Hargreaves Lansdown has launched a new online venture capital trust (VCT) service in partnership with Octopus Investments, Calculus and Blackfinch Ventures to boost investment in early-stage UK companies.

The new service will debut with five initial VCTs, three of which will be provided by Octopus and one each by Blackfinch and Calculus.

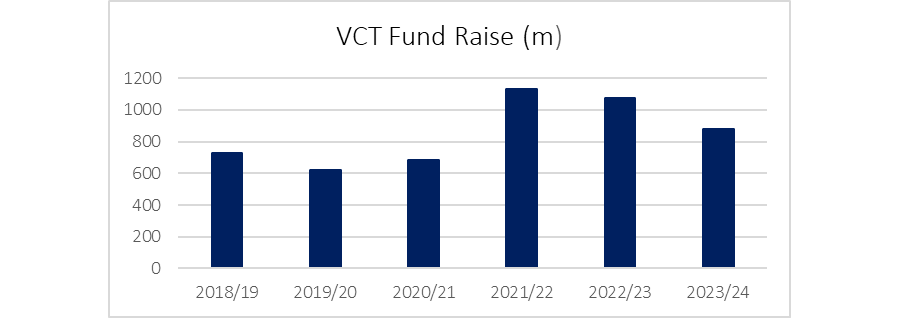

This announcement follows the UK government's commitment to extend VCT legislation until 2035 and wider tax changes during the recent budget. Moreover, recent statistics from the National Audit Office have demonstrated that VCT investment has become increasingly mainstream, with more than £800m raised by VCTs in the 2023/2024 tax year.

Source: National Audit Office

Emma Wall, head of platform investments at Hargreaves Lansdown, said: “The VCT market has been a vital tool for entrepreneurial UK businesses to get the seed funding they need to kick-start their enterprise for nearly 30 years, which has helped the UK to be one of the best places in the world to start a business.”

Indeed, according to recent statistics from McKinsey, 319 of Europe’s top 1000 high-growth startups are based in the UK.

As a result, Alex Sumner, commercial and investment director at Blackfinch Ventures, concluded: “The UK remains one of the best places in the world to launch and grow an ambitious start-up”.

Applications to the new service will incur a £50 dealing charge, with no platform fee and zero commission. Following the initial investment, a £50 fee will be charged on VCT trades.