The Invesco Asia trust and Asia Dragon, managed by abrdn, have announced a proposed merger this morning. If the move meets investors’ approval from both sides, the newly created vehicle will be called Invesco Asia Dragon Trust and, with £800m of assets under management (AUM), is set to become the largest in the IT Asia Pacific Equity Income sector.

The new strategy will retain the investment approach of Invesco Asia, as well as its managers Fiona Yang and Ian Hargreaves, who employ a total-return mindset applied to undervalued Asian companies with the goal to provide capital growth and “enhanced” dividends.

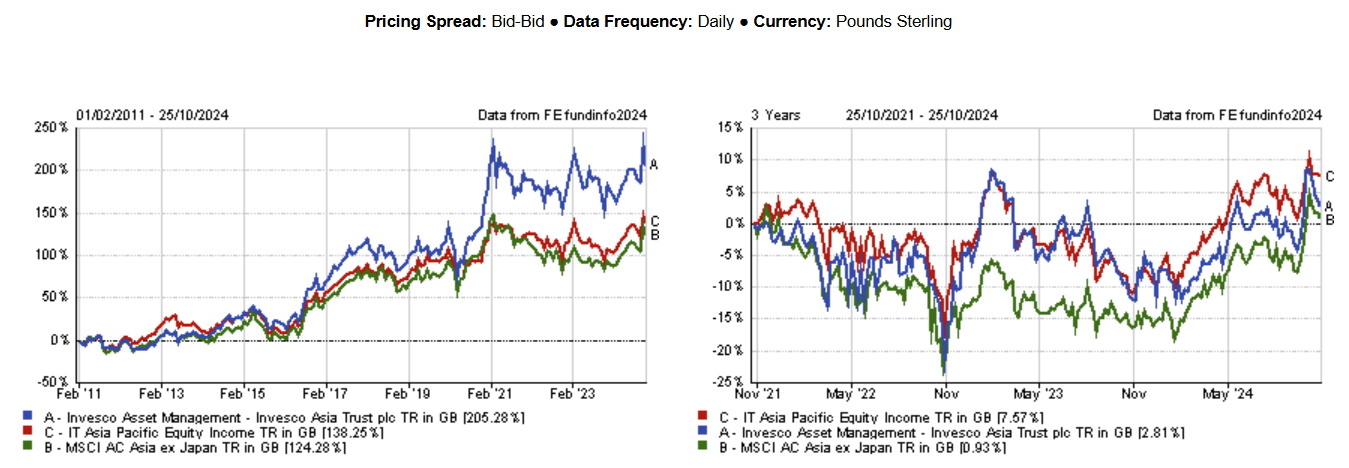

During Hargeaves’ tenure, which began in February 2011, Invesco Asia has returned 205%, 67 percentage points ahead of its peers. It remained in the first quartile of its sector over the past 10 and five years, but fell below its peers over more recent time frames, as the chart below shows.

The new vehicle will benefit from a lower fee of 0.75% for investments below £125m, 0.6% below £450m and 0.5% thereafter, from the current 0.75% below £250m and 0.65% thereafter.

Performance of trust against sector and index over manager’s tenure and 3yrs

Source: FE Analytics

Deutsche Numis analysts Ewan Lovett-Turner and Gavin Trodd said it is “somewhat unusual” to see the smaller vehicle, acting as the consolidator, but this “reflects that Invesco Asia has the better performance track record after a strong run for its value style between mid-2020 and late 2023”.

Asia Dragon's performance has been “disappointing” for years, they said, with a strategic review triggered in May 2024 after an approach by Ashoka WhiteOak Emerging Markets.

Shareholders in Asia Dragon will have a 25% cash exit opportunity at a 2% discount to formula asset value (FAV), while the combined entity will put in place a three-yearly unconditional tender offer for up to 100% of share capital.

“The board of Invesco Asia is seeking to make this the go-to Asian trust, with a premium rating to grow organically and through further combinations. To achieve this, it will need to raise its profile,” the analysts said.

“Invesco used to have a large stable of investment companies, but this is down to four now. The three-yearly exit is a useful addition, but the fund might need to be more active in buying back shares, given it has consistently traded wider than the 10% target, and it needs to seek to reduce the stake held by City of London holding [30% of Dragon’s and 20% of Invesco] for the discount to narrow meaningfully.”

Winterflood’s Shavar Halberstadt said the proposed transaction is “very much in line with sector trends”, with entrenched discounts and “subpar performance” driving boards to consider combinations, increasing scale and “presumably manager quality” in the process.

Yang and Hargreaves said the move comes “at an exciting moment to invest in Asia”, as valuation disparities across the region offer “abundant opportunities” for the active investor.

For the chairman of Asia Dragon, James Will, the concluded review process was “full and robust”.

He said: “The combination of the two trusts was the most attractive outcome for shareholders, providing a partial capital return alongside the continuation of shareholders' investment in a trust that has delivered strong long-term performance managed by a highly regarded team at Invesco.”