The board of the Baillie Gifford European Growth trust plans to offer shareholders their money back if it continues to underperform for the next four years.

The European equity market has been led by a narrow group of 11 large companies recently and the trust, which is biased towards mid- and small-caps, has lagged behind. It also had to write down the value of its stakes in two private companies, Northvolt and McMakler.

Chairman Michael MacPhee said: “Aside from the damage done to valuation of long-term growth by a major shift in interest rates, there is no doubt that stock-picking mistakes have been made. We wanted reassurance that lessons had been learned, however, and are optimistic on this score.”

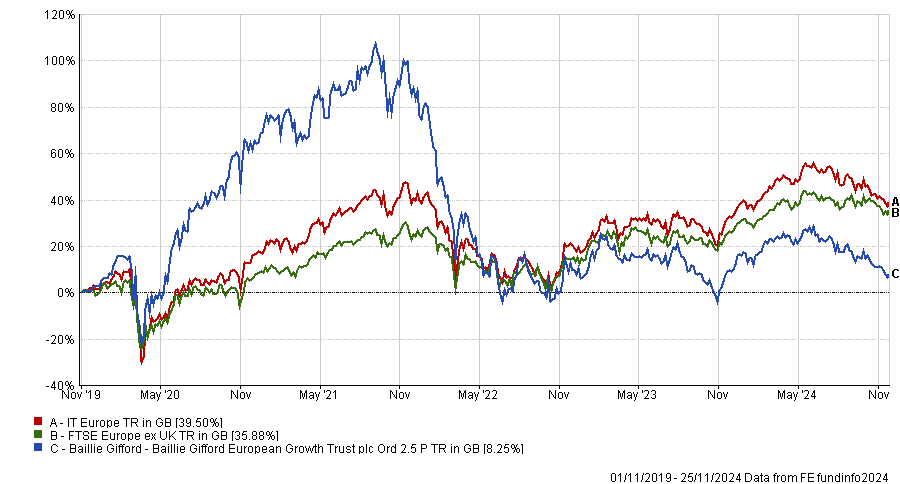

Since Baillie Gifford began managing the portfolio in November 2019, the net asset value (NAV) total return has been 22.4%, while the share price rose 12.1%. Both are significantly below the benchmark’s 44.3% rise in sterling terms. The discount has widened in that time from 7.5% to 15.7%.

Performance of trust vs sector and benchmark since November 2019

Source: FE Analytics

“The board is painfully aware of the disappointing absolute and relative performance of the company over the past three years”, MacPhee said, and has therefore proposed a one-off tender offer for the entirety of the trust’s share capital. It will be triggered if the £364m trust’s NAV total return per share underperforms the FTSE European ex UK Index over the four years to 30 September 2028, in sterling terms.

The tender would be at a price close to NAV and shareholders would have a chance to approve it at the annual general meeting (AGM) in early 2029.

The trust’s managers, Stephen Paice and Chris Davies, said: “We are clearly very disappointed with the recent period of sharp underperformance. The board has set us a four-year performance-based challenge and, as managers, we acknowledge and accept this.

“We strongly believe that the starting point for future investment returns hasn't been this favourable for many years. We are confident that we will return to delivering the performance our shareholders have every right to expect.”

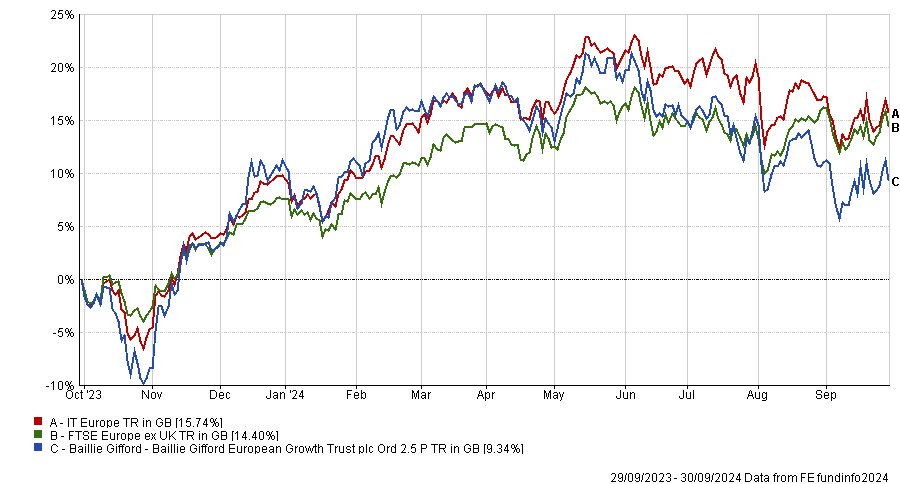

The trust announced its results for the year to 30 September this morning, with an NAV total return of 12.1% and a share price total return of 9.3%. Its benchmark rose 15.3%. The discount widened from 13.6% to 15.7% during the period.

Performance of trust vs sector and benchmark for financial year to 30 Sep 2024

Source: FE Analytics

Public companies, which account for 94% of the portfolio, returned 20% – meaning the trust would have outperformed without its unquoted private holdings. Write-downs of Northvolt and McMakler caused a 6.5% performance haircut.

Swedish battery startup Northvolt struggled with operational performance and liquidity, and made 20% of its workforce redundant. It has filed for Chapter 11 reorganisation and chief executive officer Peter Carlsson has resigned.

McMakler, a real estate agency and brokerage company in Germany, faced a tough economic backdrop but Baillie Gifford has supported McMakler’s recapitalisation on favourable terms. “If business continues to improve, we would expect the value of our new investment to rise materially,” said Paice and Davies.

The trust owns three other private companies which have fared much better: Italian software company Bending Spoons; the digital freight-forwarder sennder; and global travel-tech business Flix.

“With two of our five private company investments in distress, it is fair to ask whether we ought to stick to public markets,” the managers said.

“We believe strongly that this is an area where we can offer something quite unique with the potential for worthwhile and asymmetric payoffs. If anything, our long termism and privileged access to companies mean that we should have an even stronger advantage in private markets. It is here that we are meeting some of the most innovative companies in the world.”

In the first half of the financial year, the trust bought three healthcare companies, Lonza, Genmab and Camurus, as well as Assa Abloy. During the second half, it added two serial acquirers: Vitec in software and in Instalco in construction and installation. It also bought Dino Polska, a Polish convenience store chain.

Paice and Davies recently invested in Novo Nordisk, which had been “a painful omission”. “There are decades of innovation left in GLP-1s and combination therapies, and the potential one billion patient population has barely been penetrated. Novo has distribution and manufacturing advantages through increasing scale which will help cement its position as lowest cost provider,” they said.

“There are very few companies in Europe, or even in the world, that have the potential to grow revenue at 15% for more than a decade while making incredibly high returns on capital.”

Strong performers within the portfolio included Spotify, which increased its subscription prices with limited impact on demand, and Dutch payment company Adyen, which grew revenues by more than 20%. Hypoport, Germany's largest online marketplace for mortgages and home loans, benefitted from transaction volumes picking up.

Schibsted, the Nordic online classifieds platform, divested its News Media business and its stake in Adevinta, a European classifieds platform. “What is left is a much cleaner business with a lot of scope to increase prices for its services while benefitting from a recovery in demand,” the managers noted.

On the other hand, Soitec, a manufacturer of engineered substrates or wafers for semiconductors, underperformed because its customers had built up excess inventories. The managers believe this to be a temporary phenomenon and have added to their position.

They sold meal kit business HelloFresh and Kering, which owns Gucci and has suffered from weaker Chinese demand. “This downturn has been especially tough as Gucci's extraordinary growth of recent years came to an end and those who led it left the business,” said Paice and Davies.