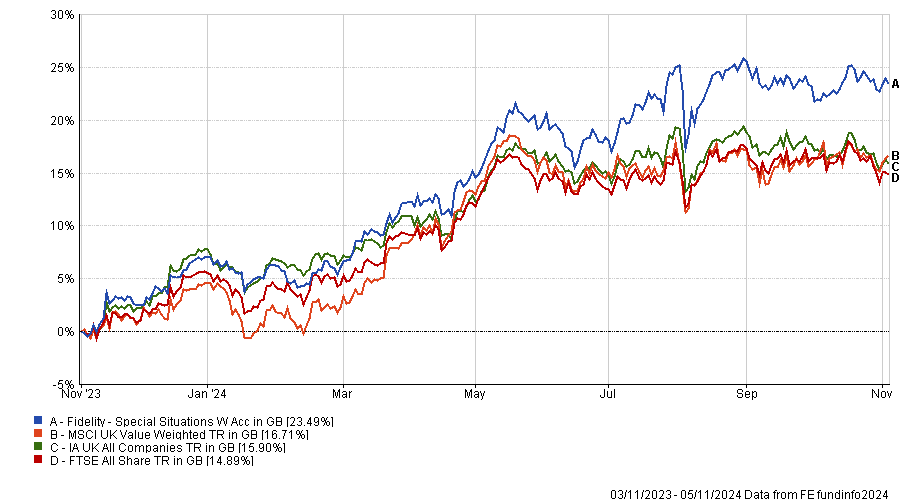

Value funds’ strong performance in 2022 and 2023 hasn’t been replicated this year, but some value strategies have still managed to outperform.

The Fidelity Special Situations fund, run by FE fundinfo Alpha Manager Alex Wright, is one of them, outperforming its sector, benchmark (the FTSE All Share index) and the MSCI UK Value index.

Wright achieved that by looking in areas where other people are not – something that, admittedly, has got easier by the decade.

Performance of fund against sector and indices over 1yr

Source: FE Analytics

“It has always been a bit contrarian to be a value investor – looking at things other people don't like to look at – but it's become more contrarian over the last 10 years,” he said.

“That means there's less money invested in the space and less people looking at these stocks, so the chance of adding idiosyncratic alpha is higher now than it was 10 years ago.”

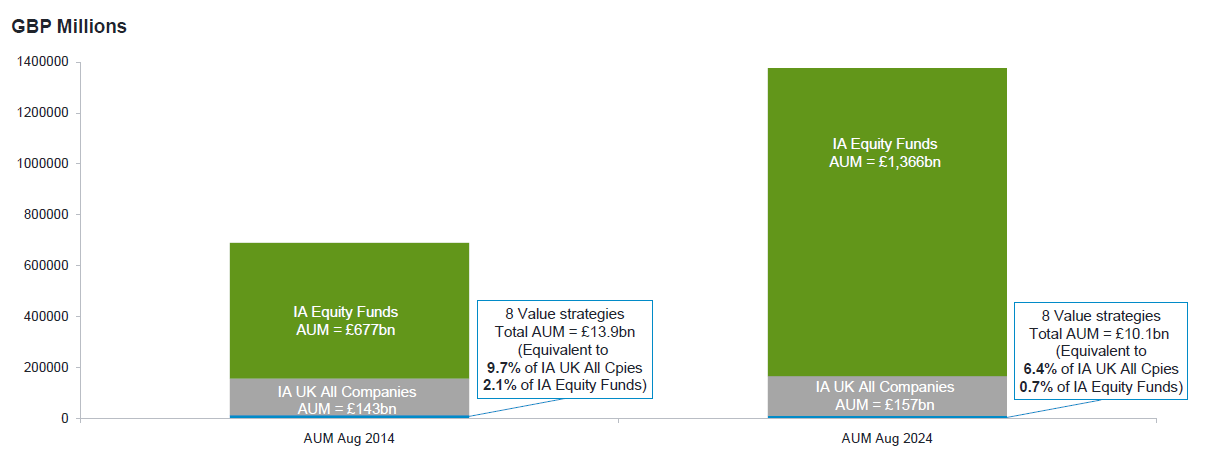

About a decade ago, value funds were already only 2% of people's investable assets in the UK, while at the same time, the domestic market accounted for 10% of the average investors’ investments.

Today, the UK allocation has fallen a substantial amount to only 6% and UK value funds are only 0.7% of people's total investments, as the chart below suggests (taking into account the top-eight active value IA UK All Companies strategies: Fidelity Special Situations, Jupiter UK Special Situations, M&G Recovery, Man GLG Undervalued Assets, JOHCM UK Dynamic, Schroder Recovery, Invesco UK Opportunities and Ninety One UK Special Situations).

This suggests more than £4bn has been taken out of the biggest UK value funds, which, according to Wright, should give an edge to those who remain invested.

“While it has been a tough time in terms of flows, that is setting up a really good opportunity to outperform,” he said.

Opportunity for alpha in UK value increases as competitors look elsewhere

Source: Fidelity International, Morningstar Direct, 31 August 2024.

“If you're competing with hundreds or maybe even thousands of other investors, it's incredibly hard to get an idiosyncratic edge – as it is for stocks such as Tesla, Nvidia or Apple,” he continued.

“Whereas, if you're looking in the UK market, which is unloved, and then in the value space down the market-cap spectrum, you're possibly competing with maybe tens of other investors, so the chance that you can find something that the market has missed is much higher.”

That is accentuated by the fact that there aren’t that many value funds available in the first place, despite the UK being a value-focused market, as Wright highlighted in the chart below.

Fund style bias within an increasingly growth-leaning peer group

Source: Fidelity International, Morningstar Direct, July 2024.

This observation was also made by Legal and General Investment Management fund manager and researcher Francis Chua.

According to his data, about 5% of UK funds show a value tilt from their label, while a regression analysis, which looks at the historic returns generated from its holdings, highlighted that 15% to 20% of IA UK All Companies funds exhibit a value factor.

But the scarcity premium wasn’t enough for Chua to allocate more to value in his portfolios. Quite the opposite: the value overweight that he maintained between 2022 and 2023 has evolved today into a more neutral stance, mainly driven by two reasons – the economic cycle and valuations.

“From a macro perspective, the economy is closer to a late cycle than it was before and typically late cycles are about a preparation for a turn, where value is not necessarily a good place to be,” he said.

“Also, the strong performance value has had over the last 18 months has weakened the valuation argument versus the market-cap index in the UK.”

For Christopher Carlton, head of fund selection at abrdn, value's potential can only be realised if and when flows turn more positive.

“The flow of funds out of UK value certainly creates the opportunity for managers to find high-quality companies at attractive valuations, however for this value to be realised in the stock price it may also require us to see a return to positive capital flows into UK equities,” he said.

For this reason, he has not been increasing exposure to value in the MyFolio range of portfolios, which don’t usually tilt too aggressively to a particular style factor.

“Among the fund of funds which allocate to active managers, we have retained a consistent exposure to fund teams that are specialists in allocating to UK value and who we believe will be significant beneficiaries should some of these attractive valuations begin to be realised in stock prices,” he concluded.