Jefferies has given the Scottish Mortgage Investment Trust a buy rating while Numis Securities’ Ewan Lovett-Turner believes it “warrants a place in portfolios for its unique mandate focused on companies that have the potential to deliver exceptional growth,” after the trust’s commitment to investing at least £1bn in its own shares – some 9% of its £10.9bn market capitalisation.

Spread equally over two years this would be equivalent to £2m per day, which is around 10% of average daily trading volume, the Numis head of investment companies research noted.

“The willingness to buyback such a significant sum also highlights that the board and manager are comfortable that there is sufficient headroom on limits on private company exposure and gearing, with £450m of short-term debt repaid over the past two years.”

The trust is trading at a 15% discount, which its board is determined to narrow. Shavar Halberstadt, an analyst at Winterflood, said: “Reminiscent of Mario Draghi’s ‘Bazooka’ moment at the European Central Bank, the Scottish Mortgage board has decided on a bold move, aiming to jolt the market into a correction.”

Experts expect the buyback programme, which Numis described as “excellent news for shareholders”, to succeed.

Lovett-Turner said: “We believe the shares are cheap given today’s announcement and the view that we are also positive on the prospects for the portfolio. Investors have the potential to accentuate any gains through discount narrowing, which we believe is likely given the significant buyback programme.”

Darius McDermott, managing director of Chelsea Financial Services, agreed that the buybacks are “good news for investors” and “should eventually start to push the share price up”.

“For those investors looking for a high-growth strategy, you can buy this trust at a 15% discount, knowing that the trust itself is going to continue to buy its own shares back, presumably until that discount narrows,” he said.

Buybacks are popular with shareholders, said Nick Britton, research director at the Association of Investment Companies, “as they can help support a trust’s share price while also increasing the value of net assets per share”.

It follows an increasing trend of investment companies buying back their own shares. Last year broke records for share buybacks, with more than £3.5bn worth of shares repurchased as boards responded to the deepest discounts.

AJ Bell investment director Russ Mould, however, was more circumspect. He said: “Once a darling of the stock market during the red hot ‘go-go growth’ phase that was propelled by very low interest rates, the trust fell out of favour after central banks started to lift the cost of borrowing and one of its long-standing fund managers departed.

“The new team have been trying to make a comeback ever since, but it’s been hard going. The latest bright idea is to throw a massive wad of cash at share buybacks.

“However, it raises a key question – wouldn’t that money be better deployed into new investments to generate future returns? Investment trusts are constantly judged on their discounts or premiums to NAV and Scottish Mortgage clearly wants to lift itself out of the bargain bin.”

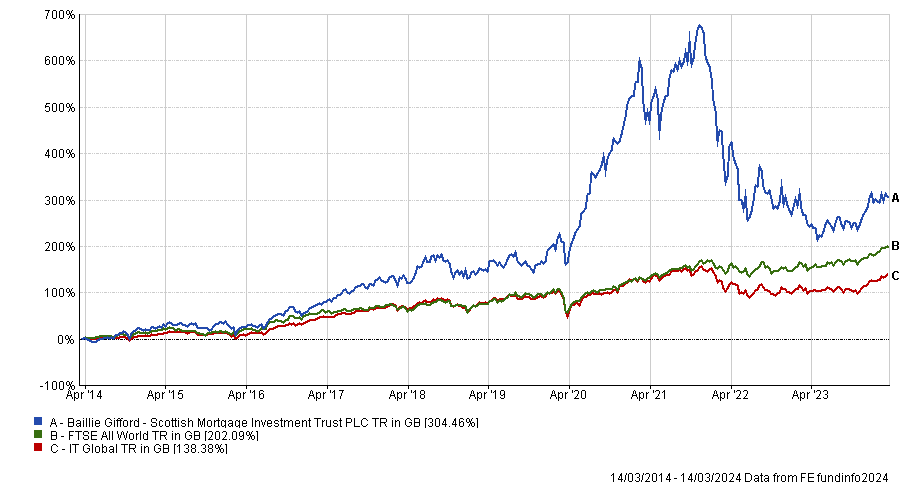

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Another question for investors is whether Scottish Mortgage’s listed portfolio, which includes large positions in Nvidia and Amazon, is richly valued (the trust’s discount notwithstanding). It has a one-year forward price-to-earnings (P/E) ratio of 30x, almost double the FTSE All World at 16.1x on 31 December 2023.

Lovett-Turner said: “The manager believes that the growth opportunity more than compensates for more expensive ratings than the market.”

Nonetheless, Jason Hollands, managing director at Bestinvest, sees the buyback announcement as a line in the sand moment.

“Having been through a fairly tough period and been knocked off its pedestal, the announcement sends an important signal by the board of Scottish Mortgage that it is resolutely focused on shareholder returns and that, while the underlying investment philosophy and approach of buying and holding growth companies remains unchanged, the board is also mindful of the value that can be created through efficient capital allocation.”

Meanwhile, the unquoted portfolio (worth 26.2% of the trust) contains several large businesses that could become public imminently, providing a potential uplift, Lovett-Turner said. There has been speculation about Starlink, Northvolt and Tempus Lens considering initial public offerings.

“We believe there is potential for liquidity events in the portfolio, with capital markets showing signs of life, which would simultaneously address multiple investor concerns such as proving valuations, reducing private exposure and giving flexibility to manage the balance sheet or provide cash for buybacks,” he noted.

One risk is that if the value of the unquoted holdings increases, they could bump up against the self-imposed 30% limit. Selling listed equities to fund buybacks would exacerbate that, warned James Carthew, head of investment companies at QuotedData.

More broadly, Scottish Mortgage’s buyback programme could have a positive impact for other trusts, according to Halberstadt: “As the second largest and arguably the highest profile fund in the investment trust sector, this commitment by the board and any consequent re-rating of the Scottish Mortgage trust’s shares may help to improve investor confidence in the wider investment trust sector, which we think has been oversold.”