Patience is a key virtue that many investors lack, according to Gary Robinson, manager of the Baillie Gifford US Growth trust.

One needs patience for compounding to kick in (whereby earnings from an investment generate additional earnings over time), for the discounts-and-premiums cycle to come through, and for companies to realise their potential.

Performance can wobble over shorter time frames, especially if anomalies such as Covid interfere. For Baillie Gifford US Growth, the pandemic was a boon, with the trust growing 133% in 2020. But as the situation normalised, so did returns.

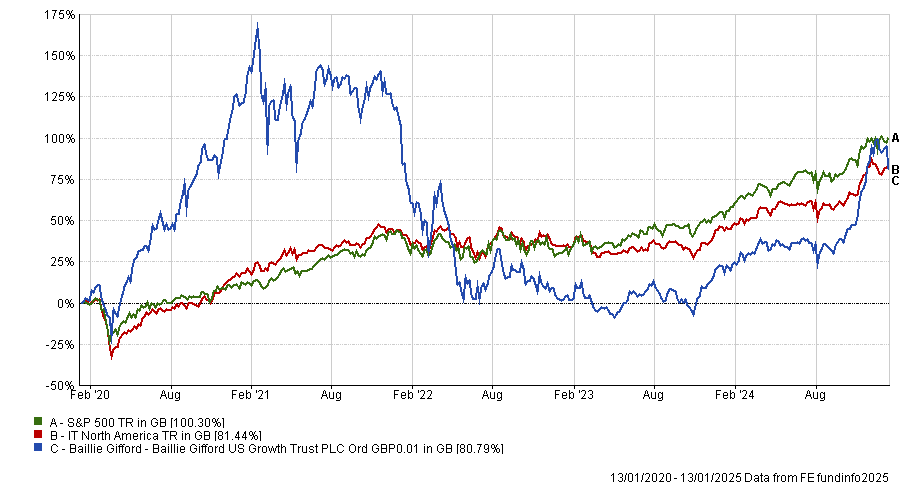

The trust’s underperformance started in late 2021 and continued until recently, as the chart below shows.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

On the back of its three-year numbers and its discount, the strategy is being targeted by activist manager Saba Capital Management, which aims to replace the board and then potentially take over as the trust’s investment manager.

Below, Robinson explains why he believes shareholders should vote against Saba’s proposals, why the performance timeframe chosen by Saba is skewed by the Covid numbers, and why the trust’s fortunes have already started to turn around.

What are you trying to achieve with this trust?

We are looking to identify what we call ‘exceptional growth companies’ – rare, special businesses that have the potential to grow faster than average for longer than average.

When we find these great growth companies, we deploy the power of compounding. This where other investors often fall short. What makes these companies so valuable is their ability to grow sustainably at high rates for very long periods of time. You have to be willing to be patient and own them for a long time to fully benefit.

What role do private companies play in the strategy?

Many exceptional growth companies stay private until a very late stage. By the time Facebook came to public markets in 2012, for example, it was already a $40bn company. A lot of the outlier value creation that we are trying to capture is happening in private markets.

We can invest up to 50% of the portfolio into private companies. Today, we have 31%. These are the innovators driving the global economy – companies such as SpaceX, Stripe, Epic Games and Databricks.

Ordinarily, it is very hard to access these players, you would have to be rich to have the networks and pay for the privilege. This fund democratizes access to America's private, exceptional growth companies for any investor.

What were the best calls of the past year?

SpaceX, the fund’s top holding at 7.6%, has been a very positive contributor for the trust over the past 12 months.

Its Starlink internet business has continued to grow very strongly, and alongside that, the company is developing a next-generation rocket called Starship. Quite spectacularly, it managed to launch it up into orbit and bring it back down to Earth, catching it with the ‘chopstick’ method (where two large metal arms resembling chopsticks catch the rocket).

Software provider Shopify also continued its strong execution, broadening out its opportunity set after some difficulties post-pandemic.

It originally overestimated how much of the Covid demand would stick post-Covid and turned unprofitable for a period of time. Now it has emerged after a period of adjustments, optimizing and right-sizing the cost base, and it is very profitable again. In the most recent quarter, its free cash flow margins almost reached 20%.

The stock grew 25% over the past year and is the third-largest holding in the fund, at 4.9%.

And the worst?

Moderna has been struggling; the share price is down 65% over the past year.

The Covid vaccine market has turned out to be smaller than people expected it to be, but also the launch of its second drug, another respiratory vaccine, didn't go as well as the company or we had hoped. There have been some execution missteps along the way and we are engaging with the company to try and understand what they have learnt.

We are still excited about the mRNA technology, however, which has the potential to address a lot of different diseases. One application that I'm most excited about is the personalized cancer vaccine, there have been pretty extraordinary results with that so far.

Saba Capital criticised your weak three-year performance. What caused it?

If you look at the share price chart, you'll see we had a big spike during Covid and that’s the starting point for the three-year number. The other time periods look a lot better.

Performance since inception was behind for a while following Covid but has recovered a lot and is now in line with the S&P 500 – a pretty good outcome given how strongly the index has performed over this period.

Shareholders who invested at the time of IPO have nearly tripled their money. We are ahead of Saba over one year, five years and since inception. The only timeframe that this fund is behind Saba is the three-year figure that they chose to present in the requisition.

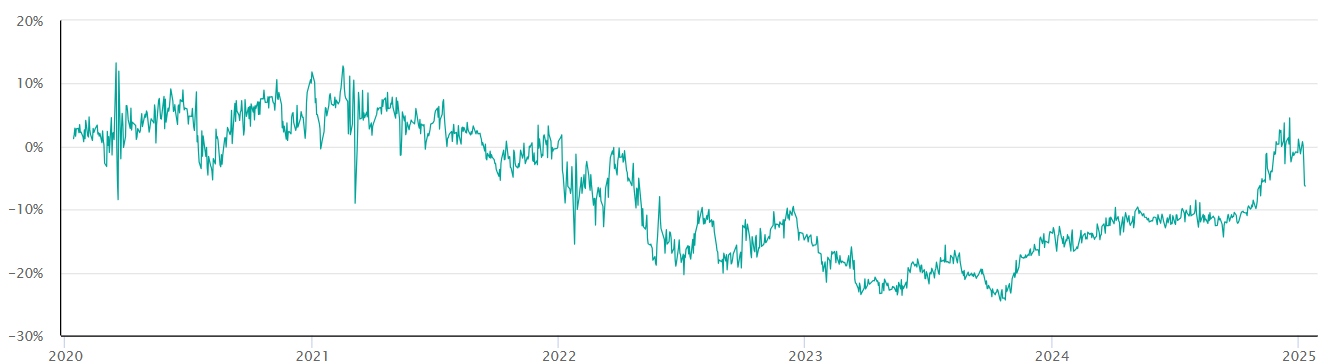

Saba also took issue with the trust’s discount.

The discount has already narrowed. Saba would probably attribute that to its buying, which will have had some influence, but that is not the whole story.

Premium/discount of trust over 5 years

Source: FE fundinfo

We have been proactive in addressing the discount with buybacks, but also the US has been in favour, particularly after the election on 5 November, and discounts have been coming in across the sector.

The average discount from IPO to date has been 4.4%, with the trust trading at a premium at times. So the current discount level isn't particularly notable in a historical context.

These things tend to be cyclical. In its history, the trust has traded at a premium because the market was viewing private companies quite differently and there is nothing to say that the market won't take that view again at some point in the future.

What do you do outside of work?

I love reading about business and psychology. I play golf and enjoy walking and travelling.