The board of the Baillie Gifford-managed Edinburgh Worldwide trust has published a list of proposed measures to reset the trust after years of underperformance.

It intends to name Luke Ward and Svetlana Viteva as co-managers alongside Douglas Brodie. Ward and Viteva have been deputy managers of the trust since December 2017 but they will now rank equally with Brodie, who has been the lead manager since January 2014.

This adjustment to the team’s structure should “increase challenge and enhance performance”, the board stated in a circular to shareholders.

The board also wants to reduce the number of holdings in the trust, which should “improve decision-making and portfolio discipline” and enable “more regular and deeper engagement with companies”.

The portfolio will now contain 60-100 companies instead of 75-125 and the upper size limit will be raised from $5bn to the market cap of the S&P Global Small Cap index’s largest constituent.

The board also committed to return up to £130m to shareholders in 2025 and confirmed that the ongoing share buyback programme will continue.

All these changes which will subject to shareholder approval at the general meeting on 18 December.

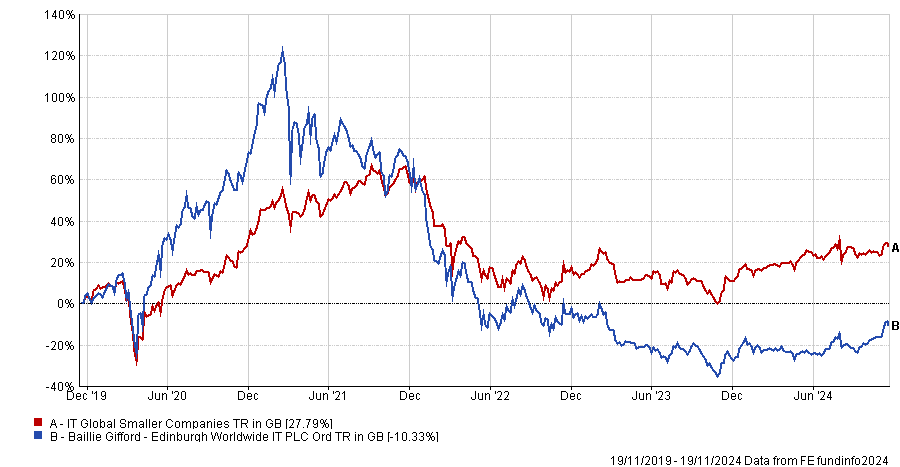

Performance of fund against sector over 5yrs

Source: FE Analytics

In common with a number of other Baillie Gifford vehicles, Edinburgh Worldwide has underperformed in recent years, against a difficult backdrop for the firm’s growth-oriented investment approach.

Emma Bird, head of investment trusts research at Winterflood Securities, said that due to its growth focus, she would not have expected the trust to generate notable outperformance in the recent higher interest rate environment. However, she commended the board for conducting a review of the investment team and strategy and introducing changes to try to improve performance going forward.

Despite its underperformance, the trust’s discount has tightened considerably in recent months and weeks, and now stands at 4%, significantly tighter than its Global Smaller Companies peers and Baillie Gifford global stablemates.

Bird attributed this to activist US hedge fund Saba Capital, whose presence on the share register drove the board’s decision to return up to £130m to shareholders next year.

“This amount represents c.20% of current net assets and we await further clarification on how the portfolio will be positioned to accommodate this capital return, given the large exposure to unlisted investments,” she said.

“The unquoted allocation is limited to 25% of assets at the time of initial investment, and we would not view it as appropriate to increase the current exposure significantly as a result of the sale of listed holdings to fund the £130m capital return, as this would restrict the fund’s ability to make new unlisted investments or follow-on investments in existing portfolio holdings.”

Commenting on the review, Jonathan Simpson-Dent, chair of Edinburgh Worldwide, said: " Our vision to identify and manage a carefully selected portfolio of transformative businesses has the potential to deliver outsized returns for shareholders.

“We have developed a comprehensive action plan to improve execution and we believe that this wide-ranging package of changes will put the trust back on a path for growth."