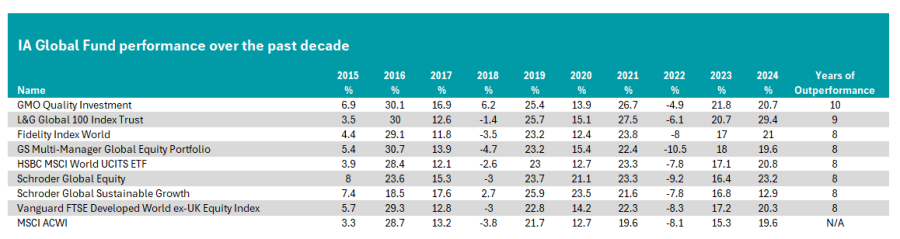

The £3.9bn GMO Quality Investment fund was the only one in the IA Global sector to successfully beat the MSCI ACWI index in each calendar year over the past decade, according to a study by Trustnet. This consistency led to a 10-year return of 339.1%, the best result in the IA Global sector overall.

Yet the portfolio, managed by Tom Hancock, Ty Cobb and Anthony Hene, has not been overly risky in search of its returns. Indeed, the fund’s 10-year maximum drawdown was just 19.6%, a first-quartile result in the IA Global peer group. Additionally, it posted a second-quartile downside risk score of 15.3%. However, a 10-year volatility of 14.5% placed it within the third quartile for risk.

Analysts at FE Investments said that the fund benefits from an "all-weather" approach, which should allow the portfolio to perform well in the long term. They explained that the manager's willingness to rotate capital away from expensive names to more favourably priced counterparts meant the portfolio could manage drawdowns better than many of its competitors.

Source: FE Analytics

Moreover, according to a study from Trustnet in September, it was also one of the best funds in the sector for risk-adjusted returns, with the second highest five-year Sharpe ratio in the sector.

As a result of the fund’s consistent track record, analysts at FE Investments said it was a “suitable cornerstone” of investors' portfolios, particularly for those focused on stock selection.

Performance of fund vs sector and MSCI ACWI over 10yrs

Source: FE Analytics

This is the first part of a new series looking at the most consistent funds in each Investment Association sector. We have done this by looking at the funds that beat the market, year in and year out, over the past decade. As funds are benchmarked against different indices, we are comparing all funds to a common index. For the IA Global sector we have chosen the MSCI ACWI, a true global benchmark that includes emerging markets.

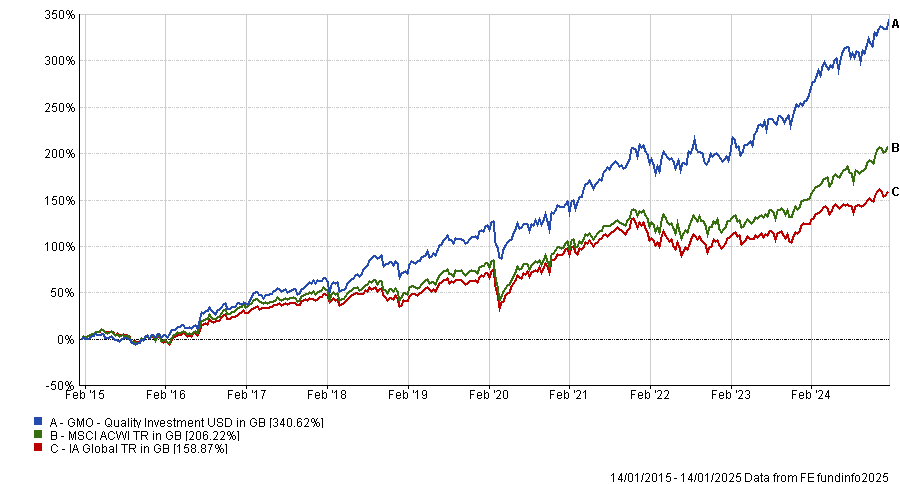

Just behind GMO Quality Investment, the £2bn L&G Global 100 Index Trust outperformed the market in nine out of the past 10 years. Over the past decade it failed to beat the market in 2017, when it returned 12.6% against the MSCI ACWI, which rose by 13.2%. However, it remains consistent and has made 300.8% in the past 10 years.

Performance of fund vs sector and MSCI ACWI over 10yrs

Source: FE Analytics

However, it should be noted that the fund benchmarks itself against the S&P Global 100 index, which means it is more exposed to the world’s largest companies, than the MSCI ACWI, which consists of some 2,647 stocks.

The recent market concentration into the biggest tech companies, nicknamed the ‘Magnificent Seven’, will have aided recent performance. The fund has double-digit weightings to Apple (12.4%), Nvidia (11.8%) and Microsoft (10.9%) while the MSCI ACWI has no holdings larger than a 4.9% weighting.

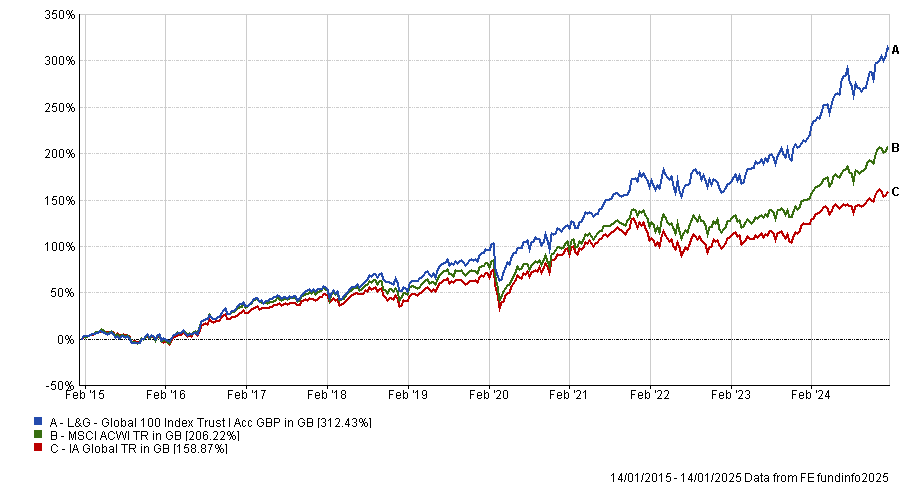

Broadening our scope further, six funds outperformed in eight years split evenly between active and passive strategies.

The £10bn Fidelity Index World, £9.5bn HSBC MSCI World UCITS ETF, and the Vanguard FTSE Developed World ex UK Equity Index all beat the MSCI ACWI. The first two track the MSCI World index and the latter tracks FTSE AW Developed ex UK.

Both indices benefited from being developed-market only, as the emerging markets have weighed down MSCI ACWI returns over the past decade. Additionally, the FTSE index also excludes the UK, which has lagged.

Of the three passives, Fidelity failed to outperform the MSCI ACWI in 2017 and 2020. Vanguard's tracker faltered in both 2017 and 2022. Finally, the HSBC fund consecutively underperformed against the market in 2016 and 2017.

Performance of fund vs sector and MSCI ACWI over 10yrs

Source: FE Analytics

Over the past 10 years, the Vanguard tracker was the best performer, up by 235.5%, followed by the HSBC exchange-traded fund (ETF) at 228.4% and Fidelity’s index tracker at 225.5%.

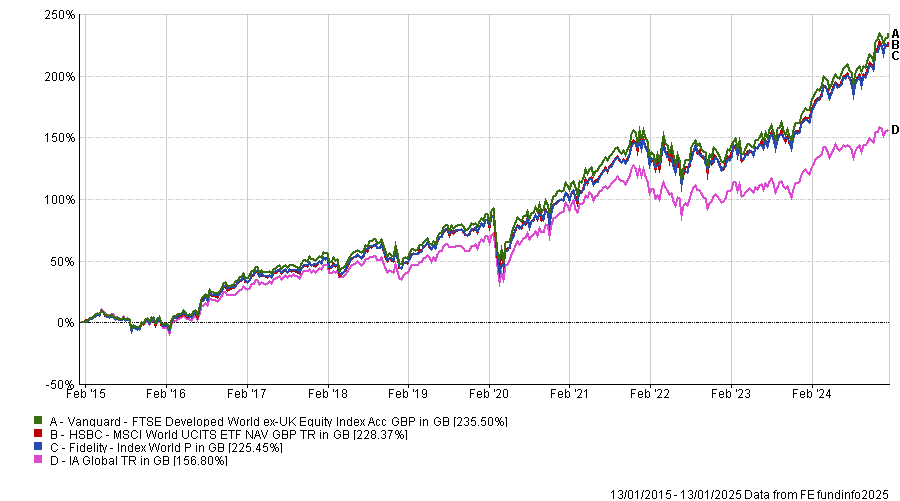

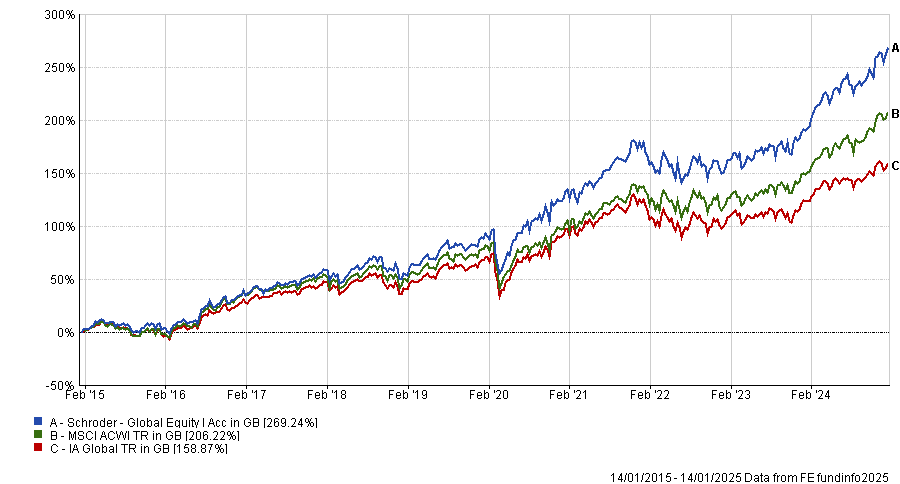

Turning to the actives, the £1.9bn Schroder Global Equity portfolio, led by FE Fundinfo Alpha Manager Alex Tedder since 2014, made the list. His strategy failed to outperform the MSCI ACWI in 2016 and 2022, when the fund rose by 23.6% and fell by 9.2%, respectively. However, due to outperformance in every other calendar year over the past decade, the strategy posted a top-quartile return of 258.9% over 10 years.

In 2020, despite the challenges of the pandemic, the fund surged by 21.1%, compared to the MSCI ACWI, which rose by 12.7%.

Performance of fund vs sector and MSCI ACWI over 10yrs

Source: FE Analytics

Across the period, the fund would have been a consistent choice for investors, with second-quartile results for both downside risk and overall volatility. Despite having a bottom-quartile 10-year maximum gain of 14%, it also had one of the lowest maximum losses of 11%. Moreover, with a first-quartile maximum drawdown of 19.8%, the fund was one of the best choices in the sector at preventing major losses.

Its cousin strategy, the Schroder Global Sustainable Growth, also beat the market in eight of the past 10 calendar years, faltering in 2016 and 2024.

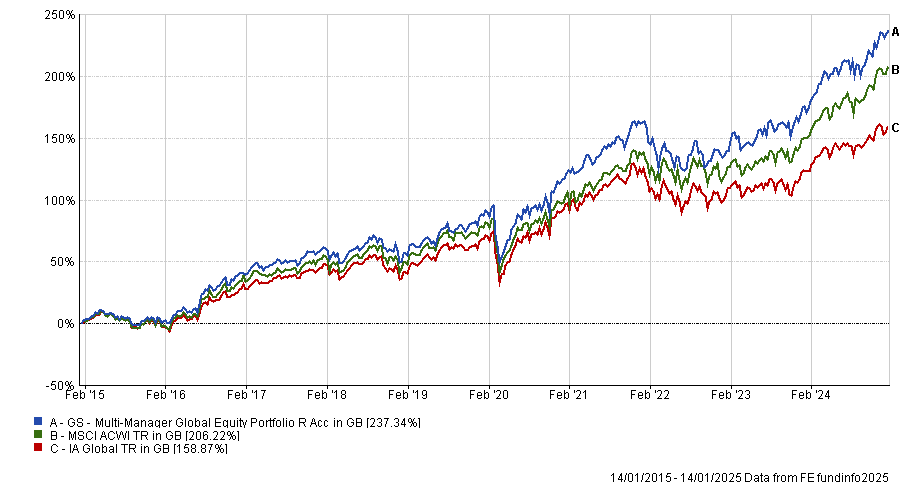

The GS Multi-Manager Global Equity fund also qualifies. Despite failing to outperform the market in 2018, when it fell by 4.7% and 10.5%, relative outperformance in each other calendar year led to a 10-year return of 228.8%, another first-quartile return.

Performance of fund vs sector and MSCI ACWI over 10yrs

Source: FE Analytics

In the past decade, the fund has achieved a first-quartile maximum drawdown of 20.9%. However, it ranked in the second quartile for overall volatility as well as a third-quartile maximum gain of 14.9% compared to other IA Global portfolios.