In recent years, it has been “almost impossible” for funds to lead their peer group in one three-year period then stay at the top for the next three years, according to Craig Baker, manager of the £4.9bn Alliance Trust.

The most recent three-year period was drastically different from October 2018 to October 2021. That era saw the tail end of ultra-low interest rates then the shock of Covid-19. Global equity markets plunged into freefall upon the pandemic’s outbreak but recovered steeply afterwards, providing plenty of pitfalls and opportunities for stock pickers.

In the past three years there has been considerable upheaval in global stock markets with war in Ukraine and more recently the Middle East, resurgent inflation, an aggressive rate-tightening cycle and monetary policy uncertainty. Additionally, this year, at least half of the world’s population will have headed to the polls.

Furthermore, the artificial intelligence (AI) boom proved rewarding for some global equity funds but punitive in relative terms for those who didn’t hold the ‘Magnificent Seven’. The ascendance of mega-cap technology stocks was an obstacle for global equity income funds, in particular, because most of these companies pay low or no dividends.

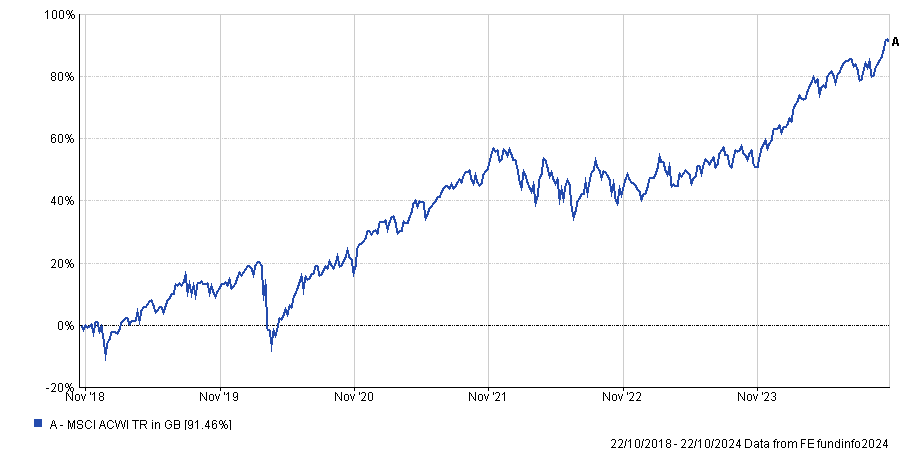

Global equity market performance over 6yrs

Source: FE Analytics

Against that backdrop, Trustnet decided to put Baker’s assertion to the test to see if any global equity funds achieved top-quartile performance in the two back-to-back three-year periods culminating on 21 October 2024.

Of the 375 funds in the IA Global sector with a track record of at least six years, just six funds (or 1.6% of the sector) were in the top quartile for the three-year period ending on Monday as well as the three years to 21 October 2021.

They include: Guinness Global Innovators, led by Ian Mortimer and Matthew Page; Schroder Global Equity, helmed by Alex Tedder; and Purisima Global Total Return.

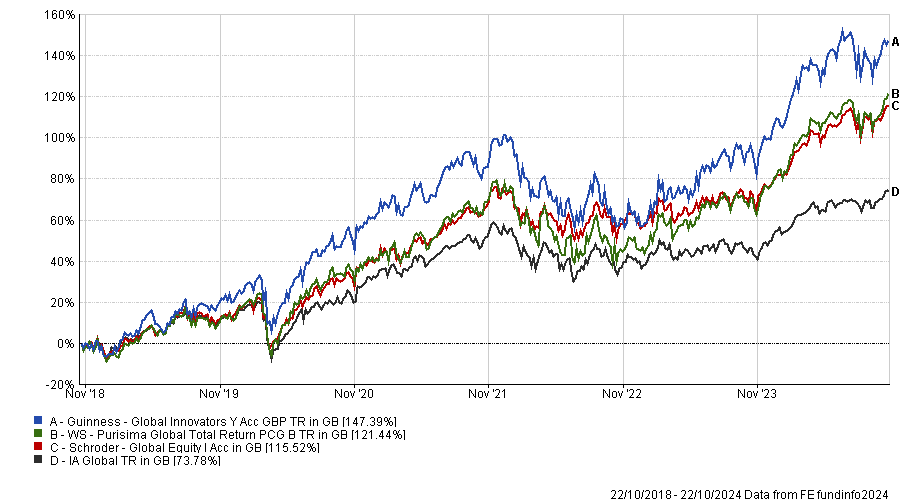

Performance of funds vs sector over 6yrs

Source: FE Analytics

A trio of funds from Fisher Investments round out the list: Global Developed Concentrated Equity ESG, Global Developed Equity and Global Developed Equity ESG. All three have been managed by the same five-strong team since they were launched in 2018, comprising Aaron Anderson, Jeffery Silk, Michael Hanson, William Glaser and the firm’s founder, Ken Fisher.

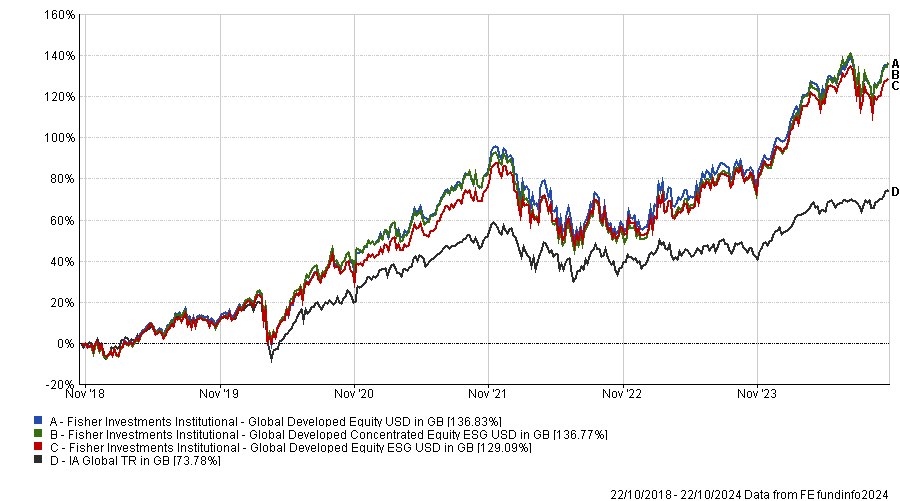

Performance of funds vs sector over 6yrs

Source: FE Analytics

Meanwhile, the IA Global Equity Income sector houses 42 funds with a track record of at least six years, of which five (11.9% of the sector) were top quartile for the two back-to-back three-year periods in question.

They include: Aegon Global Equity Income, which is managed by Mark Peden, Douglas Scott and Robin Black; JPM Global Equity Income, under FE fundinfo Alpha Manager Helge Skibeli, Sam Witherow and Michael Rossi; and Guinness Global Equity Income, run by the aforementioned Mortimer and Page.

Aviva Investors Global Equity Income also made the list but its managers, Richard Saldanha and Matt Kirby, both left the firm recently.

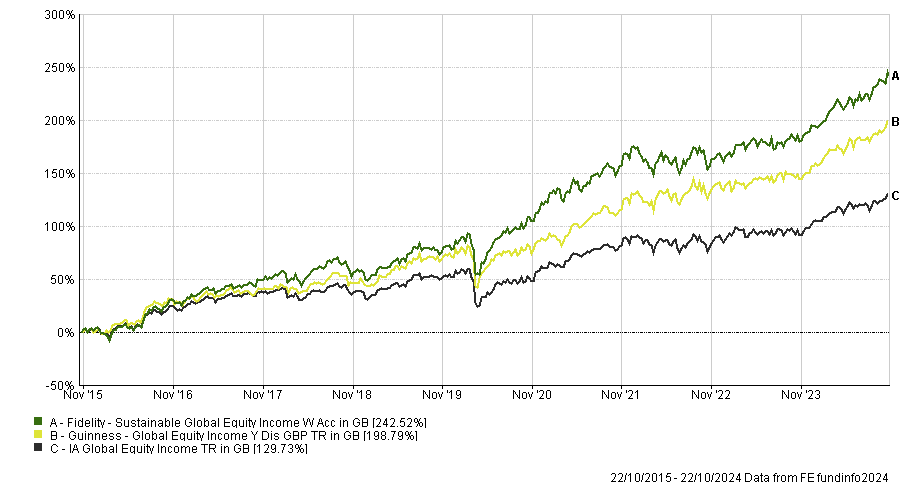

Finally, Fidelity Sustainable Global Equity Income achieved the feat, but it changed its investment style to quality income on 18 March 2022. Prior to that, it was called Fidelity Institutional Global Focus and it had a core growth approach.

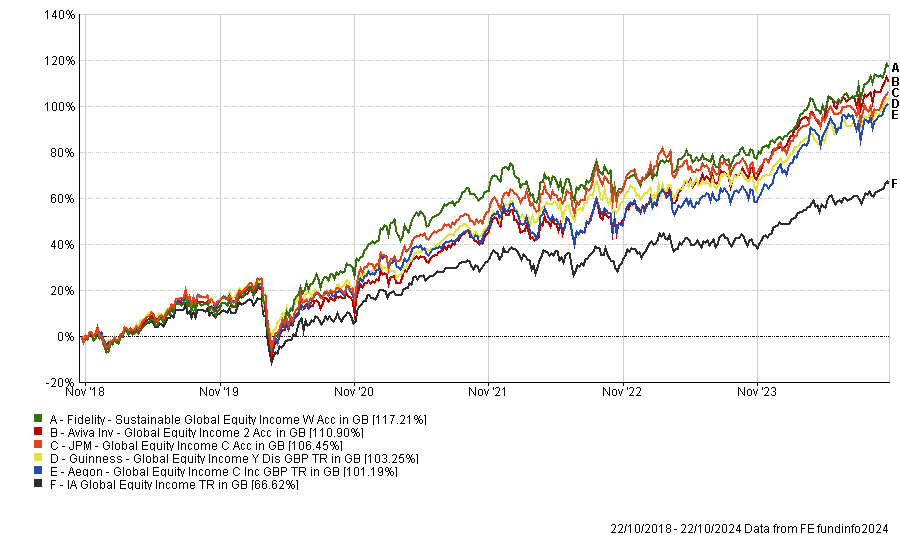

Performance of funds vs sector over 6yrs

Source: FE Analytics

Raising the bar further, two funds in the IA Global Equity Income sector achieved top-quartile returns in a hattrick of consecutive three-year periods – Guinness Global Equity Income and Fidelity Sustainable Global Equity Income – although only the former had the same managers throughout this time.

The £6.6bn Guinness fund was the fifth or sixth best performer in its sector over three, five and 10 years to 21 October 2024. Fidelity’s sustainable fund was top of its sector for five and 10 years.

Performance of funds vs sector over 9yrs

Source: FE Analytics

Guinness Global Equity Income stands out from the pack by having an equally weighted portfolio. Mortimer and Page look for companies with a high return on capital and low leverage that are attractively valued, according to analysts at Square Mile Investment Consulting & Research, who have given the fund an AA rating.

The fund is overweight consumer staples that have competitive advantages and pricing power, so it tends to perform well in inflationary environments because investee companies can pass on cost increases to their customers.

The £135m Fidelity Sustainable Global Equity Income OEIC shares the same investment approach and portfolio manager (Aditya Shivram) as the $1.2bn Fidelity Funds Sustainable Global Equity Income SICAV. Both funds have an unconstrained, high conviction global equity portfolio with a high active share.

Shivram aims to deliver a strong cross-cycle, dividend-based total return with lower drawdowns versus the market and a sustainable dividend stream with income growth and capital appreciation.

There were no IA Global funds that were able to sit in the top quartile of the sector over three consecutive three-year periods.