Witan Investment Trust’s chief executive officer Andrew Bell has announced his intention to retire in the coming year after 14 years in his role. Following the news, the investment company decided to review the proposals for the future management of the portfolio.

Chairman Andrew Ross said: “The process of considering proposals will take place over the coming months and a further announcement will be made when a preferred option has been chosen.”

Bell will continue in his role until the review is completed. During the transition period, it will be business as usual for the company, which is known for its multi-manager approach to global equities launched in 2004, whereby the team picks specialist managers for each area of investment, independently of any single investment management group.

In Bell’s words: “Our diverse range of managers remains well-positioned for 2024 when, with a turn in the interest rate cycle and unusually wide valuation spreads within the markets, we expect to see share returns more evenly spread than in the unusually concentrated markets of 2023.”

Gavin Trodd and Ewan Lovett-Turner, analysts at Numis, said should the trust be put up for a merger, there would be “significant interest” due to its size (net assets of £1.7bn).

“There are numerous large and liquid global ICs, which we would expect to be interested, and note that JPMorgan Global Growth & Income has been an active consolidation in the sector, whilst Alliance trust has a similar multi-manager approach, albeit this is less popular than it once was, whilst we would expect many ICs and other managers will throw their hat in the ring,” they said.

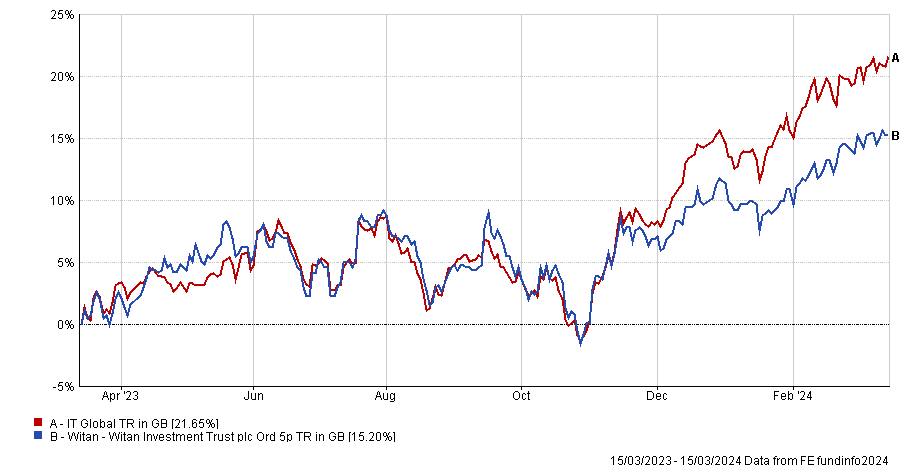

The news came alongside Witan’s annual results for the year to 31 December 2023, when it underperformed its benchmark by 2 percentage points and widened its discount from 5.4% to 7.8%.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The largest detractors included Syncona (-31.8%) and VH Global Sustainable Energy Opportunities (-18.6%), Winterflood analysts noted.

Overall, investments were responsible for a loss of 3.4%, while gearing (1.0%) and other contributors (0.8%), including fair value of debt (0.1%) and share buybacks (0.7%), contributed positively.

The Numis analysts added: “While performance of the fund since 2004, when it adopted a multi-manager approach has been solid, we note that in more recent years the fund has underperformed its benchmark, contributing to the board’s review of its options.”