Value investing is about buying a stock cheaply and owning it while there is evidence that it can deliver good returns. As soon as the market is extrapolating too much, it’s time to sell to someone else – usually growth managers.

That is the view of Nicholas Kirrage, who has recently been reinstated as manager of the Schroder Income fund after Kevin Murphy’s departure to Brickwood Asset Management. He had previously co-managed the fund alongside Murphy for almost a decade between 2013 and 2022.

The fund maintained a first-quartile ranking against its IA UK Equity Income peers over 10, five and one year, slipping down to the second quartile over three, but it remains popular with Hargreaves Lansdown analysts, who added it to the firm’s Wealth Shortlist last year and with fund pickers, who invited investors to keep faith.

Below, Kirrage explains how he combines total return with dividend yield and growth, what success looks like to him and why he had to let go of Rolls Royce.

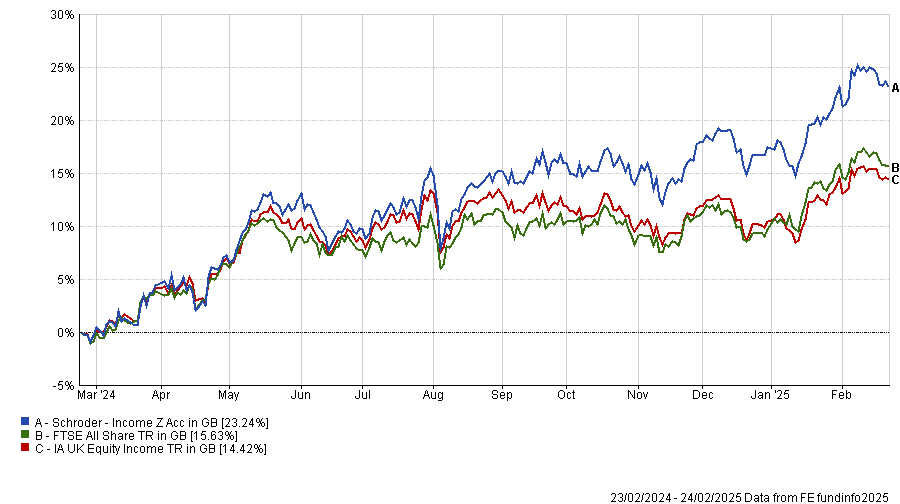

Performance of fund against index and sector over 1yr

Source: FE Analytics

Can you describe your philosophy?

We are value investors who are looking to exploit the one thing in stock markets that never changes – us. The politics, themes and macroeconomics are always changing, but the humans in the system don’t.

It's not nearly as important to know what will happen in Ukraine, what will happen to interest rates or whether Microsoft actually has invented quantum computing, it's more important to understand how people will treat those developments and where there is bad news baked into share prices.

How does this materialise in the fund?

Income funds have always been value funds because, at its heart, investors want a high dividend yield, which is a valuation metric. High-yielding stocks tend to be shares that are cheaper.

We define income as three things: the dividend yield, which is only important when investors are buying the fund, the total return, and the growing income. All three must happen together.

What would success for the fund look like?

Probably an average total return of 10% per annum for a decade, eight from the market and two from our stock picking skill, a dividend yield of around 4% and dividend growth of about 6% per annum, so well ahead of inflation.

How do you make sure you are achieving that?

There are two ways to do it, one is to buy the few stocks that combine all three elements and the other is to blend stocks to try to achieve all three.

A business today which has a high yield but may not grow as quickly is tobacco, for example British American Tobacco [the fund’s top holding at 3.9%], while a sector with very reasonable yields but which is growing very quickly would be banking.

Five years ago, everyone thought banks were uninvestable as an income sector and we disagreed. Today, if you look at any of our most recent best calls, they have all been banks.

What were you best calls of the past year?

NatWest, Barclays and Standard Chartered are all up there, with a total effect of 1.5, 1.2 and 0.9 percentage points respectively on the fund’s performance.

Most banks remain pretty attractively valued today, despite their strong performance, with the FTSE Bank Index up 60% in the past 12 months. On top of that, dividends are compounding at 20% per annum and dividend yields are between 4% and 8%.

Do they still have much further to go?

Yes, quite a long way. A lot of the mechanics driving these businesses are very well set. Banks lock in their income on a rolling basis, meaning for the next two or three years they will have an enormous wave of very sustainable income, even if interest rates fall.

People who've done well will start to look to sell them down over time and try and find the next investments but banking remains a very attractive area.

What were the worst calls?

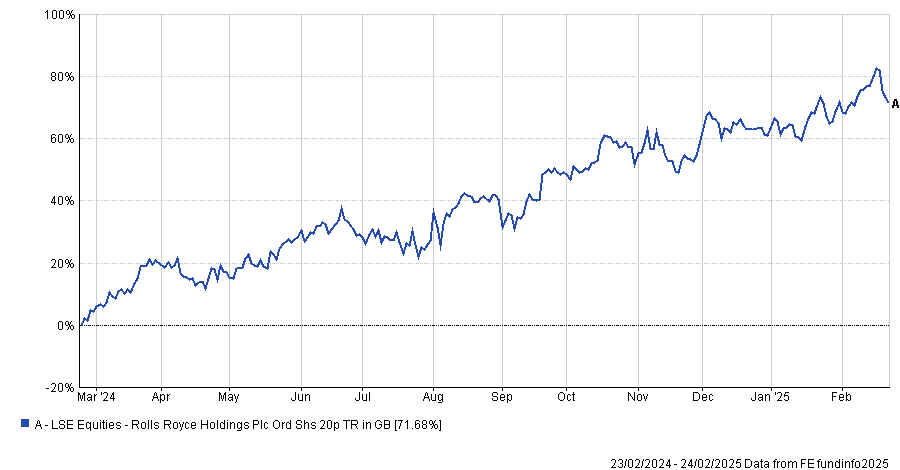

The worst performance last year came from not owning Rolls Royce, costing the fund 0.9 percentage points. The irony about it is that it was one of our best performers in the previous year, when we did own it.

People became very concerned about its financing during Covid, when we bought it at 70p per share. We sold it at £3, and now it has gone further to £6.50. But we haven't lost any money for our investors by not owning a stock.

Performance of stock over 1yr

Source: FE Analytics

The main detractor in the portfolio has been Intel (-0.8 percentage point total contribution). We have around 10% of the fund in overseas companies to get exposure to income investments that don't exist in the UK, primarily in the technology and software spaces. Through its own stock-specific factors, it was very weak last year and it was one we sold from portfolios as a result.

Was it a mistake to sell Rolls Royce?

What we always say in these cases is that we're trying to have a process where if we did the same thing 100 times, we'd be right more often than not. Rolls Royce is now on a price-to-earnings ratio of nearly 30x, which is extraordinarily high for a stock in a market that is notoriously cheap in global terms.

We are value investors, we buy things when history suggests there's no reason this business shouldn't recover and be a good company in the future. We then sell the stock to someone else when there is now no longer any historical evidence that it can make the level of returns that are being suggested by the stock market.

Rolls Royce is now suggesting it will make a level of returns it's never made, so we are happy to give it to growth investors and let them continue to ride the shares and take that risk. We will go and find another idea where history suggests it's undervalued and we can have a bit more safety and confidence in that investment from our perspective.

What do you do in your free time?

Try to find a way to relax and refresh mentally and physically, because this job can be very demanding and all-consuming. So I go spend time on a mountain or I cycle. It used to go running but I'm getting too old for that.