America is, by and large, a culture of risk-takers and entrepreneurs. For Kirsty Gibson, manager of the Baillie Gifford US Growth Trust, the American approach to investing is based on the same values as the American Dream: “that anyone could start a business and change the world”.

This uniquely entrepreneurial culture has given the US an “unrivalled optimism, ambition and willingness to accept failure”, she said. In such an environment, fund managers who are willing to take risks should be able to thrive.

But perhaps counterintuitively, a couple of US equity funds with cautious, low-risk strategies achieved some of the best risk-adjusted returns in their sector over the past five years. That might be because cleaving relatively close to their benchmarks – which have large weightings towards the mega-cap technology companies that have led the market – proved to be a winning strategy.

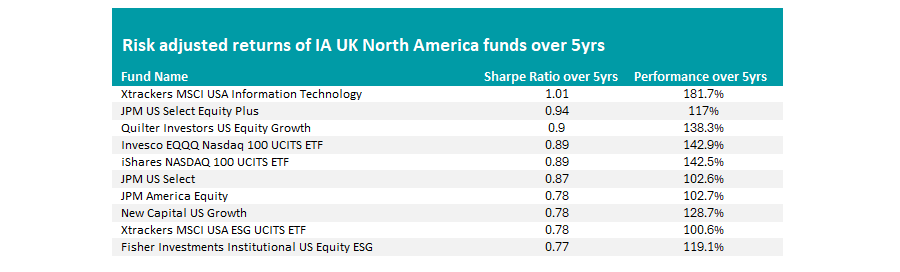

As part of an ongoing series, Trustnet is examining which funds made the best risk-adjusted returns over the past five years, looking at those with top-decile Sharpe ratios as well as top-decile returns, relative to their peers. Today, we examine the funds with the best risk-adjusted returns in the 251-strong IA North America sector.

Risk-adjusted returns of IA North America portfolios over 5yrs

Source: FE Analytics, total returns in sterling, data to 30 Sep 2024

With the 10 funds listed above matching our criteria, investors have plenty of choices. For those seeking a gung-ho growth strategy, the £466m Quilter Investors US Equity Growth portfolio stood out.

Its high-risk approach resulted in bottom-decile volatility of 17.2%, but investors were rewarded with supranormal five-year returns of 138.3%, the fourth-best performance in the sector. The fund achieved the third-best Sharpe ratio of 0.9.

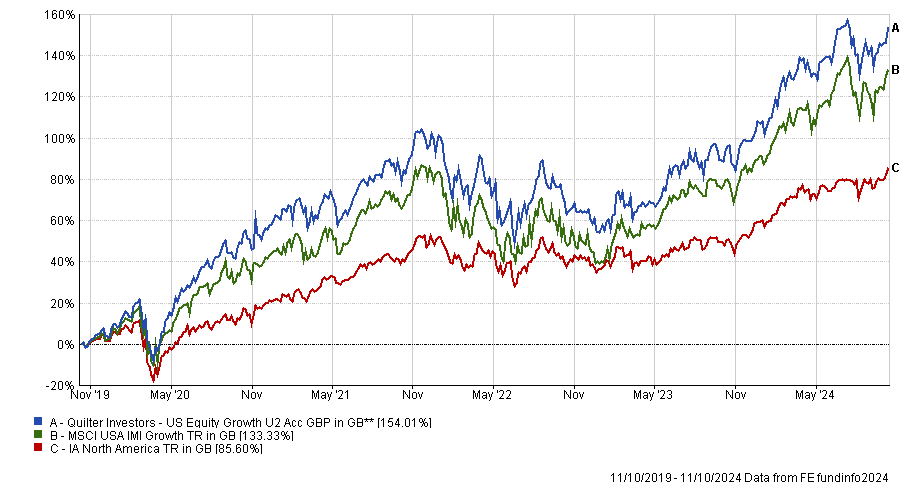

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Nevertheless, the high volatility approach had its downsides. Over three years, the fund declined into the second quartile for performance due to a poor effort in the 2022 bear market, when it slid by 21.9%.

While the fund has rallied back to the first quartile over the past year, selling the fund at the wrong time could have proven disastrous.

Despite the US being a traditionally high-risk market, aggressive approaches were not the only way to make impressive risk-adjusted returns. More cautious strategies, such as JPMorgan Asset Management’s £4.6bn JPM US Select Equity Plus fund and £1.3bn JPM US Select portfolio also had their place.

Led by Susan Bao since 2007, JP US Select Equity Plus has the highest Sharpe ratio of the actively managed strategies on our list and has achieved an FE fundinfo Crown Rating of five (the top score).

James Piper, a fund analyst at FE fundinfo, said: “It operates with a very low active share relative to the S&P 500, so has had considerable exposure to the technology names at the top of the index that have flown, which means it’s been able to avoid a massive performance headwind.

“With the low active share, it really doesn’t take any sector or factor bets and keeps its characteristics very similar to the S&P 500 at a headline level.”

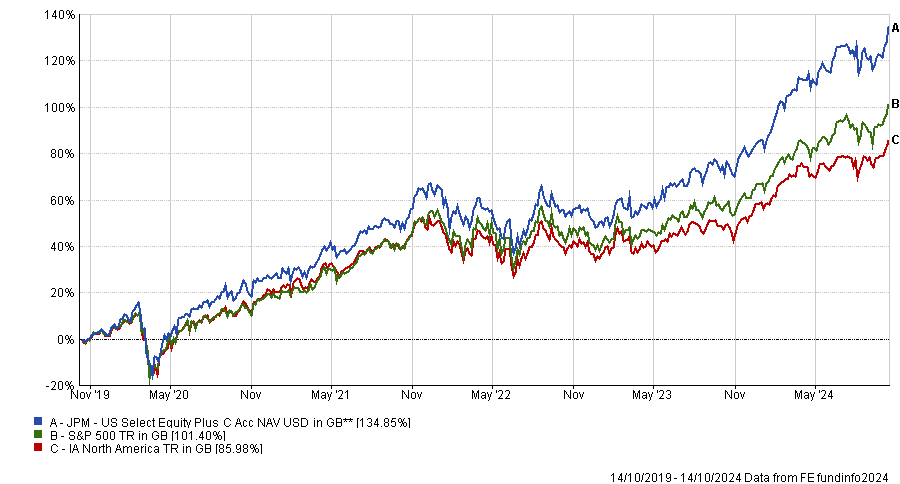

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

This strategy proved effective, with five-year returns of 117%, making it one of the few funds to surpass the S&P 500 benchmark.

Its fifth-decile volatility of 14.1% makes it a more moderate risk strategy and it has achieved the second-best Sharpe ratio in the sector of 0.94 over half a decade.

Moreover, the fund has proven to be a consistent top performer, with first-quartile efforts over one, three, five and 10 years. Its one-year performance was notably impressive, with the portfolio up by 33.6%, compared to a peer group average of 26.4%.

Its stablemate, JPM Select is one of the most risk-averse strategies on our list, with a five-year volatility of just 13.4%, a third-decile effort. Despite a comparatively modest performance of 102.6%, its low-risk strategy paid off, with the sixth-best Sharpe ratio of 0.87.

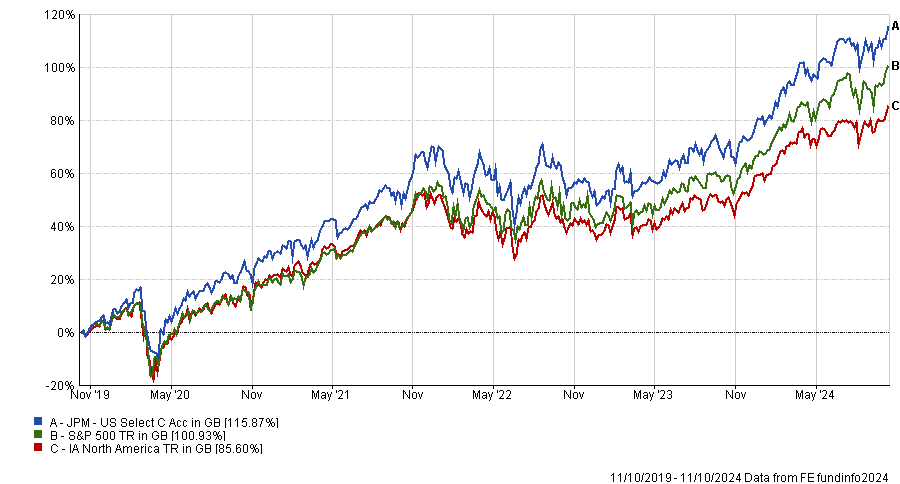

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

RSMR analysts rated the fund highly, describing it as a “core holding for investors looking for exposures to US equities”. This rating was a result of the portfolio’s long history and experienced team of analysts and managers, all of which have proven to be successful in the long term.

“There are mandate restrictions in place at stock and sector level which should ensure the fund does not track too far from the benchmark, making it well suited as a core holding for those seeking US equity exposure,” the analysts added.

However, it has not entirely been smooth sailing for JPM US Select. Its low-risk approach meant it had less potential for supranormal returns, with RSMR noting that the fund was “less likely to perform well in late cycle, deep value markets, or those that are momentum led”.

Consequently, RSMR analysts strongly recommended that investors hold the strategy as part of a wider portfolio alongside more aggressive funds.

Finally, several ETFs enjoyed top-decile risk-adjusted returns in this period. The £12bn iShares NASDAQ 100 UCITS ETF rose 142.5% over half a decade. Combined with ninth-decile volatility of 17.8%, the ETF enjoyed a Sharpe ratio of 0.89, the fifth best in the sector.

Previously in this series, we have looked at the IA Global Sector and the IA UK All Companies Sector.