact, a year-to-date total return of 9% puts the IA UK Equity Income sector in the top six returning sectors for 2024, only a whisker behind the 10% return for the top-placed IA North America sector.

One of the key catalysts driving the interest in UK equities is the improving macroeconomic environment, with the Consumer Price Index finally hitting its 2% target (ahead of Europe and the US) and the base rate heading downwards. The UK economy has returned to growth (after slipping into the shallowest recession in history), unemployment is at a 50-year low, and business and consumer confidence indices are at their highest level in two years.

With a more supportive domestic backdrop, is it perhaps conceivable that the FTSE 100 ‘tortoises’ might be about to steal a march on the mega-cap technology ‘hares’? While broker share price forecasts should be taken with a healthy (or unhealthy) pinch of salt, there are undoubtedly some appetising numbers on display.

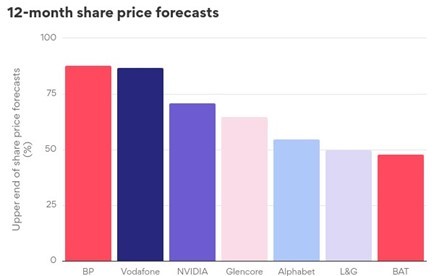

The chart below shows the upper end of the seven highest broker share price forecasts among the Magnificent Seven and our list of the top 10 most-bought shares by UK investors. BP and Vodafone take top honours for the highest share price forecasts and, indeed, UK large caps account for all but two of the seven highest forecasts.

Sources: Financial Times and Kepler Trust Intelligence, data to 16 Sep 2024

Or taking the more conservative view of the mid-range forecasts, the eight UK large-caps on the most-bought list (being Vodafone, L&G, BP, BAT, Rolls-Royce, Glencore, M&G and Aviva) have an average 12-month share price forecast of 19%, compared to 17% for the Magnificent Seven. Food for thought when you also factor in the chunky dividend yields.

It’s fair to say that the investment trust structure lends itself particularly well to the UK equity income sector, given the flexibility to dip into reserves to pay dividends in leaner years. As well as being one of the largest AIC sectors, the UK Equity Income sector also dominates the list of AIC dividend heroes (trusts increasing their dividends for more than 20 consecutive years) which helps to explain its popularity among income-seeking investors.

The positive outlook for UK equities is supported by Imran Sattar, the new manager of Edinburgh Investment Trust. The trust’s current exposure to overseas businesses is one of the lowest allocations in his career, which Imran attributes to the easing of headwinds in the UK and historically-low valuations, with Autotrader and Rotork among recent additions to the portfolio.

Edinburgh has delivered a five-year net asset return of 55%, one of the highest in the sector, and is currently trading on a discount of 10%, almost double the AIC sector average.

Another trust in the sector, Temple Bar, takes a value-oriented strategy to equity income, focusing on quality large and mid-cap companies from the FTSE 350 (including BP and Aviva from our most bought list) and currently trades on a dividend yield of just under 4%.

The focus on value has proved a strong driver of returns over the past few years, and the past 12 months in particular, with Temple Bar achieving a one-year net asset value (NAV) return of 17%. Its differentiated portfolio of undervalued UK businesses with significant upside potential could be a useful diversifier for growth-heavy portfolios.

And finally, they may not command the column inches of Nvidia, but the UK small-cap sector boasts more than a few hares of its own. Small business lender Funding Circle and communications specialist Filtronic have chalked up year-to-date share price increases of 220% and 255% respectively, helping to power small-cap specialist Rockwood Strategic to a one-year NAV return of almost 50% (as of 16 September 2024).

Looking ahead, it will be interesting to see if UK equities gain from the recent outflows from US technology funds and end the year with a flourish.

Jo Groves is an investment specialist at Kepler Partners. The views expressed above should not be taken as investment advice.