Funds from M&G Investments, Jupiter and Ranmore have all been given an ‘Elite Rating’ by analysts at investment research house FundCalibre, with a Rathbones portfolio added to the ‘Elite Radar’ of funds with the potential for the full rating in the future.

The big winner in the latest update was M&G, with two funds gaining the distinction: M&G Asian and M&G North American Dividend.

Analysts at FundCalibre said the former is a “high-conviction fund that takes an active approach to Asian equities, leveraging the experience of manager David Perrett and his team”, which includes FE fundinfo Alpha Manager Carl Vine, who is listed as a deputy manager on the fund.

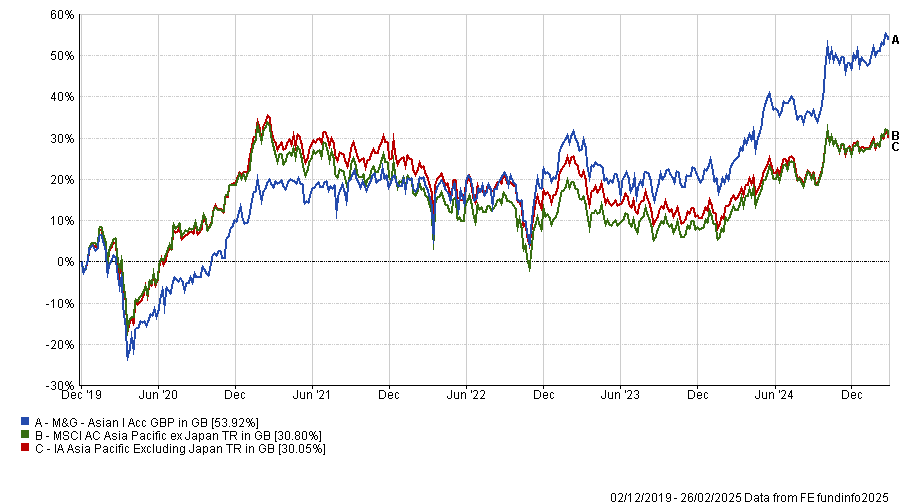

With an FE fundinfo Crown Rating of five, the portfolio has been a consistent performer over the short, medium and long term. It sits in the top quartile of the IA Asia Pacific Excluding Japan sector over one, three and five years.

Perrett took charge of the fund in 2019, replacing Alastair Bruce. In his first full year in charge (2020) the fund was a bottom-quartile performer, but it has been in the top 25% of its peer group in every calendar year since.

Performance of fund vs sector and benchmark since manager start

Source: FE Analytics

“The team’s hands-on approach and willingness to take meaningful differentiated positions sets them apart from their peers. For investors looking for exposure to the Asian market, this fund should be a strong contender,” the FundCalibre analysts said.

It was joined on the list by John Weavers’ M&G North American Dividend fund, which aims to provide a higher total return than the S&P 500 index over five years alongside a growing income stream.

Its income mandate means the fund eschews many of the biggest global companies, including iPhone maker Apple, computer chip producer Nvidia and online retailer Amazon – three stalwarts of the Magnificent Seven stocks that have dominated the global market in recent years.

Facebook owner Meta is the only name among the US tech grouping to appear in the fund’s top 10 holdings, with an emphasis instead on companies that can reliably grow their dividends.

Despite this headwind, the fund has made top-quartile returns of 51.6% over the past three years and is an above-average performer in the IA North America sector over five and 10 years – although it has underperformed the S&P 500 during both timeframes.

Still, the analysts said its “concentrated portfolio and well-defined strategy make it a solid choice for investors seeking both income and long-term capital appreciation”.

The fund is also recommended by analysts at FE Investments, who said it is “well suited as a core US equity exposure, particularly for income-seeking investors looking to diversify away from UK equity income”.

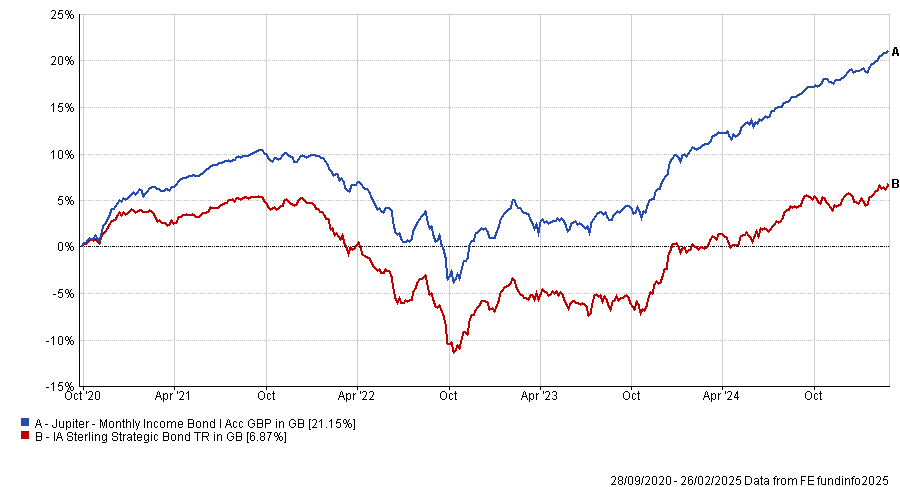

Away from M&G, Alpha Manager Hilary Blandy’s Jupiter Monthly Income Bond fund was also given an Elite Rating. It has produced returns of 21.2% since she took charge in 2020, the ninth-best gain of the 65 funds in the IA Sterling Strategic Bond sector. The average peer, meanwhile, has gained just 6.9%.

Performance of fund vs sector and benchmark since manager start

Source: FE Analytics

FundCalibre analysts said: “This is a very solid monthly income bond fund with a short-duration approach making it less interest rate sensitive than its peers.

“The monthly income payment is also a nice feature and, when combined with the fund’s yield (of 6.69%), makes this an attractive option for income seekers.”

The final addition was Ranmore Global Equity, a “differentiated global value fund” that has “delivered strong performance across various market environments”.

Run by Sean Peche since its launch in 2008, the fund has been the best performer in the IA Global sector over the past three years, up 70.5%, and has made top-quartile returns over one and five years – as well as since inception.

“Unlike traditional value strategies, it invests in companies of all sizes and incorporates momentum and technical factors into its process. With a bias towards mid and small-cap stocks, this is a true hidden gem, offering valuable diversification and making it a great option for investors seeking to balance their portfolios with value exposure,” the FundCalibre analysts said.

Lastly, Rathbone Greenbank Global Sustainable Bond was added to the firm’s Elite Radar for funds with the potential to become Elite-rated over time.

“This recently launched global bond fund follows a ‘best ideas’ approach, focusing on sustainable themes aligned with the UN Sustainable Development Goals and investments that contribute to a more sustainable world,” the analysts said.

“It provides a versatile option for those looking to integrate sustainability into their portfolios. Its commitment to investing in companies contributing to a more sustainable world makes it an attractive choice for ethically conscious investors.”