Putnam Investments, the Boston-based manager which is part of Franklin Templeton Investments, has launched the FTGF Putnam US Research Fund for UK-based investors. This core US equity strategy is Putnam’s second fund launch in the UK, following the Putnam US Large Cap Value fund’s debut last month.

The new Irish-domiciled fund is a high-conviction strategy investing in both growth and value stocks. Its co-managers, Kate Lakin and Matt LaPlant, are working with industry specialists, who run ‘sleeves’ comprising their highest-conviction stock picks.

The fund also contains a ‘risk management sleeve’, which aims to minimise the overall portfolio’s sector and factor risks relative to its benchmark, so that stock selection is the fund’s main driver of returns.

Harry Reeves, head of sales, UK wholesale at Franklin Templeton, said: “This unique combination of industry sleeves with a risk management sleeve drives natural portfolio diversification and seeks to deliver consistent alpha, moderate tracking error, low downside capture and high information ratios.”

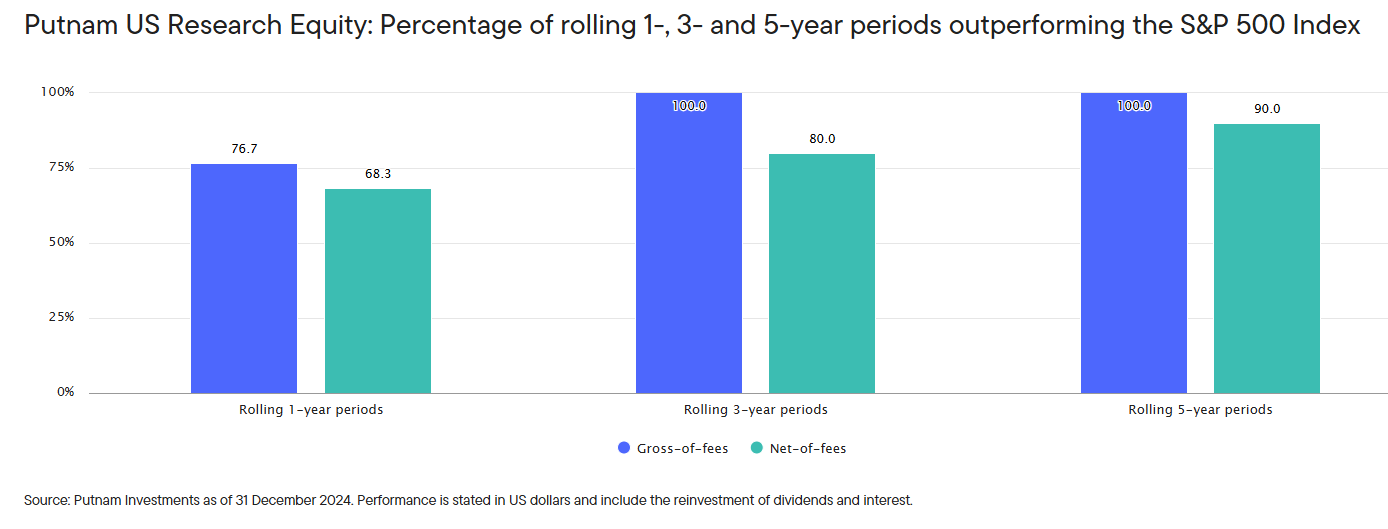

The new FTGF Putnam US Research fund has a similar approach to the Putnam US Research Equity strategy, which was established in 1995 and has $2.4bn in US client assets. It has consistently beaten its benchmark, as the chart below shows.

Putnam’s chief investment officer, Shep Perkins, said the manager aims to be “consistently good, not occasionally great” and to give investors a “palatable” investment journey without huge swings.

“We stay down the middle of the highway, don’t get near the guardrails and deliver a little better than the index every year. Then when you compound it over 10 years, it really adds up to significant, outsized performance and tends to beat the vast majority of peers,” he concluded.