Greencoat UK Wind has changed its fee structure to create more alignment with shareholders. Schroders Greencoat LLP, the trust’s investment manager, will henceforth base its fees on whichever is lowest: market capitalisation or the trust’s net asset value (NAV).

At present, the management fee is 0.9% of the trust’s NAV, which was £3.6bn as of 30 September 2024. The trust is trading on a 19.3% discount and has a market capitalisation of £2.8bn.

The new fee arrangement will come into effect on 1 January 2025. Deutsche Numis calculates that if fees are based on the trust’s current market cap, this would lead to a 19% (£5.5m) reduction in cash fees payable. This market cap-based fee would be equivalent to 0.7% of the trust’s NAV.

The fee reduction “should further enhance the implied returns from Greencoat UK Wind’s portfolio, which we calculate to be circa 12.6% at the current share price, one of the highest in the sector”, analysts at Deutsche Numis noted.

Lucinda Riches, chair of Greencoat UK Wind, said the revised fee structure “will foster even stronger alignment with shareholders”.

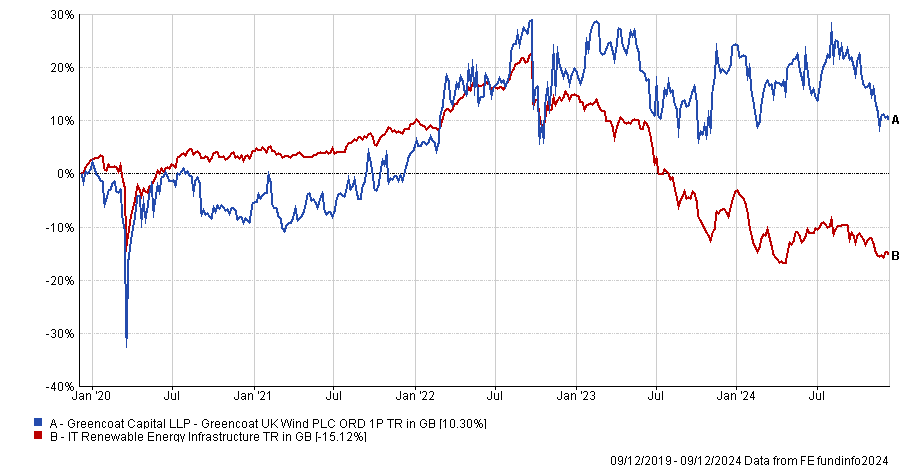

Performance of trust vs sector over 5yrs

Source: FE Analytics

Greencoat, which was launched in 2013, is the first listed infrastructure fund of its vintage to revise how its management fees are calculated.

Deutsche Numis concluded: “Given the prevalence of discounts across the peer group, we believe more companies will come under pressure to align fees with share price performance.”

Investment trust fees have been a contentious issue of late, with Hawksmoor Investment Management calling for trusts to levy charges on their market capitalisations, which is what shareholders experience.

QuotedData, however, prefers fee arrangements akin to Greencoat’s new plan. James Carthew, head of investment companies at QuotedData, said: “Our stance has always been that the best fees are based on the lower of market cap and net asset value.”

Just 4% of investment trusts do this currently, according to the Association of Investment Companies.

Greencoat UK Wind was the most popular investment trust on interactive investor’s platform in November and it was within the top 10 trust for Fidelity Personal Investing’s ISA and SIPP clients.