Law Debenture has invested in five other investment companies to gain exposure to assets as diverse as Brazilian hydroelectric power, African property developments and innovations from UK universities.

Manager James Henderson has been increasing his exposure to investment trusts during the past 18 months to take advantage of discounts, seeking to achieve strong medium-term returns by buying out-of-favour trusts cheaply. “You get the balance of probability for success on your side if you're buying at a reasonable discount,” he noted.

He is also using investment companies to access areas he wouldn’t be able to manage in house.

Below, Henderson outlines his thesis for each of the five investment companies he holds.

Herald Investment Trust

Katie Potts, who runs Herald, has extensive knowledge of small tech and media companies. “We can never compete with that,” Henderson noted. “We wouldn't have any of the holdings that she's got, so it's a real diversifier for us. It’s a core holding because it's doing something I can't do.”

Potts has an extensive portfolio of 313 early-stage companies located throughout the world. Her largest exposures are to the UK (37%) and North America (31%). The trust has a market capitalisation of £1.1bn and is a top-quartile performer in the IT Global Smaller Companies sector over one, three and five years to 14 November 2024. Despite its track record, the trust is on an 11.6% discount.

IP Group

IP Group commercialises the ideas of university professors, supplying the skills and capital to turn the best innovations into viable companies.

Its greatest success is Oxford Nanopore Technologies, which specialises in gene sequencing. Portfolio companies include Bramble Energy, which specialises in fuel cells, and another company focusing on nuclear power.

The current market environment is “very difficult for businesses that have got an element of blue sky about them”, Henderson observed. Investors prefer current earnings to future potential.

This risk aversion has been a headwind for IP Group, which has not been able to achieve realisations through the stock market because fewer early-stage companies are listing. As a result, the company is trading at a substantial discount to its asset value.

Henderson believes IP Group could perform well if the IPO market picks up, investor sentiment improves and its constituent companies are able to raise capital, which would validate their valuations.

Grit Real Estate Income Group

Grit is a London-listed, pan-African real estate investor, which develops large-scale building projects. Henderson rates Grit’s development team, which has extensive on-the-ground knowledge and contacts.

The counterparties buying Grit’s development projects often pay in dollars, which makes it easier to arrange financing. For instance, Grit is developing a complex of US ambassadorial buildings in Africa. Other developments include big hotels and retail property.

Grit is on a very large discount to its stated asset value. Its loan-to-value ratio of 50% is too high for many investors’ comfort levels because Grit had to write down assets after Covid, Henderson said. The company has been selling assets and is trying get the loan-to-value down to 40%, which he thinks would be a more palatable number for potential investors and banks.

Grit is a recovery-type investment and, as a geared play on Africa, it is risky. Yet within Law Debenture’s well-diversified portfolio of 130-150 holdings, there is space to take advantage of opportunities such as this, Henderson said. “What we're trying to do is pay attention to things people aren't paying attention to. Then you've got more chance of finding value.”

He has invested in Grit for three years but has built up most of his position during the past year as the share price has fallen. Africa is growing fast, so there is a real need for property development and Grit’s growth could surprise substantially, he added.

Scottish Oriental Smaller Companies

If president-elect Donald Trump imposes punitive tariffs on Chinese companies, Henderson expects large multinational companies to move their supply chains to other Asian countries. The small businesses which Scottish Oriental Smaller Companies holds could benefit from that tailwind.

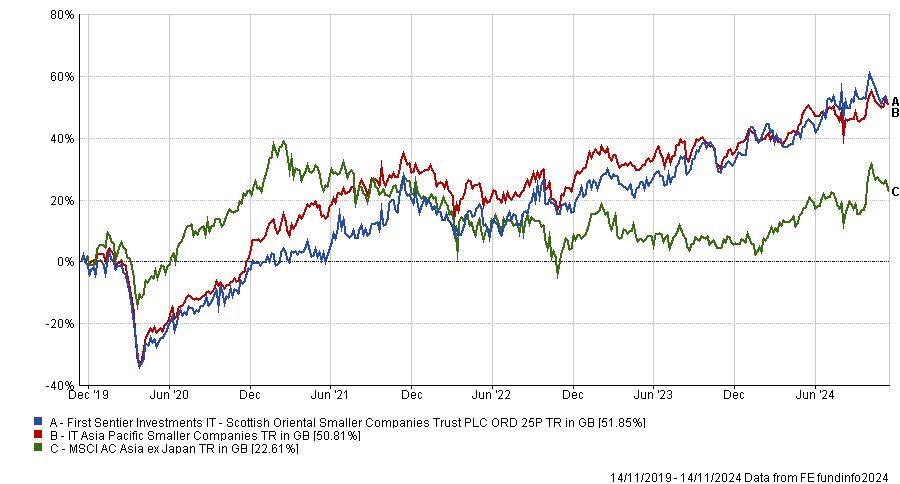

Performance of trust vs benchmark and sector over 5yrs

Source: FE Analytics

Scottish Oriental doesn’t pay a dividend “but what we're after in Law Deb is this real diversity of holdings; that's why we run the long list of 130-150 stocks and we use investment trusts”, Henderson said.

Scottish Oriental is managed by Vinay Agarwal, a director at FSSA Investment Managers.

VH Global Sustainable Energy Opportunities

VH Global Sustainable Energy Opportunities invests in alternative energy projects such as hydroelectric power in Brazil, a battery asset in Australia and a carbon capture business in Nottingham. Many of its assets are mature and generate steady income, enabling the trust to pay a dividend.

The trust is trading at a discount because wealth managers used to hold it as a bond proxy when interest rates were low, but after rates rose, they sold the trust and bought bonds instead, he noted.

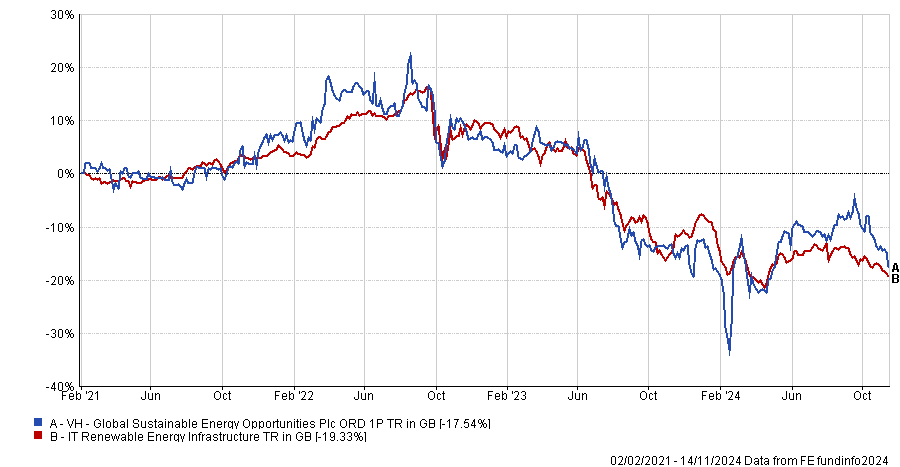

Performance of trust vs sector since inception

Source: FE Analytics

Law Debenture first invested in VH Global at launch in 2021 but Henderson has been gradually increasing his exposure as the share price has fallen to take advantage of the discount. Meanwhile, VH Global has been buying back its own shares.