The summer months of 2024 were marked by a jump in volatility as investors reacted to disappointing economic data, geopolitical risk and other headwinds, leaving M&G Investments to take some important lessons from the period.

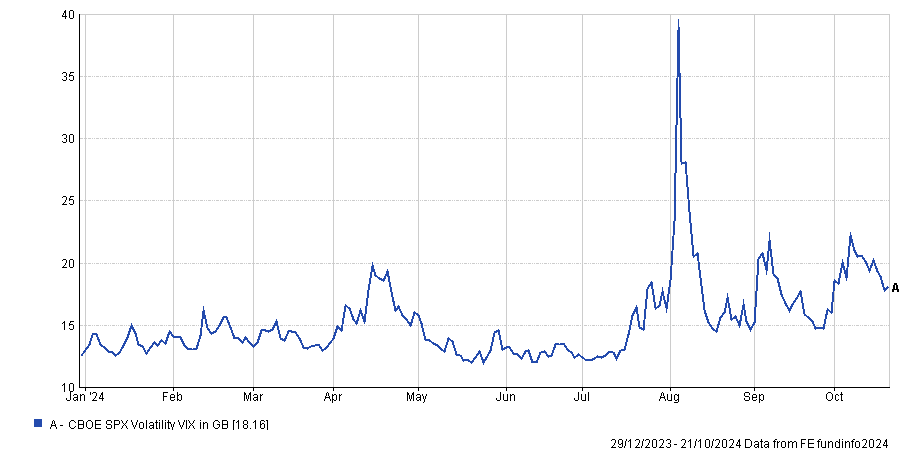

As the chart below shows, the VIX spiked in the summer and remains higher than where it started the year. The index measures the market's expectations of future volatility based on S&P 500 options and is often referred to as the ‘fear gauge’ because it reflects investor sentiment and potential market turbulence.

Performance of VIX over 2024

Source: FE Analytics

Fabiana Fedeli, chief investment officer for equities, multi-asset and sustainability at M&G Investments, highlighted the challenges that the market faced over the third quarter: weakening US activity and labour data, two assassination attempts on a presidential candidate, a last-minute change in the US Democratic Party’s nominee, an increase in the Bank of Japan’s policy rate, rate cuts by all three major developed market central banks and continued conflict in Ukraine and the Middle East.

“Markets have responded with a significant increase in volatility. In Japan, we witnessed the biggest three-day equity drawdown in the market’s history. The short-lived volatility spike that ensued was only exceeded on two occasions in the past 50 years – the crash of 1987 and the Lehman Brothers’ crash in 2008,” she explained.

“Elsewhere, during the July/August volatility, fixed income markets staged a period of outperformance versus equities, with correlation between the two squarely back in the negative camp. Equities experienced a technology-driven setback, despite a relatively solid reporting season.”

However, she noted that the market reaction to these macroeconomic and geopolitical upsets was far from straightforward and unlikely to have been predicted by commonly accepted ‘truths’ gleaned from financial history.

For example, the bond market’s reaction to the 50 basis point rate cut from the Federal Reserve in September was counter-intuitive, with the short end of the yield curve largely unmoved but the long end selling off; similarly, the value style outperformed growth as investors pulled back from artificial intelligence (AI) and tech stocks, even though bond yields had dropped.

Neither of these were textbook reactions to a rate cut.

While this caused some discomfort for investors, Fedeli said there are two main lessons that investors can learn from the recent volatility.

The first is that “history may rhyme but doesn’t necessarily repeat itself”. Fedeli argued that none of the above reactions to the Fed’s rate cut would have been surprising if investors paid close attention to their context, rather than expecting a textbook response.

“The pullback in technology came after a strong run, as investors started questioning the return on investment from all of the AI-related infrastructure spending. Then recession fears started to creep in, resulting in a very low margin for error for the technology companies heading into third-quarter earnings season,” she said.

“Market concerns on future returns trumped any pre-defined positive impact from declining rates on long-duration equities. Actually, the increase in rate cut expectations were driven by the same recession concerns.”

Meanwhile, the fixed income market’s muted reaction to the Fed’s move reflected the fact that bond prices had already run ahead of the central bank, with yields posting steep declines ahead of the rate cut decision.

Fedeli continued: “The second lesson is that we should always invest with the understanding that we don’t hold any undisputed truth and that we are bound to be surprised, either by events or by the market’s reaction to events.

“Therefore, we should always put ourselves and our portfolios in the best position to deal with the inevitable balls coming out of left field.”

This means the “essential ingredients” for investors during market volatility are portfolio diversification, process flexibility preparation and a deep understanding of the investment universe.

During the third quarter’s volatility, M&G’s equities and multi-asset teams added to sold-off Japan, bought highly cash-generative Chinese stocks and added to northern European banks and high-quality global consumer names that have proven resilient to consumption trends.

They also sold some US treasuries – especially those at the shorter end of the yield curve – and shifted into UK gilts and credit. But the asset management house maintained exposure to the longer end of the US treasury curve, which sold off after the Fed’s rate cut.

“The long end should provide an ‘insurance’ role should the macroeconomic picture significantly deteriorate,” Fedeli said.

“Importantly, this is a good market environment for tactical asset allocation, responding to short-term market gyrations based on excessive expectations in either direction.”

The M&G CIO added that heightened volatility could remain a feature of the fourth quarter and into 2025 owing to factors such as the looming US election and a new president, escalating conflict in the Middle East, the unexpected win of Shigeru Ishiba to be Japan’s next prime minister and high expectations of China’s stimulus package.

“We remain ready to take advantage of any price dislocations that take valuations below what the long-term outlook would warrant,” Fedeli finished.

“Volatile markets can be unsettling and emotionally draining. However, through careful portfolio construction and disciplined fundamental analysis, these instances can create compelling opportunities for investors with a longer-term horizon.”