Passive funds have outperformed their active peers on a wide range of closely watched risk and return measures over the past three years, Trustnet research has found.

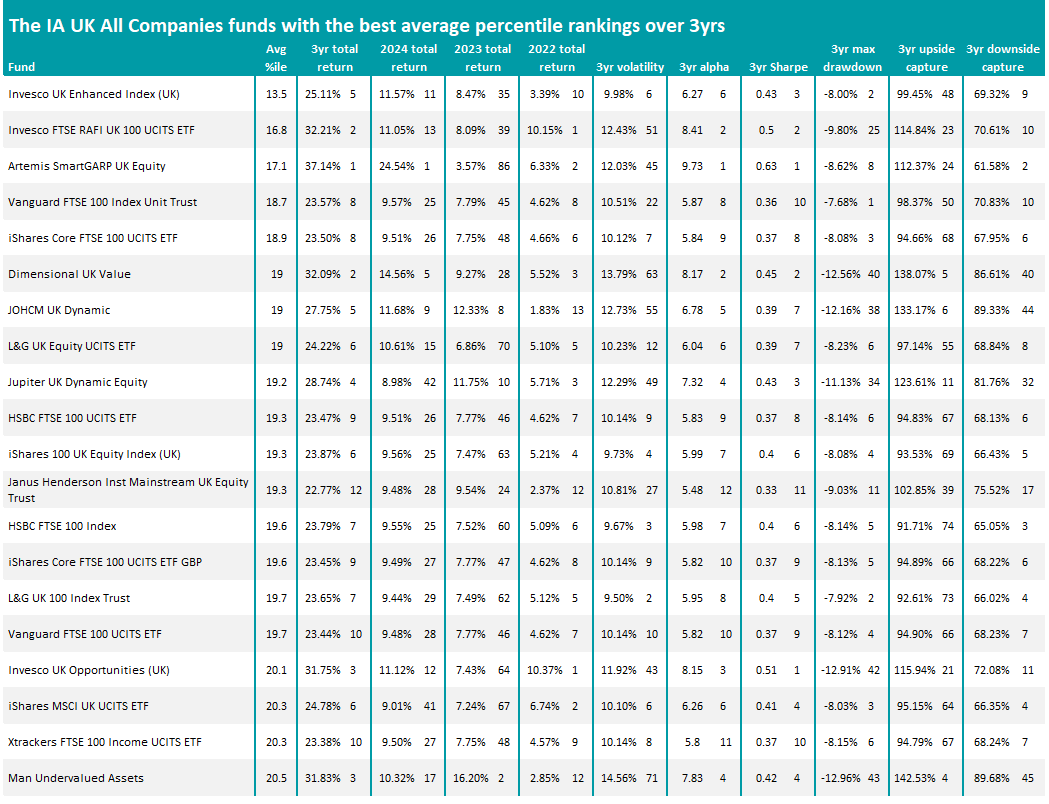

In this study, we have scored IA UK All Companies funds on 10 key metrics: cumulative three-year returns to the end of 2024 as well as the individual returns of 2022, 2023 and 2024 (to ensure performance isn’t down to one standout year), three-year annualised volatility, alpha generation, Sharpe ratio, maximum drawdown and upside and downside capture, relative to the sector average.

To discover which funds were most consistently at the very top for the sector for different risk and return measures, we then worked out each fund’s average percentile ranking for the 10 metrics; the lower a fund’s average percentile score, the stronger across the board it has been over the past three years.

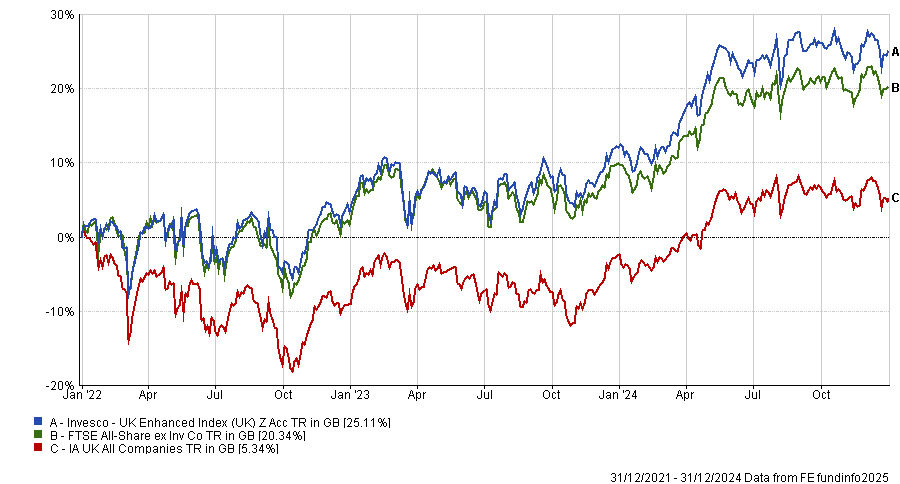

Performance of Invesco UK Enhanced Index vs sector and index over 3yrs to end of 2024

Source: FE Analytics

Invesco UK Enhanced Index (UK) took first place in this research, thanks to an average percentile ranking of 13.5 across the 10 metrics we examined. Its three-year return of 25.1% (shown above) is in the IA UK All Companies sector’s fifth percentile, while the £1.2bn fund was at the top of the sector for volatility, alpha, Sharpe ratio, maximum drawdown and downside capture.

As its name makes clear, the fund uses an ‘enhanced index’ approach that sits between pure index trackers and actively managed funds. It aims to offer index-like exposure while outperforming the benchmark over a market cycle.

Managed by Georg Elsäesser and Michael Rosentritt, the portfolio is managed with the belief that value stocks will outperform expensive ones over the long term, high-quality companies will beat low-quality and market trends – or momentum – can persist for some time.

The managers combine these value, quality and momentum factors into a portfolio of between 60 and 80 stocks. However, they avoid stock picking and instead look to largely match the beta of the index through a collection of cheaper stocks that can generate small incremental excess returns.

While Invesco UK Enhanced Index (UK) combines elements of index tracking and active management, the table below – which shows the 20 highest-scoring IA UK All Companies funds in this research – reveals how strong passive management has been in recent years.

Source: FE Analytics

Of the remaining 19 funds, 12 of them are pure index trackers with the majority following the FTSE 100 index. Their outperformance reflects the fact that mega-caps have led the market for some time now – the FTSE has made a 24% total return over the three years examined in this research, compared with a gain of just 2.1% from the FTSE Small Cap index and a 3.5% loss from the FTSE 250.

Investor sentiment in recent years has generally favoured blue-chip stocks, as the uncertain market backdrop means they have prioritised stronger balance sheets, more robust earnings and stable dividend yields.

In addition, the UK has been unloved by investors, which has caused small- and mid-caps, which are more geared to the health of the domestic economy, to suffer. The FTSE 100, in contrast, is more exposed to international revenues.

The highest-ranked active IA UK All Companies member in this research is Philip Wolstencroft’s Artemis SmartGARP UK Equity fund. It has an average percentile ranking of 17.1, aided by first-percentile numbers for three-year returns, alpha and Sharpe ratio.

Wolstencroft uses a ‘growth at a reasonable price’ (GARP) approach, which seeks out companies that are growing faster than the market while trading on lower valuations. SmartGARP refers to Artemis’ in-house software tool, which helps its managers identify companies with the most attractive financial characteristics by scoring them on eight investment factors including growth, value, investor sentiment and ownership, and environmental, social and governance credentials.

Artemis SmartGARP UK Equity’s tilt to value is a common factor among many of the other active funds coming out strongly in this research. Dimensional UK Value, JOHCM UK Dynamic, Jupiter UK Dynamic Equity, Invesco UK Opportunities and Man Undervalued Assets all take a value approach.

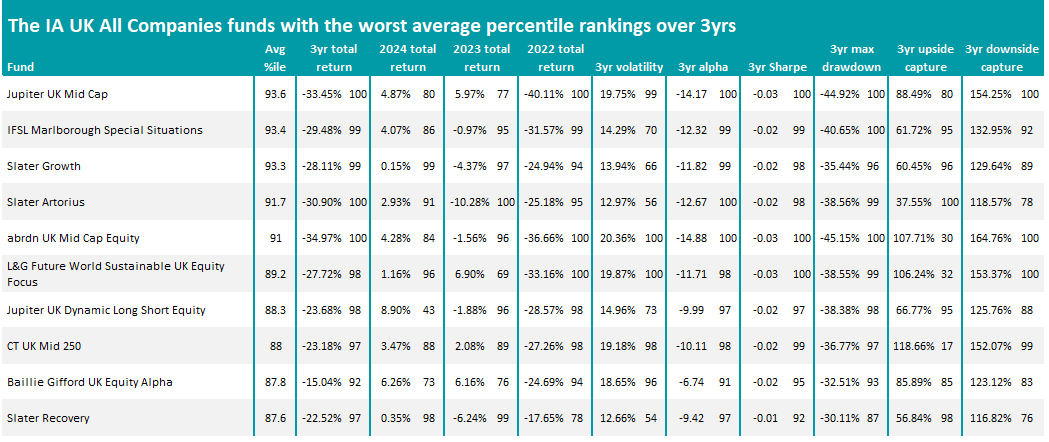

Source: FE Analytics

The funds with the highest average percentile ranking – i.e. the funds that have been towards the bottom of the IA UK All Companies sector for multiple metrics – tend to invest in small- or mid-cap stocks.

This should not be too much of a surprise, given the massive outperformance of UK large-caps during the three years under consideration. Nine of the 10 funds on the above table have a bias towards smaller or medium-sized business in their portfolios.

The exception is L&G Future World Sustainable UK Equity Focus, which has more than 80% of its portfolio in large-caps. Sustainable investing has struggled in recent years because of higher interest rates while the election of climate-sceptic Donald Trump as US president has hampered sentiment more recently.