Tech funds and China-focused portfolios generated 2020's highest returns by a wide margin while funds run by Baillie Gifford have jumped to the very top of the performance tables.

But as well as clear winners, the unique events of last year created some clear losers - with UK equity strategies being among the worst.

The Covid-19 coronavirus pandemic sparked a massive market crash at the start of 2020 but the rest of the year saw stocks grind higher following huge fiscal and monetary stimulus to shore up the global economy.

While areas such as tech stocks thrived when vast swathes of the global population started using their products to work from home, shop online and socialise with friends and family remotely, companies geared towards a non-lockdown economy – such as energy, travel and hospitality – suffered.

When we look at how this affected the performance of the Investment Association sectors, we get the below results.

Source: FE Analytics

The sector posting the highest total return over the past 12 months was IA Technology & Telecommunications, where the average fund made 44.52 per cent. This was the strongest year for the peer group since 2009, when its average member was up by 48.03 per cent.

Darius McDermott, managing director of Chelsea Financial Services, said: “With much of the world working from home in 2020 and many months spent in lockdown, the technology sector has been one of the beneficiaries of the pandemic.

“From online shopping to kitting out the home office, both software and hardware have been in demand, along with many other internet services. So it’s perhaps no surprise that the IA Technology & Telecommunications sector has been the best performer.”

The IA China/Greater China sector comes in second place thanks to an average total return of 33.43 per cent. While coronavirus was first spotted in China and the country was the first to implement a lockdown, it opened up its economy first and has managed to recover much quicker than much of the West.

IA Asia Pacific Including Japan, IA North American Smaller Companies and IA Asia Pacific Excluding Japan are the only other peer groups to generate an average total return of more than 20 per cent.

At the bottom of the table is the IA UK Equity Income sector, where the average fund lost 10.66 per cent. IA UK All Companies was down 5.99 per cent.

Adrian Lowcock, head of personal investing at Willis Owen, said: “The UK market simply had the worst mix of companies for investing in a lockdown, impacting the cyclical oil majors, airlines, mining stocks and hospitality businesses in particular.

“Because of the speed of the crisis and the extent of the response companies were quick to cut their dividends to protect their businesses. The UK’s traditional bias towards paying an income therefore added to the woes of the sector.

“Finally, the issue of Brexit was never too far away from investors’ minds and weighed on the UK stock market for over four years. International investors continued to avoid the region, waiting for more clarity before deciding to invest – especially given there are less risky options available.”

Property sectors such as IA Property Other and IA UK Direct Property were down amid uncertainty over the future of the office given the effects of the pandemic and trading suspensions.

Turning to individual strategies, the £6.6bn Baillie Gifford American fund made 2020’s highest total return by a decent margin after rising 121.84 per cent.

Source: FE Analytics

The fund, which is managed by Baillie Gifford head of US equities Tom Slater and his team, aim invest in “exceptional growth businesses” for the long term. With top holdings including Tesla, Amazon, Zoom Video Communications, Netflix and Google parent Alphabet and one-third of the portfolio in tech names, the fund owns many of 2020’s ‘coronavirus winners’ and prospered over the past year.

Indeed, Ballie Gifford’s long-term investment approach and preference for disruptive quality-growth stocks has seen many of its funds sit at the top of the respective peer groups for much of 2020.

As the table above shows, Baillie Gifford Long Term Global Growth Investment, Baillie Gifford Positive Change, Baillie Gifford Global Discovery and Baillie Gifford Global Stewardship have made some of the highest returns out of the entire Investment Association universe.

Many of the other funds in the top-25 of the Investment Association universe fit in with the themes highlighted so far, such as tech, Ballie Gifford, the US and China.

But Gervais Williams and Martin Turner’s £106m Premier Miton UK Smaller Companies fund stands out for being the sole UK equity strategy to make it anywhere near the top of the performance tables.

The fund prospered in 2020 thanks to a put option on the FTSE 100 (which allowed it to profit when the market fell) as well as some stock-specific successes over the course of the year.

Williams recently told Trustnet that he believes the UK market now presents investors with a “sensational” opportunity after four years of being overlooked because of Brexit.

Source: FE Analytics

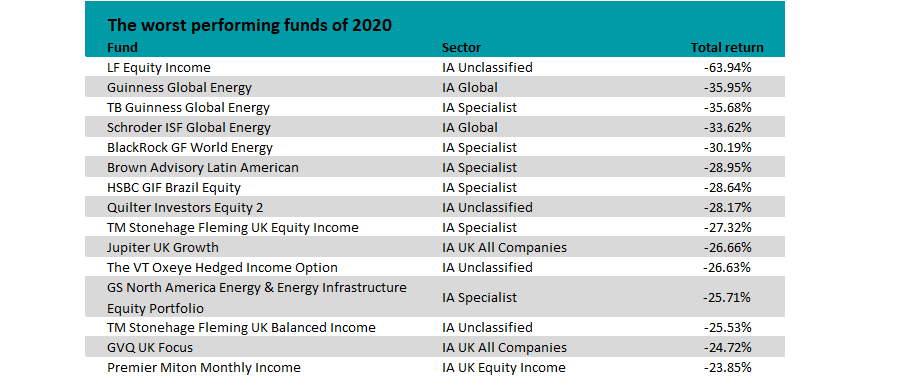

At the very bottom of the performance table is LF Equity Income. Formerly known as LF Woodford Equity Income, the fund is closed and in the process of being wound after the collapse of Neil Woodford’s investment empire.

Many of the other funds making 2020’s heaviest losses, however, are specialist strategies that focus on energy companies. These suffered in 2020 after widespread lockdowns led to lower demand and excess supply of oil.

This also caused problems for Latin American funds, given that oil exports are a significant component of many of its economies.