Investors who backed smaller companies when individual savings accounts (ISAs) were first launched would have experienced significant outperformance compared to large-cap funds, analysis of the past 22 years of returns shows.

ISAs launched in April 1999 when Gordon Brown became chancellor. The initial allowance was set at £7,000 per tax year and stayed at that level until the 2008/09; this started a decade of gradual increases and the allowance currently stands at £20,000.

AJ Bell financial analyst Laith Khalaf has been looking at how funds and trusts have performed since ISA were launched 22 years ago and found that, in addition to small-caps outperforming, investment trusts, have tended to make higher returns than their open-ended counterparts.

“1999 wasn’t exactly an auspicious time to start investing,” said Khalaf. “The tech bubble was about to burst, the split cap investment trust scandal was about to explode and stocks were about to fall into a three-year bear market.”

Despite that, over the last 22 years, the average fund sector has turned £1,000 invested into £4,257 today and there has been strong performance from funds investing in UK small-caps and Asian equities over the same period.

“Funds in the IA UK Smaller Companies sector have significantly outperformed the underlying index, showing the benefit of active management in picking out tomorrow’s winners from today’s stock market minnows,” he said.

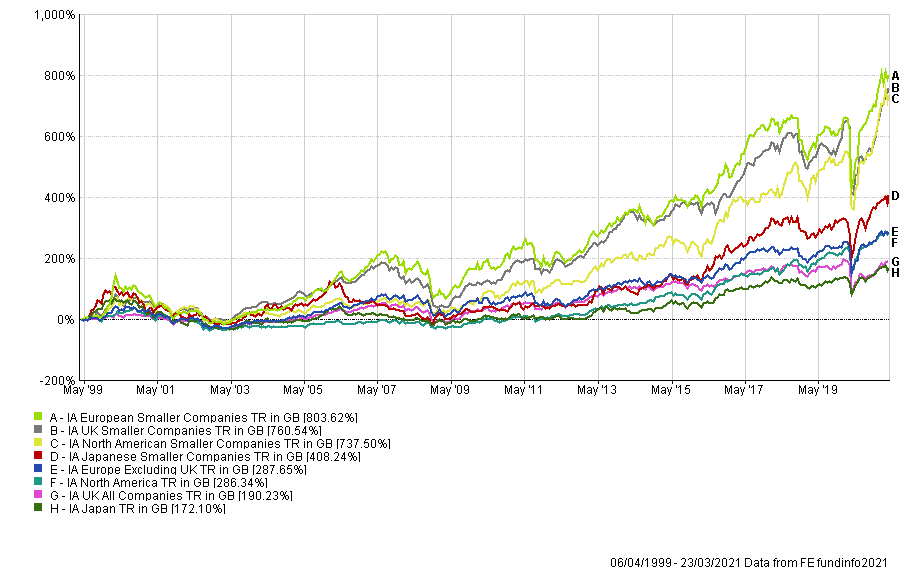

Performance of IA sectors since April 1999

Source: FE Analytics

As the chart above shows, smaller companies have outpaced their blue-chip peers over the 22-year period, and the average IA UK Smaller Companies fund made a total return of 760.54 per cent compared with 190.23 per cent for the IA UK All Companies sector peer.

The nature of smaller companies allows for a greater propensity to grow and active managers can take advantage of their under-analysed nature to secure significant outperformance.

“The superior performance of smaller companies funds is apparent across all developed markets, so it might be a good idea for today’s investors to think small with their ISA portfolio,” Khalaf said

“While the risk of falling prices might put some off investing in the stock market, they should consider the cost of missing out on gains too.”

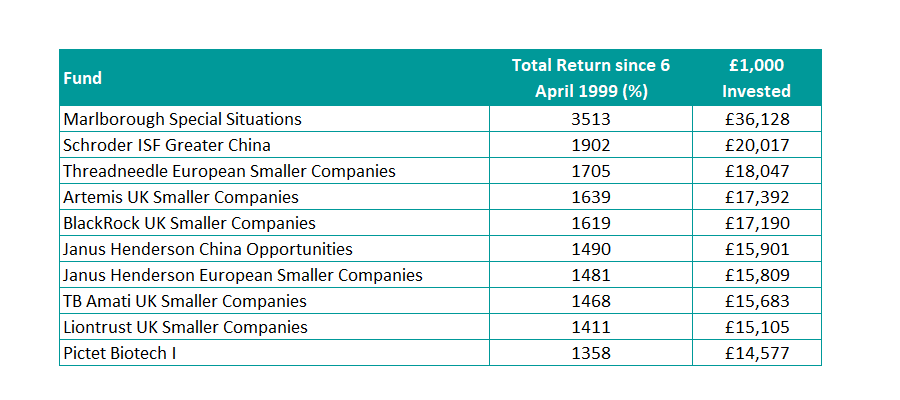

Best performing funds since April 1999

Source: FE Analytics

By quite a margin, the best performing open-ended fund since April 1999 has been the £1.4bn Marlborough Special Situations fund, managed by Eustace Santa Barbara and Guy Field.

Over 22 years, the fund has posted a 3,513 per cent return, which equates to £36,128 from an initial investment of £1,000 back in 1999.

Providing exposure to small-and-mid-cap UK companies, Marlborough Special Situations aims to identify companies with significant growth potential and try to invest at an attractive price whilst also having some, though limited, exposure to companies going through a tough period but have strong recovery prospects.

Secondly, the £2.9bn Schroder ISF Greater China fund has made a total return of 1902 per cent over the time period and would have given investors a total of £20,017 from an initial investment of £1,000.

Not forgetting the performance of European smaller companies, the £480m Threadneedle European Smaller Companies fund has made a total return of 1705 per cent over the time period.

Managed by Mine Tezgul, the fund selects smaller companies considered to have good prospects for share price growth, regardless of industry or economic sector, which may also provide exposure to niche growth areas that often cannot be accessed through large companies.

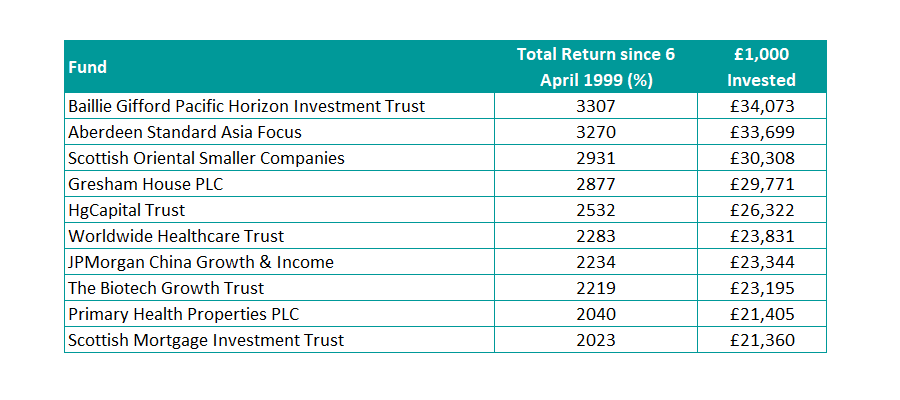

Best performing trusts since April 1999

Source: FE Analytics

With the exception of Marlborough Special Situations, the top 10 investment trusts have outperformed their open-ended peers.

“That’s to be expected over a long time frame,” said Khalaf. “Unlike open-ended funds, investment trusts can borrow money to invest in the market, adding risk, but also exacerbating strong performance.”

The top performing trust is the £665.2 Baillie Gifford Pacific Horizon Trust, which from an initial investment of £1,000 in 1999 would have yielded £34,073.

The five FE fundinfo Crown Rated fund is, according to Rayner Spencer Mills Research, a very distinctive Asian equity portfolio with a sole focus on growth companies.

The managers analysis is focused on a company’s ability to grow earnings whilst appreciating the tendency of volatility from the region.

Two further Asia trusts follow, the £392.3m Aberdeen Standard Asia Focus and £284.4m Scottish Oriental Smaller Companies trusts. The strategies have returned 3,270 per cent and 2,931 per cent respectively.

The £16.6bn Scottish Mortgage Investment Trust makes the list, but with a return of 2,023 per cent, it just makes the top 10. Manager James Anderson announced this month that he would be stepping down in April of next year, after running the trust for more than 20 years.

“The returns from these funds and trusts since 1999 has been remarkably high, despite the market blow out right at the start of this period,” said Khalaf. “Investors’ faith and patience has been rewarded by their initial investment being multiplied many times by these investments.”