Omnis Investments has chosen Alessandro Dicorrado, head of value at Ninety One, to replace veteran stock picker Ben Whitmore at the head of the £573m Omnis Income and Growth fund, effective from December 2024.

The decision follows Whitmore’s departure from Jupiter Asset Management, which previously held the Omnis mandate.

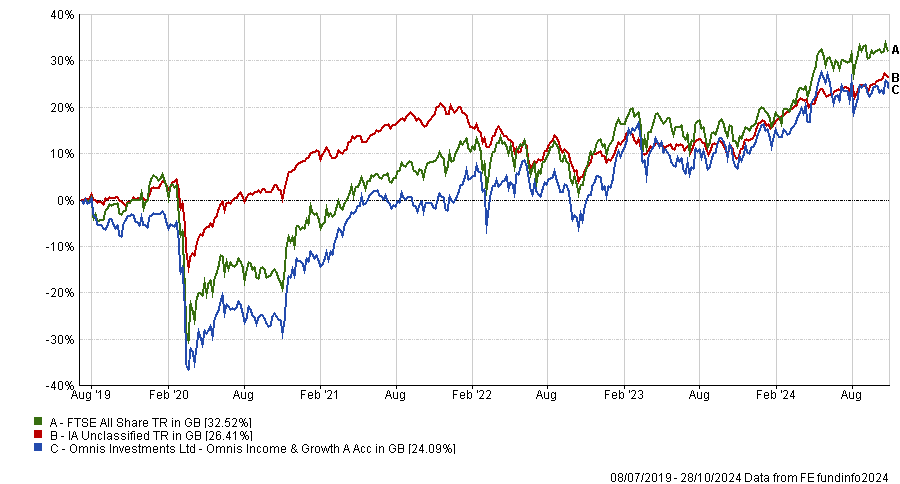

Over Whitmore’s tenure, which began in July 2019, the fund returned 24%, underperforming the FTSE All Share, as the chart below shows.

Performance of fund vs sector and index since July 2019

Source: FE Analytics

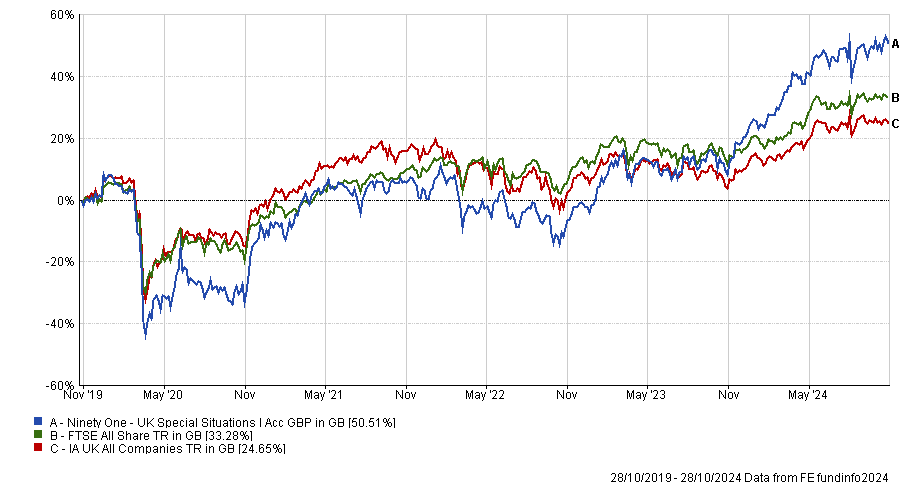

Dicorrado and seven of his colleagues will deploy the same investment approach as the Ninety One UK Special Situations fund, with some adjustments specified by Omnis, which has specific volatility and tracking error parameters designed to better cater for their clients.

The managing team will focus on mispriced UK companies that demonstrate sustainable earnings recovery, growth or cash return potential.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

The Omnis fund’s objective remains unchanged – to achieve a return consisting of both income and capital growth exceeding that of the FTSE All Share Total Return index, after fees and expenses, over a five-year rolling period.

Omnis’ chief investment officer Andrew Summers said he was “impressed” by the “clarity and rigour” of Dicorrado’s investment approach, which has enabled the team to “consistently identify compelling investment opportunities”.

Ninety One managing director Tom Peberdy added: “By seeking to understand why conventional wisdom is wrong through fundamental research, the team is able to deliver a differentiated, concentrated, high-conviction portfolio.”