As the dust settles on last year’s elections and new political leaders chart their course, change and uncertainty will be the hallmarks of 2025, making extreme events (known as fat tails) more likely.

This is the view of Justin Onuekwusi, chief investment officer of St James's Place, who believes the best way to navigate unchartered territory is diversification.

“Fat tails challenge assumptions and require careful preparation. This is a year to climb steadily, avoid rash decisions or speculative bets and embrace diversification to ensure portfolios are equipped for whatever challenges lie ahead,” he explained.

He compared investing to a mountain climbing expedition. “While most days on the trail bring steady progress, the climber must always prepare for the unexpected. Success depends on carrying a backpack filled with a range of tools. For investors, the principle is the same. Fat tails can’t be timed, but they can be prepared for.”

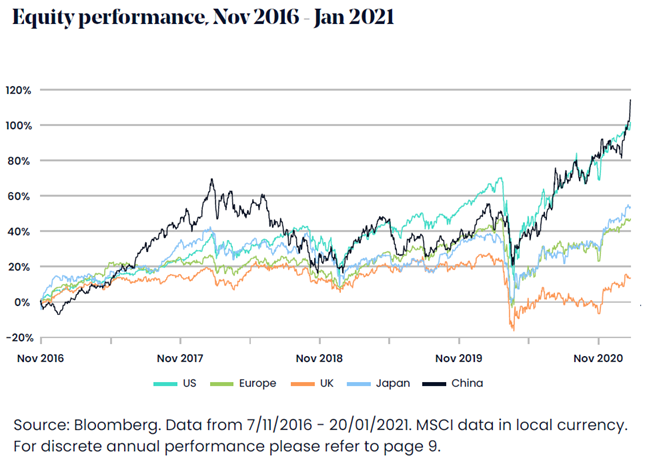

President-elect Donald Trump’s first term provided a crash course in navigating fat tails. Despite initial fears of economic turmoil and geopolitical disruption, “markets defied expectations, with the MSCI China index doubling despite tensions in US-China relations”, he pointed out.

“The lesson? Predications fail, but diversified portfolios succeed.”

Sources: Bloomberg, MSCI, St. James’s Place

Onuekwusi thinks investors should consider rotating into small-caps and emerging market equities, the laggards of the past few years, whose fortunes could reverse going forward as they spring back from a low base.

Undervalued, overlooked, beaten-up asset classes provide “fertile ground for identifying mispriced investments with significant potential for long-term growth”, he explained.

He also believes bonds have earned their place as the income engine of a diversified portfolio.

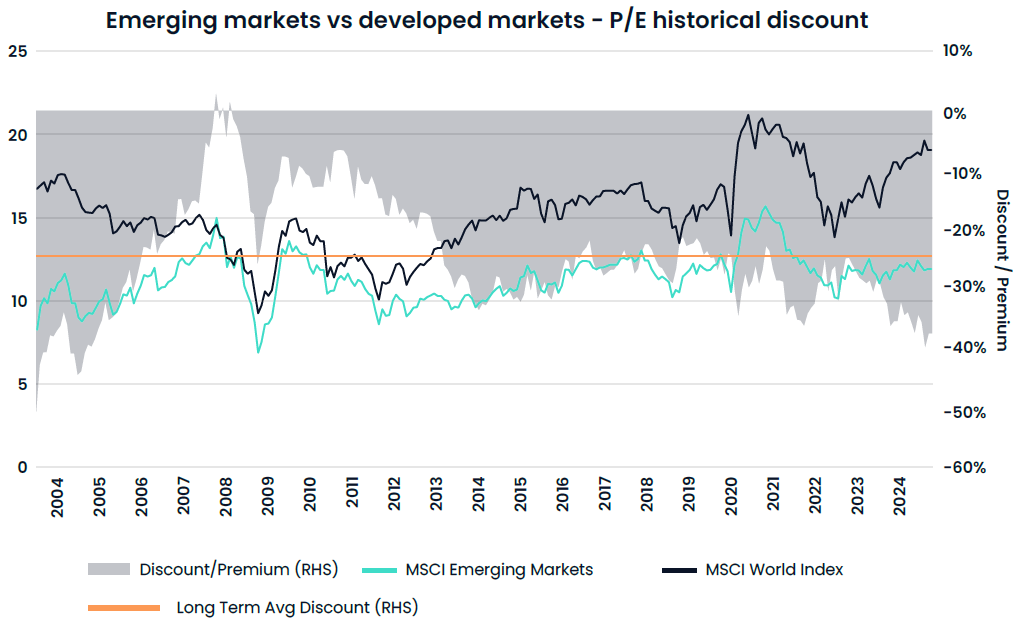

Emerging market equities

“Emerging markets equities are at an intriguing crossroads. After years of underperformance relative to developed markets, they are trading at near historic lows – valuations seen only a quarter of the time over the past two decades,” Onuekwusi said.

Sources: FactSet, MSCI, St. James’s Place

Emerging market equities are trading at a discount of 34% compared to developed markets, well below the long-term average discount of 26%.

“History shows prolonged underperformance often sets the stage for significant rebounds. As global monetary policy eases and geopolitical risks are repriced, emerging market equities could deliver robust returns,” he said.

Furthermore, emerging markets are set to benefit from structural drivers such as favourable demographics, rapid urbanisation, an expanding middle class with rising incomes, and a shift towards higher-value sectors such as technology and consumer goods.

Small-caps

“Small-cap stocks are one of the most overlooked segments of the market. After significantly underperforming their larger-cap peers, they are now trading at extremely pessimistic valuations, creating a rare opportunity for investors who are willing to show patience and take a long-term view,” Onuekwusi said.

“If valuations and performance gravitate back toward historical norms, investors stand to benefit significantly.”

Smaller companies historically generate higher earnings growth than larger companies and they tend to often operate in emerging, high-growth industries such as biotech and digital transformation.

“For those willing to exercise patience, tolerate short-term volatility and additional risk, small-caps offer a rare combination of value, growth potential and the opportunity to capitalise on an eventual shift in market dynamics,” he concluded.

The role of bonds

With yields on government and corporate bonds at multi-year highs, bonds are once again functioning as the income-generating engine of portfolios. Bonds also offer a hedge against equity market volatility.

“With interest rates expected to remain elevated, the ability of bonds to deliver steady income and stability is more relevant than ever,” Onuekwusi said.

“Fixed income assets offer an essential counterweight to equities, reducing overall portfolio volatility while providing liquidity in times of market stress.”