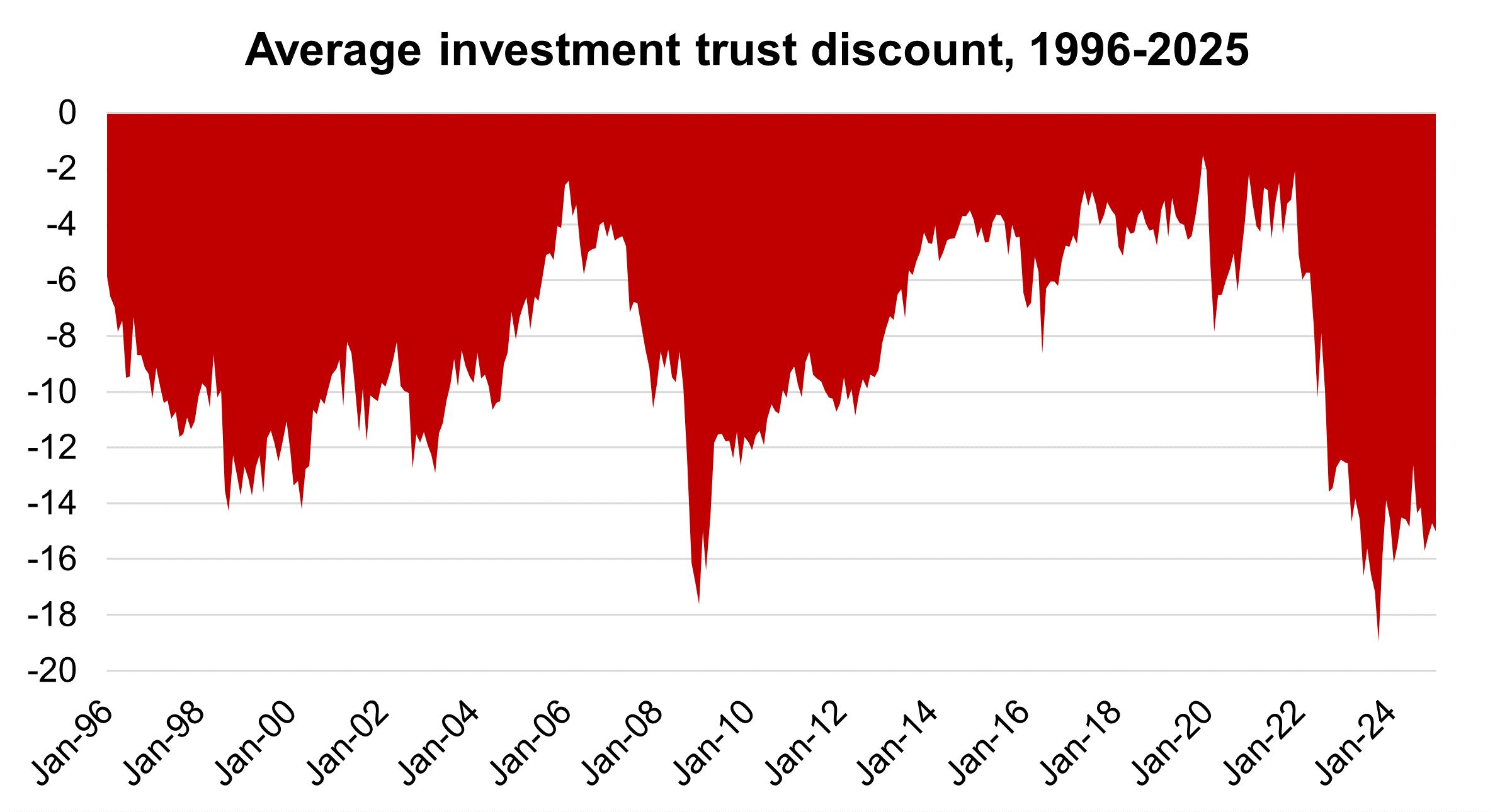

Investment trusts have been on double-digit discounts for 29 consecutive months, the longest period in 30 years, the Association of Investment Companies (AIC) has revealed.

This is even longer than during the financial crisis, when double-digit discounts only persisted for 25 months between September 2008 and September 2010. The previous record, however, was 27 consecutive months in the period between August 1998 and October 2000.

There is one thing that these time frames have in common, according to Nick Britton, AIC research director, enhanced returns in the following five years.

“Discounts can spell opportunity when it comes to investment trusts. Our research shows that investing at double-digit discounts is generally good for your pocket,” he said.

“Previous periods like this have ended with some combination of market recovery and corporate activity – and there’s no reason to think this one will be any different.”

As for how much investors have made previously, the AIC has calculated that average returns can be as much as 32.7 percentage points higher after a long period of double-digit discounts, amounting to 4.3 percentage points higher per annum, compared to periods when the discount was below 10%.

More specifically, this has emerged by analysing 139 overlapping five-year periods (the first one beginning on 1 July 2008 and the last one on 1 January 2020); in 105 of these five-year periods, where the starting discount was narrower than 10%, the average return was 53.8%, or 9.0% annualised. In the remaining 34 five-year periods, the starting discount was wider than 10% and led to an average return was 86.5%, or 13.3% annualised.

Today, investors should act quickly, as the average discount to net asset value across the whole universe is 14%, having peaked at 19% in October 2023.

All figures exclude venture capital trusts (VCTs) and 3i Group, one of the best performers of 2024 and one of the most expensive trusts on the market, trading at a premium of nearly 60% .

“The current period of double-digit discounts has been long, but it can’t last forever,” said Britton. “It can be hard to invest when sentiment is downbeat, but history shows this is usually the best time.”

Source: Association of Investment Companies.

This is something private and activist investors are well aware of with a number starting to act and in some cases making headlines, such as Saba Capital’s requisition attempts.

But while discounts are great for those looking to buy, the same isn’t true for every investor and for all sectors.

Emma Bird, head of research at Winterflood Securities, attributed the widening of the average discount in 2024 to a number of reasons, including negative sentiment towards investment trusts with high weighting to interest rate sensitive asset classes, such as infrastructure, property, private equity and growth-oriented equities.

“A lack of demand from both institutional and retail investors in an environment where ‘risk-free’ returns remained much higher than recent history, will have weighed on discounts,” she said.

“Some sector-specific concerns continued to have a negative impact on sentiment too, particularly amongst institutional investors, including cost disclosure rules and an increasing demand for liquidity and scale.”

She agreed, however, that the discounts offer an attractive entry point in some areas, particularly rate-sensitive asset classes.

“These areas have the potential for a ‘double whammy’ of improving net asset value (NAV) performance and a positive re-rating if gilt yields see a sustained decline, especially if this acts as a catalyst for retail investors to re-enter the investment trust market,” the researcher said.

“Nevertheless, given that interest rates are unlikely to return to near-zero levels any time soon, the extent of this re-rating may well be limited.”

For Abbie Hines-Lloyd, associate director of Research in Finance, discounts remain “a significant factor in what makes investment trusts appealing”.

However, “stubborn discounts can be problematic for those who have already weathered several market cycles, and who may be more focused on cashing in their investment than seeking new buying opportunities”.