Despite best efforts, enthusiasm for UK equities largely failed to manifest this year. Indeed, according to the most recent Hargreaves Lansdown Investor Confidence Index, confidence in the UK stock market has fallen by 11% month-on-month this year.

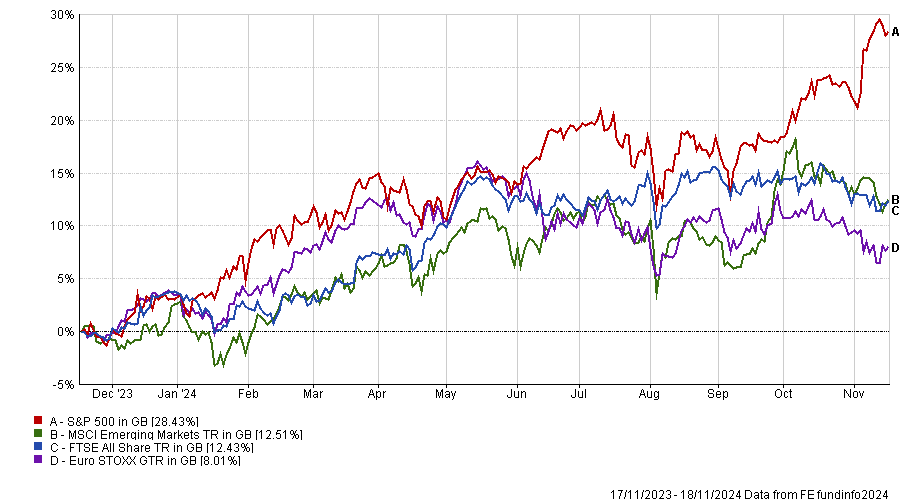

Additionally, over the past 12 months, the FTSE All Share has risen by just 12% and is now lagging both the Euro STOXX and the S&P 500.

Performance of market indices over 1yr

Source: FE Analytics

For Nigel Yates, portfolio manager on AXA Investment Managers’ UK equity range, falling investor confidence has become one of his biggest professional frustrations.

Yates said: “We’ve got a good market here, with great underappreciated companies, and from a market perspective, it frustrates me when people sell out of it.”

The market has become increasingly speculative, he said, prioritising short-term sentiment over business fundamentals, which means company valuations have started to spiral. “Companies that are out of favour become increasingly out of favour, and vice versa,” he explained.

As a result, the UK is home to exceptional growth stocks that are being valued well below what their fundamentals deserve.

Below, Yates highlighted industry leaders with even greater growth potential and laggards on the verge of a resurgence.

Kainos

Investors have traditionally underestimated UK technology due to the dominance of companies such as Sage within the index. However, by digging into the mid-cap and small-cap arenas, adventurous investors will be rewarded with a "thriving tech sector”.

One of Yates' favourite opportunities in this space is the Irish software company Kainos, responsible for public sector and government digital transformation programmes, in partnership with leading organisations such as Workday.

It has struggled since January, with its stock price sliding by 25% year to date (YTD), with a particularly large decline in August.

Share price performance of Kainos YTD

Source: Google Finance

Despite these poor results, Yates is optimistic about the stock’s potential for a resurgence, playing on megatrends such as digitalisation.

“If we’re going to save the money that we need to save, public services need to deliver far better value for money, and digitalisation and artificial intelligence (AI) are going to be crucial for that,” he said.

“Government spending on digitalising the public sector is a massive opportunity. It’s the only way they are going to break the link with the ever-increasing spending burden,” he added.

“It has a rock-solid balance sheet, good margins, strong employee metrics, a decent dividend yield and now a buyback, which means you are being paid to be patient before the inevitable pick up in market demand.”

Trainline

Travel and ticket booking app Trainline struggled during the pandemic, which Yates said he found frustrating because he uses the app almost every day. “I talk a lot about the sentiment and noise surrounding companies, and Trainline was a company that got unduly caught up in that.”

It has gone from strength-to-strength this year, with the share price climbing by 31% YTD despite surges in volatility earlier in the year.

Share price performance of Trainline YTD

Source: Google Finance

He was encouraged by Trainline’s recent rally, on the back of optimistic November results. Trainline announced it had sold £3bn in net tickets this year, an increase of almost 14% compared to 2023. The app now has more than 12 million monthly users in the UK alone, making it the largest ticket reseller in Europe.

Yates said: “I’m pleased to see that the performance of the business has started to come through and people are starting to appreciate it. For us, it’s always been a consumer champion.”

Rightmove

Another favourite for Yates was the property business Rightmove.

Despite a relatively volatile year for the property market, the firm has enjoyed a 9% rise in share value YTD and trades on a price-to-earnings (P/E) ratio of 25x.

Share price performance of Rightmove YTD

Source: Google Finance

Yates said: “Again, this is another company in which sentiment unduly affected performance, most notably the threat of CoStar buying it."

In the UK there is a real fear that US tech is superior to our domestic businesses, he explained, meaning that acquisition fears can cause drastic moves in share prices.

While Rightmove has mostly recovered from its nadir in 2022, Yates believes the stock price is still not reflecting the company’s strong fundamentals

For Yates, Rightmove maintains a strong grasp on the UK property market which gives it great long-term growth potential. The brand is so well known and its customer base so concentrated that the barrier to entry for other property companies is extremely high.

“It would be difficult for even CoStar to disrupt Rightmove’s hold on the UK market. We think there is an interesting story there”.