The momentum trade has dominated the market for the past year as investors piled into a narrow band of stocks but analysts at Hargreaves Lansdown think investors should now be looking at more unloved areas.

A significant chunk of last year’s gains came from US large-cap tech stocks, which bounced back from a terrible 2022 as investors became increasingly excited about artificial intelligence (AI). This hype was most prevalent among the ‘Magnificent Seven’ – Amazon, Apple, Nvidia, Meta Platforms, Microsoft, Alphabet and Tesla – which are seen as natural beneficiaries of the AI revolution.

However, Hargreaves Lansdown head of investment analysis and research Emma Wall said the best opportunities today appear to be in three areas that have been out of favour with the platform’s clients over the past year.

“In three themes, the biggest investment opportunities right now are fixed income, UK equity income and China. Those are our short-, medium- and long-term sector picks,” she said.

“Of course, all portfolios need a good chunk in the US, but you also need other assets as well, and with valuations towards the top end of its historical range in the US we urge diversification, to include other styles, sectors and countries.”

To this end, Wall suggested investors consider trimming some of the gains they might have made in US stocks and channelling them towards these three areas. Below, Trustnet takes a closer look at why.

Fixed income

Wall pointed to high-quality corporate and government bonds as Hargreaves Lansdown’s preferred short-term opportunity, noting that these can help to mitigate the volatility of an equity portfolio.

“Though we don’t expect the UK, US or EU central banks to start cutting rates until the second half of the year, now is a good entry point as you get income now and growth as yields fall,” she said. “On a one-to-five-year view, bond funds offer a great opportunity for total returns.”

On where in the fixed income market to invest, Wall said most bonds now have a more attractive yield than a couple of years ago but high-quality corporate bonds offer an attractive premium over government bonds.

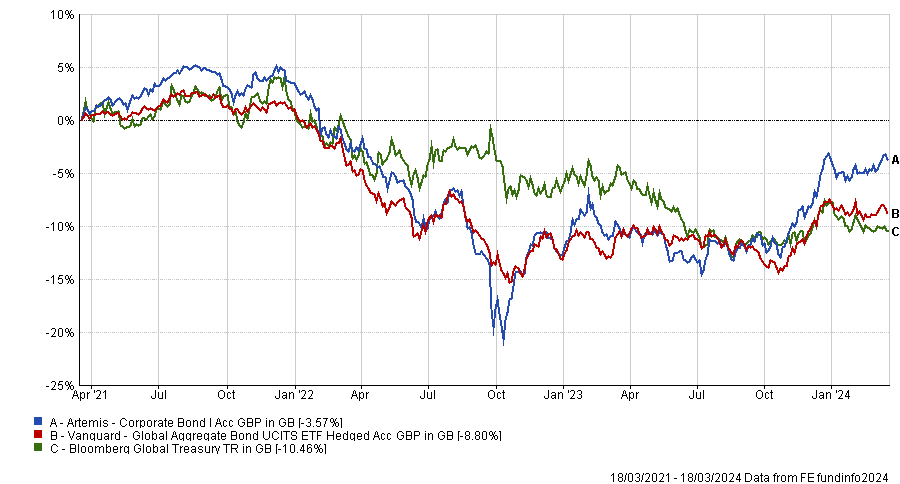

Performance of funds vs global govt bonds over 3yrs

Source: FE Analytics

“We do predict continued volatility in the market, however, as macro news and events spook traders, and so suggest someone nimble – such as Stephen Snowden who runs Artemis Corporate Bond, who we think is well positioned to take advantage of this market,” she said.

“We prefer active management in a market like this but if you want a passive, Vanguard Global Aggregate Bond ETF is a good pick.”

The UK

Hargreaves Lansdown’s medium-term investment opportunity is the UK, especially from an equity income point of view.

“It is just too cheap to ignore,” Wall argued. “The market is trading at a 40% discount to developed market peers, despite offering some great dividends from high-quality businesses.”

The platform’s analysts like Adrian Frost, Nick Shenton and Andy Marsh’s Artemis Income fund, which has a strong long-term track record, and the City of London Investment Trust, highlighting its “exceptional” manager Job Curtis and double-digit discount.

Performance of funds vs index over 10yrs

Source: FE Analytics

For passive investors, she pointed to the iShares UK Dividend ETF, which offers exposure to 50 of the highest dividend-paying stocks listed in the UK.

“Stock picks in the UK from our equity analysis team include undervalued dividend payer Lloyds Bank and out-of-favour pet care firm CVS, whose valuation has been dragged down by an upcoming competition and markets review, as well as oil and gas services firm Baker Hughes, which is well placed to benefit from the energy transition,” Wall added.

China

Chinese equities – which have been among the global market’s worst performers in recent years – are the longest-term investment opportunity highlighted by Hargreaves Lansdown.

“It is a contrarian call, but bad news is priced in and we think it is significantly undervalued, even after the recent rally,” Wall said. “Is there political risk? Yes. Are demographics as supportive of economic growth as they were 40 years ago? Definitely not.”

However, the head of investment analysis and research pointed out that China is the world’s second largest economy, remains one of the main engines of global growth and is “significantly undervalued” compared with developed markets and other more popular emerging markets such as India.

Wall added that investors should have around 10% of their equity allocation in China, unless they are focused on capital preservation and/or have a shorter-term investment horizon.

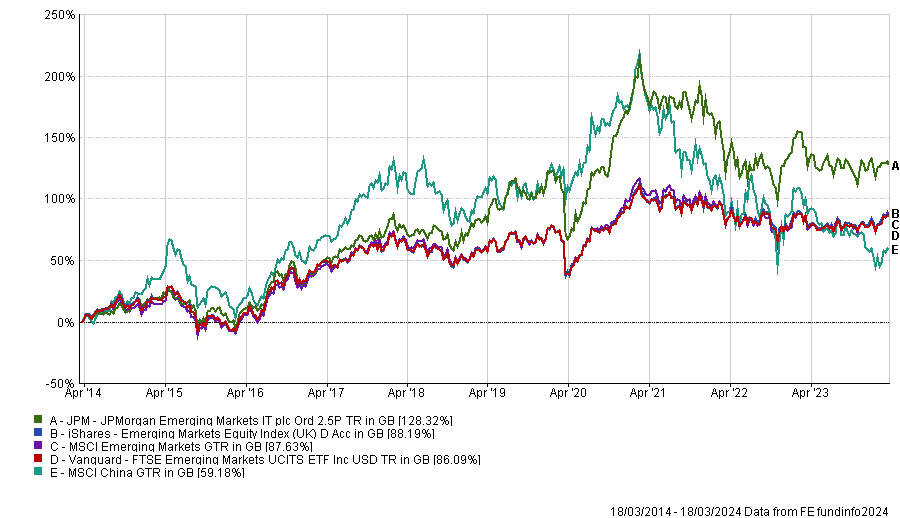

Performance of funds vs indices over 10yrs

Source: FE Analytics

In terms of exposure, she suggested cheap and diversified trackers such as iShares Emerging Markets Equity Index or Vanguard FTSE Emerging Markets ETF. For active investors, she pointed to JPMorgan Emerging Markets Investment Trust, adding that “stock selection can be key in this market”.