After facing years of headwinds, we believe global small-cap stocks may be poised to benefit from changes in the macroeconomic environment in 2025.

Inflation, higher interest rates and recession fears have hit smaller companies hard in recent years, leading to the significant underperformance of small-caps compared with large-caps.

This trend continued into 2024, with large caps continuing their dominance through the first half of the year. However, sentiment shifted at mid-year and small-caps rotated into favour.

They picked up an additional tailwind after the US election. Investors expected stocks, especially small-caps, to benefit from the incoming Trump administration’s approach to taxes, tariffs and regulations.

Expectations for continued rate cuts by the Federal Reserve and other central banks have also contributed to favourable conditions for small-caps. Smaller companies often carry more floating-rate debt than their larger peers and may benefit as interest rate pressures ease.

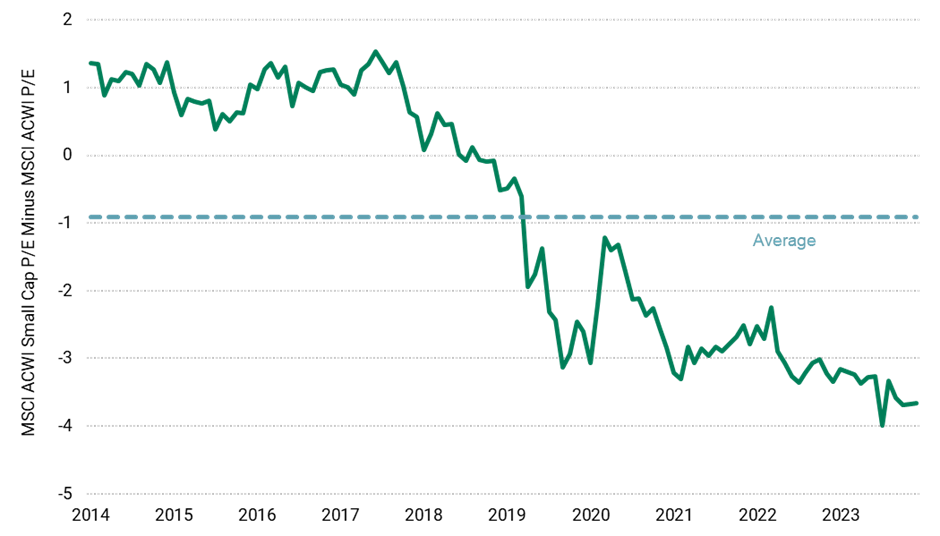

Despite this stretch of outperformance and an improving outlook, global small-caps continue to trade at a discount compared with large-cap stocks, as the chart below shows.

In our view, current valuations could make this an attractive entry point to offset concentration risk in mega-cap stocks.

Spread in next 12-months price-to-earnings ratio between large- and small-caps

Sources: FactSet, American Century Investments; data from 31 Dec 2024 to 30 Nov 2024

Global small-cap earnings growth expected to broaden in 2025

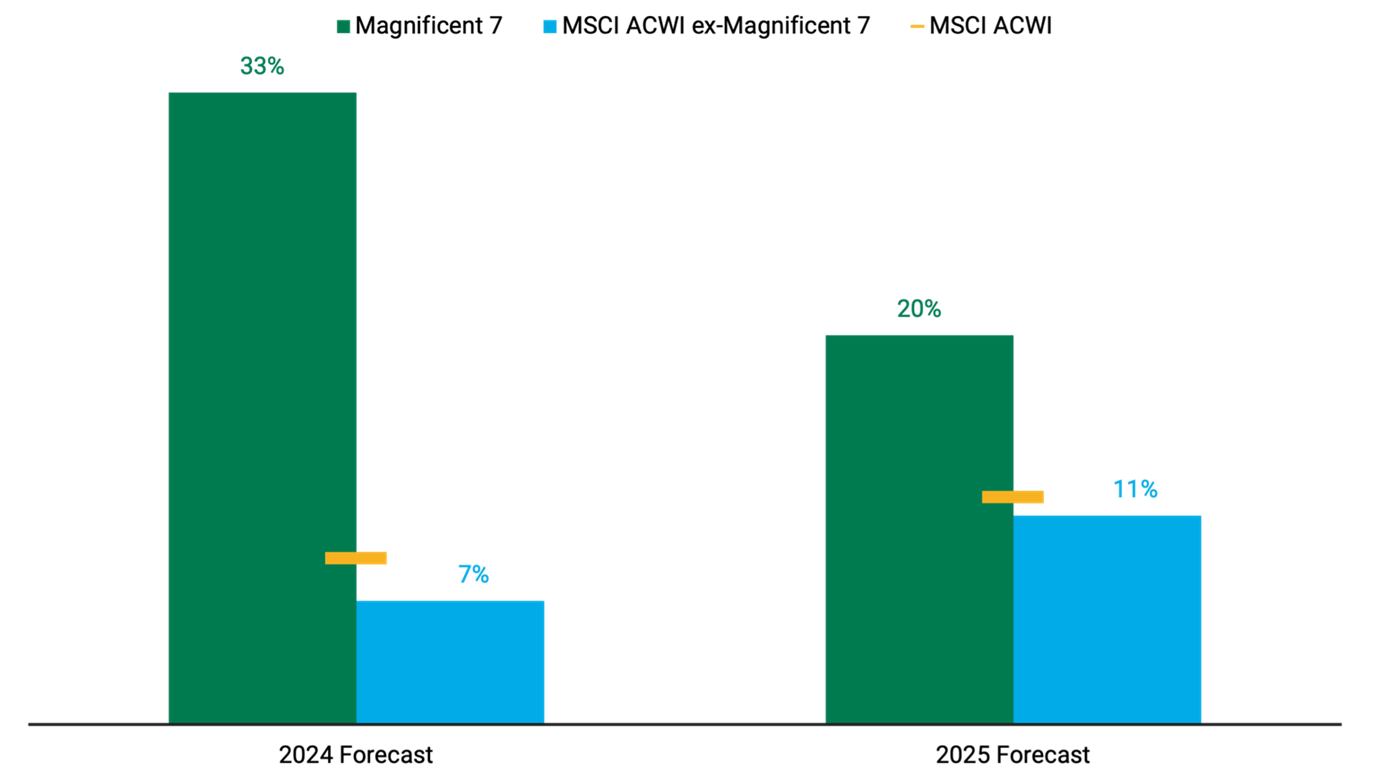

The strong performance of large-caps, particularly mega-caps, is hardly surprising given their robust profit growth. As shown in the chart below, the Magnificent Seven’s profit growth has dwarfed the rest of the MSCI All Country World Index. Looking into next year, however, analysts expect the profit gap to narrow and earnings growth to broaden to more companies.

On an equal-weighted basis, small-caps are expected to deliver 22% earnings per share (EPS) growth in 2025 versus 15% from large-caps, based on FactSet consensus estimates.

EPS year-over-year growth

Sources: FactSet, American Century Investments; estimates as of 12 Sep 2024

We have identified five trends that may help drive profit growth for these companies in 2025.

Reshoring and nearshoring

Donald Trump’s incoming administration has threatened to increase tariffs, which could lead more large companies to bring their supply chains closer to home. Small-caps may benefit from increased capital spending tied to reshoring and nearshoring.

Historically, smaller companies have tended to generate more revenues domestically and tend to be less exposed to global supply chains, potentially reducing their tariff risk.

Increased reshoring may benefit companies such as Clean Harbors, a provider of environmental and industrial services. Accelerating reshoring would increase US manufacturing activity, a key driver of Clean Harbors’ growth.

AI and data centres

The growth of artificial intelligence (AI) is expected to continue fuelling demand for data centres and energy. While the Magnificent Seven companies have attracted more attention, we believe this trend will also help small companies in multiple categories.

Beneficiaries could include data centre operators and providers of energy-efficient cooling solutions, such as those developed by Modine Manufacturing. Data centres are Modine’s fastest-growing end market.

Electrification

Increased electricity demand and capital spending tied to electrification may create opportunities. AI’s need for power is so great that existing infrastructure can’t keep up. Utilities are pouring more resources into their power grids and electrical transmission.

AtkinsRealis, an engineering services and nuclear energy company, and Arcadis, a design, engineering and consultancy services provider, are likely beneficiaries. AtkinsRealis’ revenue growth is accelerating and its service backlog reached a record high in 2024 driven by its nuclear energy division.

Other potential beneficiaries include Capstone Copper as higher electricity usage should increase the demand for copper.

Deregulation and M&A

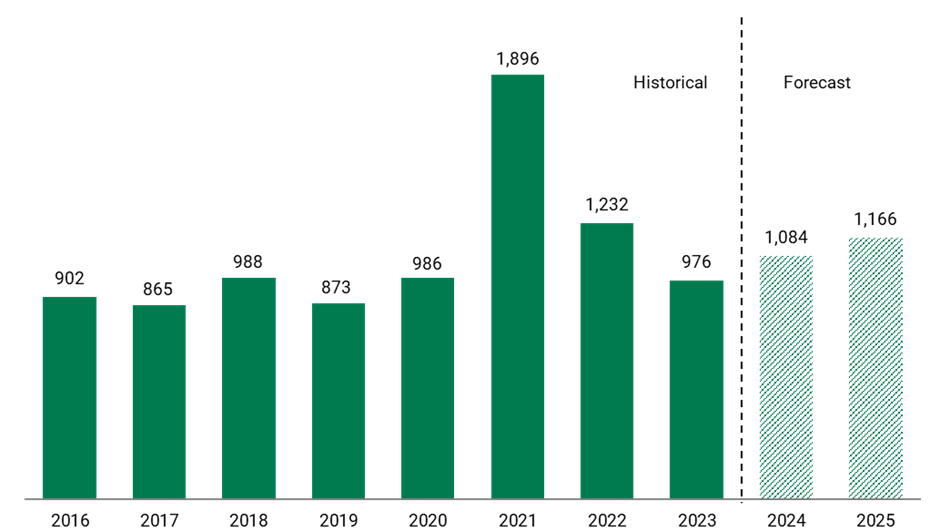

While M&A and IPO activity declined in 2022 and 2023, lower interest rates and a more favourable US regulatory environment may lead to more deals in 2025.

Small-caps tend to benefit the most from accelerating M&A as 90% of activity has historically been within that universe of companies.

Deregulation could boost capital markets activity, benefiting banks and boutique investment firms such as Evercore.

US corporate M&A deal volume

Sources: Dealogic, EY Parthenon, American Century Investments; data from 30 June 2016; data from 21 Nov 2024 and onwards are estimates

Housing bottlenecks

Limited sales of existing homes and lower material costs could benefit home builders serving budget-conscious and higher-end buyers. Examples in this arena include Champion Homes and Toll Brothers. Lower mortgage rates would further boost housing demand.

2025 outlook: Taking a balanced approach

We believe multiple indicators point to a more positive outlook for small-caps. However, as bottom-up investors, the primary drivers of our constructive view are the compelling opportunities we see in a broad array of sectors and regions.

We remain focused on identifying companies with accelerating, sustainable growth and taking a balanced approach to risks and opportunities. Uncertainty around trade policy, geopolitics and interest may continue to create market volatility. Such volatility, however, often creates opportunities for disciplined investors.

Jim Shore is a senior client portfolio manager at American Century Investments. The views expressed above should not be taken as investment advice.