Many investors use equity income funds because they want to draw a regular income from their savings – to meet living expenses in retirement, for example – at the same time as growing their capital.

Although this sounds like a ‘best of both worlds’ scenario, investors who take their dividends as income rather than reinvesting them could be missing out on thousands of pounds in compound interest.

This is also true for passive equity funds, according to research by Aberdeen. An investor who put an initial lump sum of £10,000 into the FTSE World, MSCI Europe or S&P 500 indices 10 years ago would have added more than £6,000 to their total return if they reinvested dividends, the fund manager found.

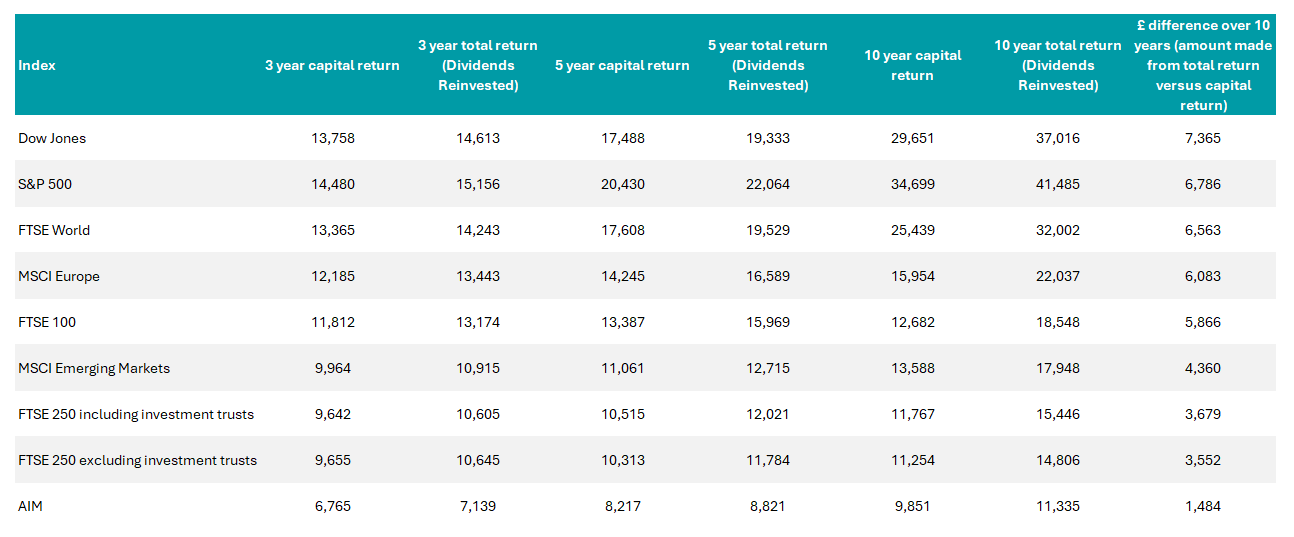

Aberdeen measured the impact of reinvesting dividends in nine major markets over a 10-year period, as the table below shows. The Dow Jones index had the biggest gap between its total return (reinvesting dividends) and capital return (when dividends were not reinvested).

Over 10 years to 28 February 2025, an initial £10,000 investment in the Dow Jones index would have grown into £37,016 with dividends reinvested. But an investor who withdrew dividends as income would have ended up with a £29,651 pot, Aberdeen discovered. In other words, they would have missed out on £7,365.

The FTSE 100 delivered a 10-year total return of £18,548 versus £12,682 on a capital return basis – a difference of £5,866.

Capital return versus total return for a £10,000 initial investment

Sources: Aberdeen, Bloomberg, data to 28 Feb 2025, returns in sterling

Ben Ritchie, head of developed market equities at Aberdeen, said: “Reinvesting dividends is key to long-term returns. While the impact has been seen over the past three and five years, it’s not until 10 years that the true magic of compounding really kicks in and delivers.

“Albert Einstein supposedly described compound interest – otherwise known as dividend reinvestment – as the ‘eighth wonder of the world’ to explain how returns can snowball over time.”

This will be a moot point for people who need income and don’t have the luxury of choosing whether to reinvest dividends.

However, savers with a longer time horizon who are going for growth should check they are using accumulation share classes for their equity funds (often signified by ‘Acc’, while ‘Inc’ stands for income), Ritchie said.

Looking at equity income funds specifically, whether investors use income or accumulation share classes will depend on their goals, said Victoria Hasler, head of fund research at Hargreaves Lansdown.

“If you are buying an equity income fund because you want to take the ‘natural’ income (i.e. the dividends from shares) then you will want to buy the income share class,” she explained.

“If you are using equity income as an investment strategy for capital growth then you probably want to reinvest the income, allowing it to compound, and the easiest way to do that is to buy the accumulation units.”

Many investors who do not need to withdraw an income hold equity income funds for their capital growth potential.

“The theory is that income funds tend to buy certain types of companies which are usually more mature with strong balance sheets and good cash flow. These types of companies can often be a bit more defensive than their growth-oriented peers and result in strong long-term returns,” Hasler said.

“This strategy relies on dividends being reinvested so investors would usually want to buy the accumulation share classes.”