Multi-asset funds provide investors with a simple one-stop-shop solution but arguably, two shops are even better. A pair of multi-asset funds can complement each other, enhance diversification, reduce volatility and guard against the risk of one fund’s manager underperforming or getting their macroeconomic outlook wrong.

Investors must be mindful not to buy the same market twice and in doing so, double down on the same risks. For this reason, we asked experts which two multi-asset funds are different enough to be compatible as joint holdings in a portfolio.

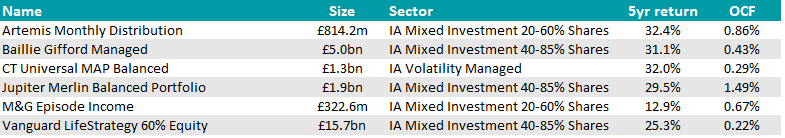

Artemis Monthly Distribution and Baillie Gifford Managed

Isaac Stell, investment manager at Wealth Club, said he would be happy to own Artemis Monthly Distribution and Baillie Gifford Managed.

The Artemis fund provides “a solid foundation to build upon”, taking a typical 60/40 approach to equity and bond exposure but with a specific focus on high-yield bonds and equities that pay a higher income.

It is managed by “four experienced pair of hands”. Jack Holmes and David Ennett apply a “rigorous” bottom-up approach to high-yield bonds, looking for smaller issuers that are often overlooked by the wider market and have the potential to provide superior returns.

For the equity sleeve, Jacob De Tusch-Lec and James Davidson look for companies with modest valuations that are producing high or growing dividend streams, attractive free cashflows and have a track record of returning cash to shareholders.

“The two approaches produce a multi-asset fund that has demonstrated its ability to consistently compound over time, leading to performance that far outpaces its relevant IA Mixed Investment 20-60% Shares sector over 10 years,” Stell said.

“This straightforward approach to asset allocation, coupled with the separate specialist teams feeding into the strategy makes this a great foundation for a two multi-asset fund portfolio and deserves a 50% weighting.”

The Baillie Gifford Managed fund provides “an additional alpha boost” by selecting stocks with a growth bias, which “nicely offsets the more core, value-orientated approach taken by the Artemis managers”.

Baillie Gifford’s “very experienced” managers Steven Hay and Iain McCombie take views on the long-term attractiveness of the underlying asset classes and maintain a higher weighting to equities at around 80%.

“The portfolio will be likely more volatile over shorter time periods, but consequently this may also be coupled with periods of significant outperformance, which was experienced during 2020 and 2021,” Stell said.

“The 50% weighting to the Baillie Gifford fund adds additional fuel to help drive long-term returns, with the benefit of the consistency of compounding that the Artemis fund offers.”

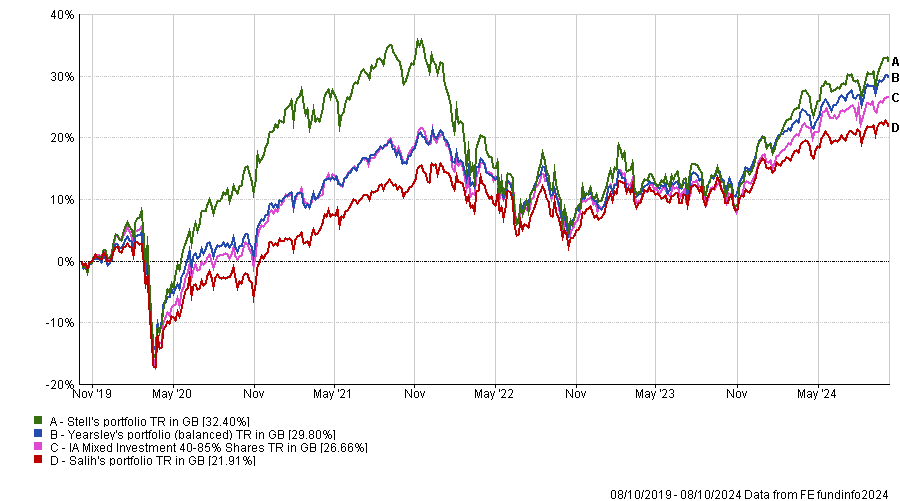

Performance of portfolios against sector over 5yrs

Source: FE Analytics

Jupiter Merlin Balanced and M&G Episode Income

For investors seeking both growth and income, Jupiter Merlin Balanced is “an excellent core fund”, according to Chris Salih, senior research analyst at FundCalibre.

“Jupiter boasts one of the strongest multi-manager, multi-asset teams in the industry, adept at capitalising on short-term market opportunities while taking defensive actions when needed,” he said.

It was paired with the more differentiated M&G Episode Income. Episode refers to times when investors act irrationally.

The manager Steven Andrew leverages behavioural finance to identify value and invest against the herd, rather than following it, Salih explained.

“Andrew assesses global assets to determine whether under-pricing is due to valid reasons or market 'episodes', driven by human behaviour. In the latter case, the team takes advantage of these episodes to buy or sell holdings at attractive prices,” he said.

The fund invests directly in stocks and bonds for added liquidity and lower costs, while some property exposure comes via property funds.

CT Universal MAP range and a BlackRock or Vanguard fund

Taking a different tack, Ben Yearsley, investment consultant at Fairview Investing, suggested pairing an active fund range with some passive multi-asset options.

“Keep it simple and buy two in equal proportion. As long as they have different styles, investors shouldn't even need to rebalance, as they will naturally do that over time,” he said.

The actively managed CT Universal MAP range is one of his “favourites”. The funds invest directly in bonds and equities, and the range spans different risk levels, enabling investors to choose how much risk they are willing to take.

Yearsley said he would blend a CT fund with a passive fund from the BlackRock MyMap or Vanguard LifeStrategy range.

Another option he gave was to pair BlackRock or Vanguard with the defensively-focused Troy Trojan fund, which has high allocations to index-linked government bonds, money markets and gold.

Source: FE Analytics

This article is part of a series on two-fund portfolios. In the previous instalment, we covered the core/satellite approach.