There are 36 investment companies in Winterflood’s list of trusts with the potential to outperform their peers in the next 12 to 24 months, one fewer than last year. This results from eight additions and nine removals across all Association of Investment Companies universes.

The challenging backdrop of 2024 caused several of these deletions and is also responsible for the wider average discount, which over the year moved from 12.6% to 14.8%, said Emma Bird, head of the investment trust research team.

“In a year of continued macroeconomic uncertainty, 62% of our selections were de-rated during 2024, while the average change in rating was -1.7 percentage points, compared to -2.2 percentage points for the investment trust universe,” she said.

Below, we focus on equity sectors and tomorrow we will reveal which trusts Winterflood is recommending in other asset classes. Equity removals included Finsbury Growth and Income, Law Debenture and Fidelity China Special Situations. They gave up their positions to accommodate, among others, Mercantile, Temple Bar and AVI Japan Opportunity.

We begin with the IT Global Equity sector, where Scottish Mortgage retained its place. Its positions in listed growth companies have “sufficient headroom” to appreciate as interest rates continue to fall, Bird said, while some of its unquoted holdings are candidates for initial public offerings (IPOs). The trust is trading on an 11% discount.

Its stakes in SpaceX and Tesla should be supported by the political influence of founder Elon Musk and Bird also expects the incoming US administration to approach TikTok owner ByteDance more favourably that its predecessor.

In the UK, Finsbury Growth and Income* was ousted by Mercantile*, which stands out for its focus on mid- and small-caps. Mercantile offers a more broad-based access to UK growth companies with less stock-specific risk than the Finsbury strategy, while also benefitting from a higher yield (3.3% versus 2.2%) and a good record of dividend growth, Bird said. It is currently trading on a 11% discount.

Temple Bar, with its “experienced manager and well-established value approach” is the new income favourite, replacing Law Debenture, whose independent professional services business, particularly pension trusteeship, “could continue to face a more challenging market backdrop”, Bird explained. Temple Bar is managed by Redwheel’s Ian Lance and Nick Purves.

Temple Bar’s current discount of 8% is wider than the average trust over the past 12 months (5%) and is also wider than the UK Equity Income peer group weighted average (6%), offering “relatively attractive value”.

Winterflood’s analysts also think its has scope for a re-rating if sentiment towards UK equities improves.

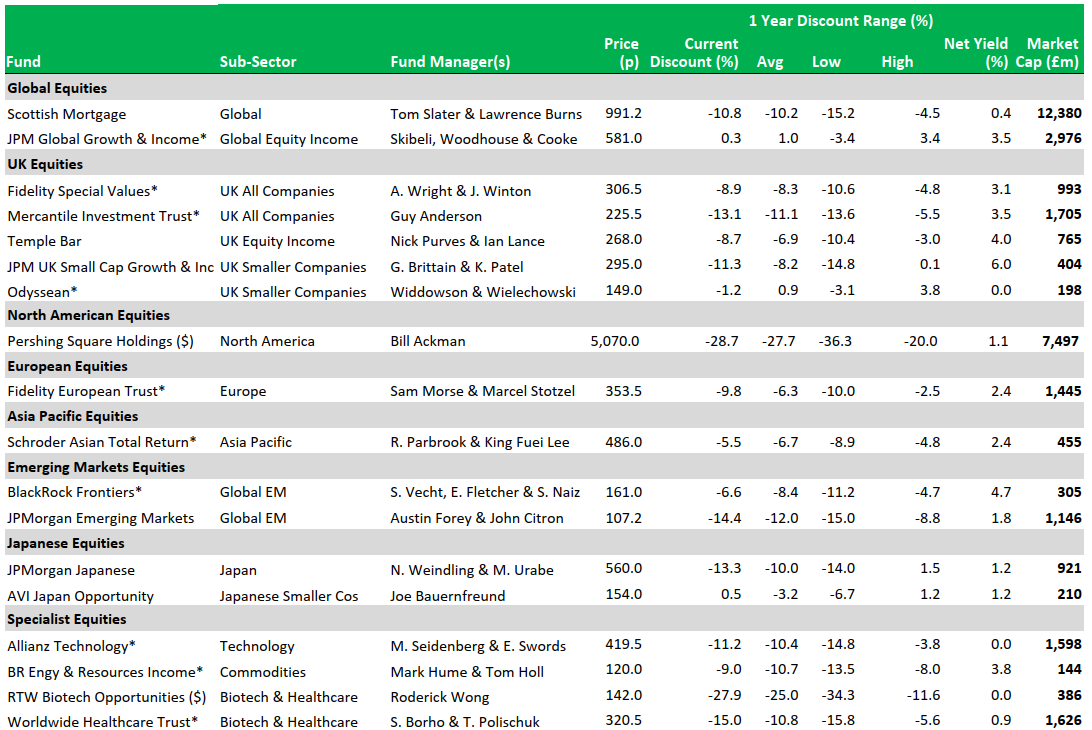

Winterflood’s 2025 equity trust recommendations

Source: Winterflood Securities

Further afield, Pacific Horizon gave way to Schroder Asian Total Return* and Fidelity China Special Situations was dropped without a replacement.

Bird tried to avoid making macro calls; nevertheless, she wasn’t sold on the Chinese market as a whole. “We consider it likely that over the next 12 months, Chinese equities will be overwhelmingly driven by geopolitical developments and other macro factors,” she said.

“From targeted US sanctions to the domestic economy and regulatory landscape, we have insufficient confidence to recommend a single bottom-up stock picker over another, although we continue to rate Fidelity China Special Situations highly.”

In the IT Japan sector, Winterflood preferred AVI Japan Opportunity to the previous favourite Nippon Active Value. Both have a similar activist approach to Japanese small-cap investing, but the AVI strategy has outperformed over the past year and benefits from an 100% bi-annual redemption opportunity, which swayed the analysts.

This mitigates downside discount risk (the shares are currently trading approximately at net asset value), as does the board’s commitment to buying back shares if the average four-month discount exceeds 5% in normal market conditions.

Finally, Impax Environmental Markets* lost its spot due to the current ‘higher for longer’ environment and the US election outcome, both unfavourable conditions for strategies focused on environmental, sustainability and governance (ESG) principles.

“We do not see an imminent catalyst for a re-rating and have therefore removed the fund from our recommendations list,” Bird said.

“Nevertheless, we continue to rate the managers highly and think that the fund offers attractive specialist exposure for investors looking to allocate to environmental markets.”

*Corporate clients of Winterflood Securities.