The US stock market surged after Donald Trump’s victory and fund managers have become increasingly bullish since the result was announced. Almost half (43%) of the fund managers surveyed by BofA after Trump won predicted that US equities would be the best performing asset class next year, up from 27% in a survey conducted before the election.

Hugh Grieves, manager of the £1.8bn Premier Miton US Opportunity fund, was positioned for stronger economic growth even before the election result and expects Trump to “just turbocharge that”.

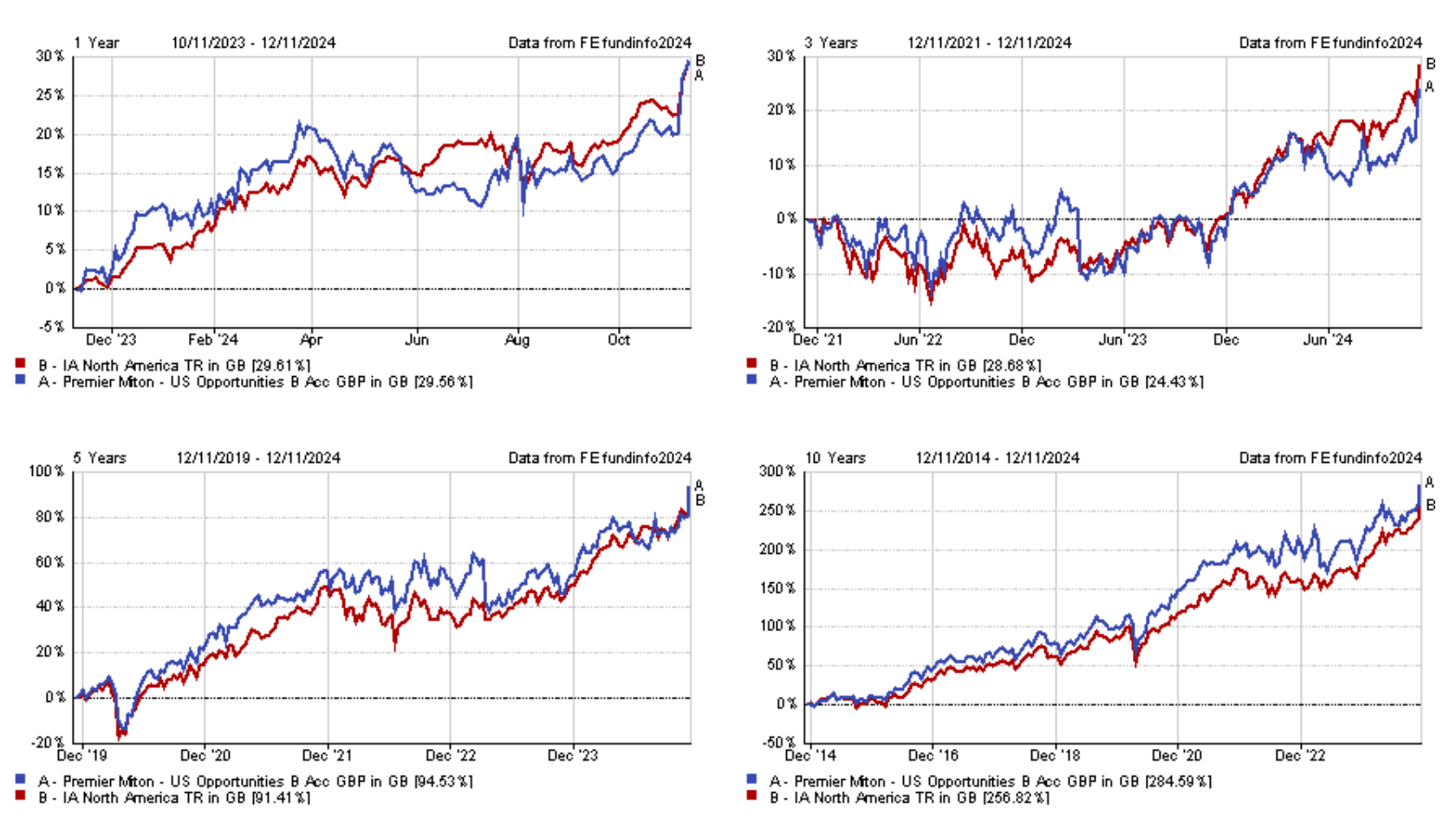

The fund, which he co-manages with Alex Knox, invests in “boring” US companies that can grow for a long time. Despite not owning technology stocks on valuation grounds, it has kept up well with the competition, as the chart below shows.

Performance of fund against sector over 1, 3, 5 and 10 years

Source: FE Analytics

Below, Grieves reveals his red flag when meeting management teams, when he thinks is the right time to buy a stock and his best and worst calls of the past year.

Please describe your philosophy and investment process

We would never invest in 85% of US companies because they're too unpredictable, too inconsistent and too vulnerable to outside shocks.

We concentrate on about 15% of the US market – businesses that are reasonably consistent and predictable, and that we can therefore model, forecast and value with reasonable confidence. When we find the right ones, we invest and hold them for a long time.

Meeting the managers is also part of the process, I’m on a business trip right now.

What do you look out for when meeting a manager?

Generally, for a business we don’t own, I would be trying to understand how consistent and how predictable it is, how vulnerable it is to outside disruption, how long a runway of future growth it has and what are the potential challenges that it may face.

For companies that we have held for a long time, I would want to know what makes the managing team tick and to make sure it will be around for a long time.

A red flag would be when the management team is pushing one particular angle and you don't understand why, or you pursue one particular item that they are not very comfortable with, and the main question there is: why? You shouldn't leave asking yourself why. Doing these trips is absolutely invaluable.

Once you identify a company, will you buy immediately?

We are patient investors because Mr. Market is emotional. Sometimes, he can get too excited and push stock prices too high, which, if you own that stock, gives you a chance to sell it at an amazingly good price.

But Mr. Market can also get too depressed and push the share price down too far. And that may give you the opportunity to buy a great company at a great price with a good margin of safety.

If you are wrong, you don't suffer a significant capital loss, but if you're right, you get the benefit of years of earnings growth and multiple expansion to come.

Did you or will you change anything in your portfolio as a result of Trump being elected?

No. The fund was already very well positioned for stronger economic growth, so Trump just turbocharges that. Also, this is not a portfolio that does hand-break turns. So far this year, we have only sold three holdings and bought five. That's very low by normal industry standards.

What was your worst call of the past year?

The worst performer has been Global Payments, which provides the connectivity between credit card terminals and the banking system.

We originally invested in Total Systems in 2016, which was then acquired by Global Payments. We kept the stock and it did very well for a period of time, but then the investment thesis changed.

This highlights the dangers of investing in tech. New competitors came in, took market share and growth slowed for Global Payments, whose economic moat weakened significantly.

We had to reevaluate the holding and realised it was no longer the consistent and predictable business it was when we originally invested, and now would not invest in it anymore. We decided to learn our lessons, bite the bullet and move on.

It cost us 75 basis points over the year to date.

And the best?

The best was the wealth manager Raymond James, which was up 142 basis points over the year to date. It has a very strong position in America and is expanding into the UK through acquisitions.

Raymond James is doing very interesting things. First, it is attracting advisors and brokers onto its platform, where they find all the tools and software they need to comply with the regulatory environment, and are then left to do their jobs on the platform.

Second, Raymond James has a bank within the business that holds cash deposits that people leave in their accounts – with interest rates at zero, it couldn’t make any money on that, but now it can.

Third, it has a strong mid-market investment banking business. Deal flow has been limited over the past couple of years, but with the arrival of Trump, deregulation and light antitrust oversight, the expectation is that deal flow will accelerate next year.

What do you do outside of fund management?

I work in the garden. It's a very calming hobby that rewards patience. You can see the analogy with investing there and then – you plant seeds, look after them and wait, and hopefully you get something great at the end of it.