Optimism has spiked among investors with allocations to stocks jumping and a record pullback from bonds, the Bank of America Global Fund Manager Survey has found.

The latest edition of the closely watched survey – which polled 195 fund managers with $503bn in assets under management between 4 and 10 October 2024 – found that sentiment is at its highest in more than four years.

The confidence boost comes from improving economic data, interest rate cuts from the Federal Reserve and stimulus in China. Below, Trustnet looks at the survey’s findings in closer detail.

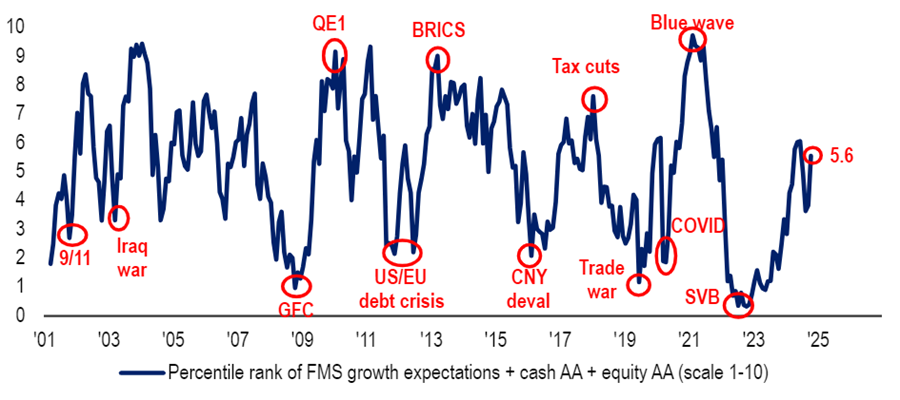

Global fund manager sentiment

Source: Bank of America Global Fund Manager Survey, Oct 2024

Our first chart shows the significant improvement in global fund manager sentiment, with Bank of America’s broadest measure of investor sentiment posting its largest monthly rise since June 2020.

This uptick reflects a broader optimism among investors, driven by expectations of central bank actions, including Fed rate cuts, and improved global economic conditions.

This indicator is based on fund managers' equity allocations, cash levels and growth expectations, all of which have improved in October.

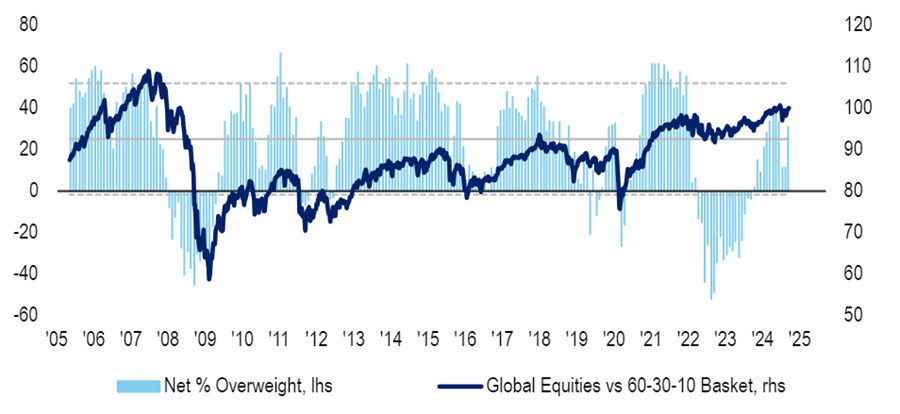

% of fund managers overweight global equities

Source: Bank of America Global Fund Manager Survey, Oct 2024

This month investors increased their equity allocation by the largest amount since June 2020 after taking it from a net 11% overweight last month to a net 31% today.

Within equities, managers sharply reduced their exposure to defensive sectors such as consumer staples and utilities and rotated into cyclical sectors like consumer discretionary and industrials.

The allocation to consumer staples declined at its steepest rate since 2005, while the shift towards consumer discretionary was the largest recorded increase over the same period. This suggests growing confidence in a global economic recovery, as investors move away from traditionally safer sectors towards those that typically perform better in periods of economic growth.

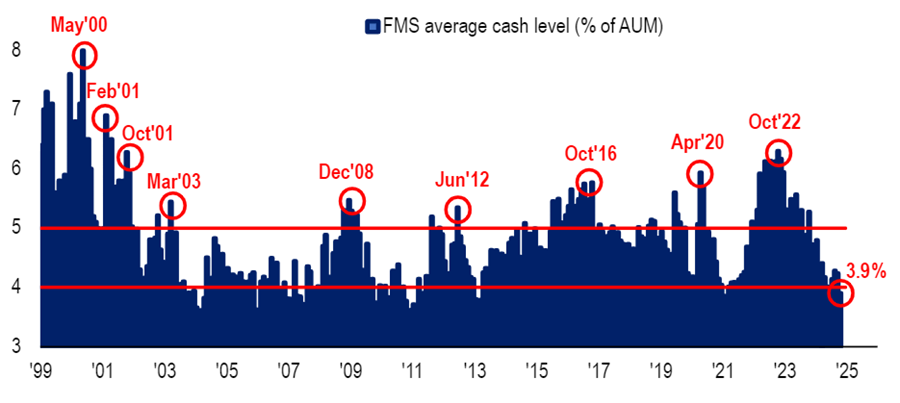

Fund managers’ average cash levels

Source: Bank of America Global Fund Manager Survey, Oct 2024

Investors’ average cash level fell from 4.2% to 3.9% in October, its lowest since February 2021. Bank of America said this fall has triggered the first contrarian ‘sell’ signal since June 2024, as cash balances have dropped below 4%.

The bank claims this signal tends to correlate with weaker global equity performance, saying there have been 11 prior ‘sell’ signals since 2011 when the MSCI AC World fell by 2.5% in the month after it was triggered.

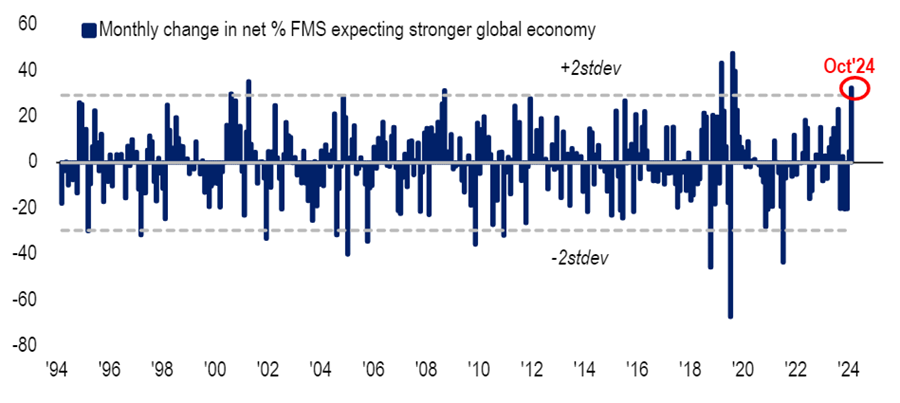

Fund managers’ global growth expectations

Source: Bank of America Global Fund Manager Survey, Oct 2024

Economic growth expectations witnessed their fifth-largest jump since 1994. One month ago, a net 47% of fund managers thought the global economy would deteriorate over the coming 12 months; this improved to a net 10% expecting a weaker economy in the latest edition of the survey.

Some 76% of investors think the global economy is headed towards a ‘soft landing’ (or economic weakness without a recession). A ‘no landing’ has become the main alternative scenario at 14% (up from 7% last month) while just 8% – a four-month low – expect a ‘hard landing’ (or recession).

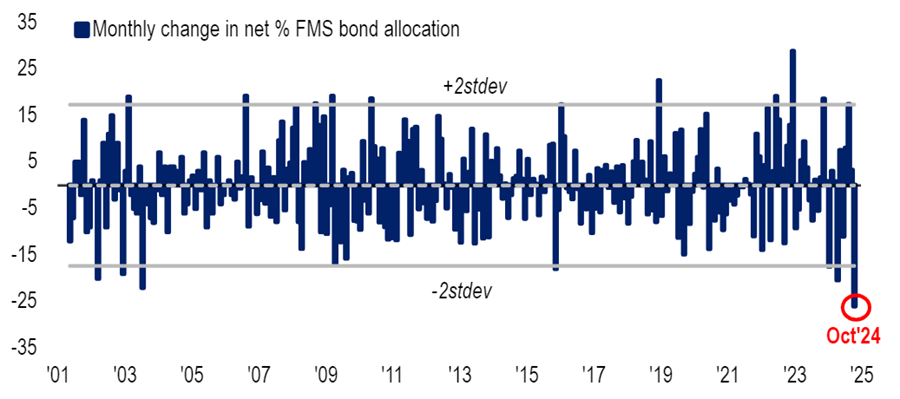

Monthly change in fund managers’ bond allocations

Source: Bank of America Global Fund Manager Survey, Oct 2024

Meanwhile, there was a record reduction in bond positions, with the net allocation dropping almost 30 percentage points in October. This marks the largest monthly decline in the survey's history.

This shift reflects fund managers’ concerns about bond market performance in the current economic climate, driven by anticipated interest rate cuts and improving equity market sentiment. The reduction is well outside the normal range of variation, falling below the two-standard deviation threshold.

Asked about positioning in their fixed income allocations, a net 18% of global fund managers said they are underweight government bonds while a net 32% are overweight corporate bonds.

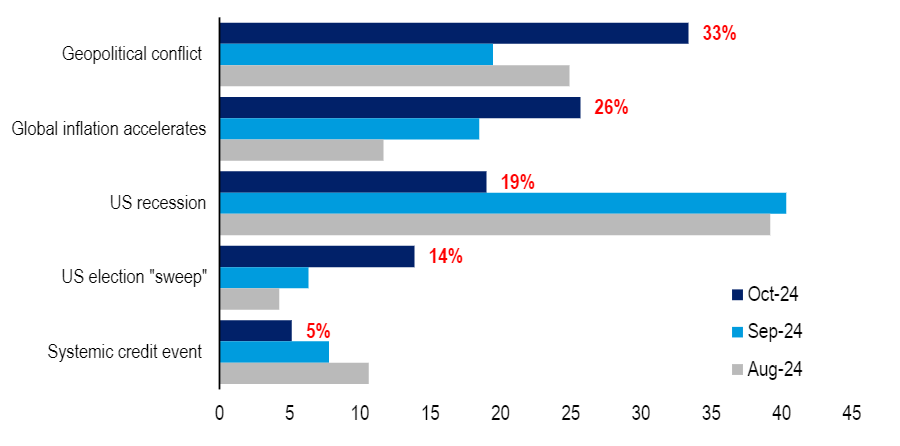

What fund managers see as the biggest tail risks

Source: Bank of America Global Fund Manager Survey, Oct 2024

Investors might be more bullish, but they are still mindful of ‘tail risks’ that could hamper the market. Concerns about a US recession have fallen from 40% of managers citing this as the main tail risk in September to just 19% today.

However, 33% of investors see geopolitical conflict as the biggest tail risk, up from 19% a month ago. Worries about over-accelerating inflation continue to rise, with the proportion of managers citing it rising from 18% to 26%.

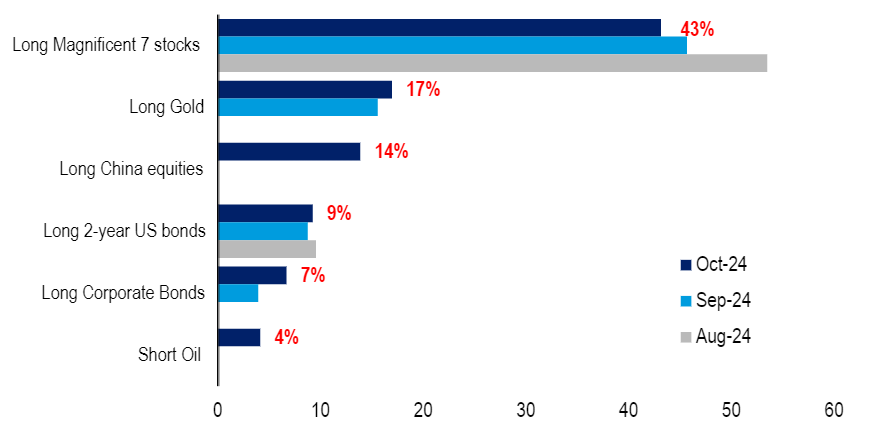

Fund managers’ most crowded trades

Source: Bank of America Global Fund Manager Survey, Oct 2024

There’s also been some change to what fund managers view as the most crowded trades in the market. Long 'Magnificent Seven' continues to hold the top spot for the 19th consecutive month after being cited by 43% of respondents, but this is down from the high of 71% in July 2024.

But long Chinese stocks was named by 14% of managers – up from 0% last month. This follows a sharp rally in Chinese equities after the announcement of monetary and fiscal stimulus for the world’s second-largest economy.

Also, 17% of investors said long gold is the most crowded trade while 4% pointed to short oil.