In terms of US equities, the ‘Magnificent Seven’ is often talked about as the only game in town, but cracks in their dominance have started to show, according to veteran fund manager Mark Sherlock.

The manager of the $1.2bn Federated Hermes US SMID Cap portfolio noted it is “quite a crowded trade”, one which, over the next 12 to 18 months, would “not surprise” him if it started “unravelling”.

As expectations around these companies continue to grow, it will become more difficult for even Nvidia – the best performing of the group – to “post numbers that excite the streets”. In these circumstances, US small and mid-caps will become increasingly appealing.

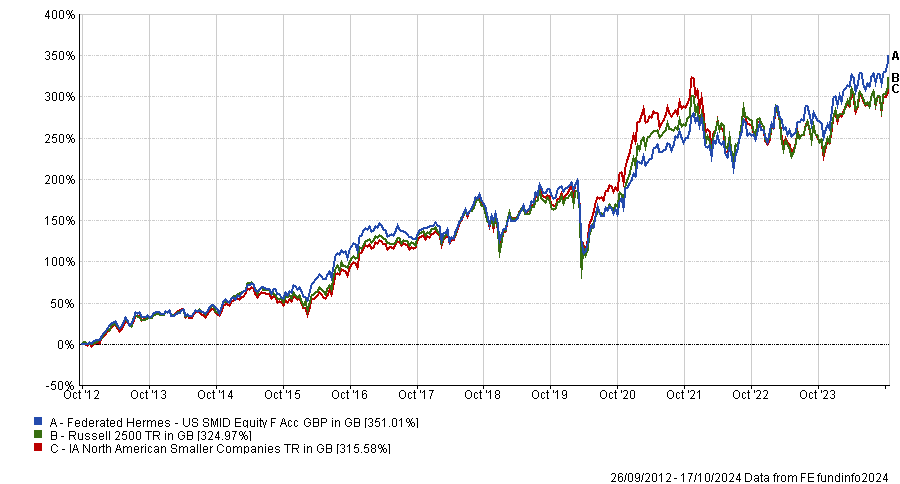

Since taking over as lead manager of the portfolio in 2012, Sherlock has delivered strong long-term results, with the fund up by 351% under his tenure. It has also been awarded an FE Fundinfo Crown Rating of five for its recent performance.

Performance of fund vs sector and benchmark since manager start

Source: FE Analytics

Below, he discusses the improving outlook for US small and mid-caps, the tendency for the market to make a “coin toss” on the performance of companies, and how a taser became one of his best performing stocks this year.

If you had to describe your process in three sentences, what would it be?

Our investment philosophy relies on identifying high-quality businesses, those with a durable competitive advantage, and holding them for the long term.

We are not looking for the ‘shiny stuff’ that would appear on the Wall Street Journal, we are looking for businesses that fly beneath the radar, tend to be number one or two [in terms of] market share in their niche, and quietly compound up over multiple years.

The strapline here would be that the tortoise beats the hare, that slow and steady wins the race.

What differentiates you from other funds?

There are two main points of differentiation – the first is that we’re looking for something different. We are not looking for the next Apple or the next Google, we are looking for those multi-year compounders, so we look in a different direction to many others

Point two really is the timescale. Our average holding period is three to five years, half of the portfolio we have held for more than 10 years. I think many participants and, this is not a value judgement it’s an observation of a fact, are trying to figure out if a company will beat or miss during a particular quarter. That is a ‘coin toss’ which is very hard to get consistently right.

What we try and do instead is focus on whether these barriers are getting broader, deeper, wider, taller and if they are, the financials will look after themselves.

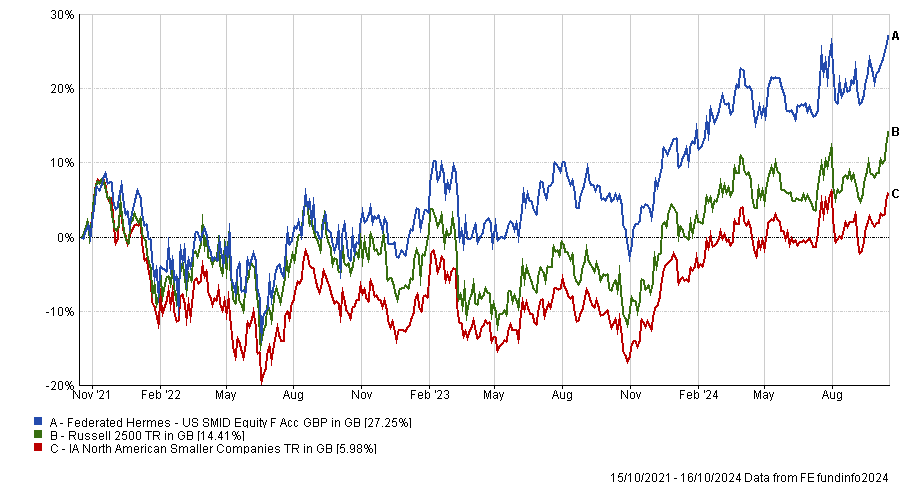

You were the second-best performer in the peer group over three years – what do you think went so well?

Point one was the economic backdrop changed. With inflation at 2.4%, we are now in a more normal economy following the pandemic, which benefits us. The second and third points are our quality bias and good stock picking – this is a part of the market where stock picking can prove very successful.

The other point to make is that several of our cyclical names worked, because we did not believe the US was going into a ‘economic armageddon’. As perceptions of the economy have improved, cyclical businesses have done well.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

What was your best holding this year?

We have been trying to run our winners as much as we can, and Axon Enterprise is a good example of this, which has gone up by 67.9% year-to-date.

Its calling card is taser manufacturing, which has saved countless lives, because in the US the alternative is a gun. The business model has morphed over time, moving into creating body worn cameras, which have also proven extremely successful.

What kicked in this year was a third leg to the service called evidence.com, which takes the videos from body cameras and uploads it to the cloud, which is then used by law enforcement agencies.

The company has iterated its way from selling hardware, through to this software as a service. There is a comparison to the Apple ecosystem, which does not just sell iPhones, it derives revenue from the whole software business behind it.

And your worst?

Columbia, a clothing business that produces outerwear such as jackets. Apparel can be very fashion led and brands such as Montclair can fall in and out of favour, whereas Columbia felt like a brand for the everyday market.

It falls into a bucket of stocks we internally call “silent killers”, which are stocks that have no blow-up moment, they just quietly flatline. You hold them for years and they remain cheap, but the market goes up around them and that impacts performance.

While it was not a disaster, we decided to move on because we had better ideas in the consumer space.

So why are small and mid-caps a good investment?

Our case is based on valuations. SMIDs traded historically on a 10% premium to the S&P because of structurally higher growth, but over the past few years, the forward P/E now trades at a 25% discount.

So, there’s a 35% value gap that’s opened and that’s for two reasons. One is the focus on artificial intelligence (AI) and all things mega-cap tech, and the other is that there is a proportion of the market that feels the outlook for the US economy is bleak. If you think this, you probably do not buy SMID companies, which tend to be less robust.

What do you do outside of fund management?

I live in the country with my family, my wife and teenage daughters and we live a quiet country life, with our dogs and chickens.