Bear markets come and go, but losses to one’s finances bite and can even scar. Jerky investors who rush for the exit get chased by the bear – not only do they crystallise their losses but they are also more likely to miss out on the gains when things turn – and they can turn quickly and unexpectedly.

This is why it is unwise to try to time the market, but much better to remain invested (hopefully in the right sectors) and wait for better times.

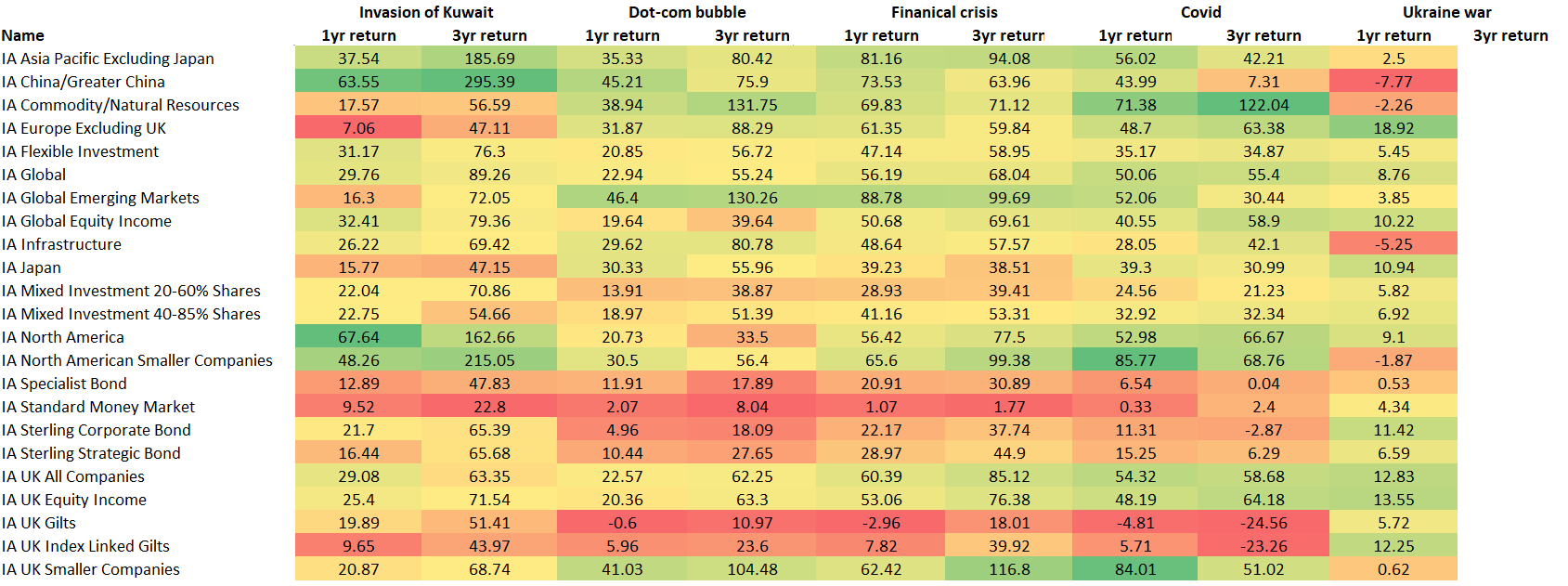

Below, Trustnet looks back through history to find out which Investment Association sectors had the best returns one and three years after the conclusion of a bear market, defined as those periods when the S&P 500 hit losses of at least 20%.

This is timely as it almost happened again earlier this month and there are fears that a recession could push the US market into bear territory once again before the end of 2025. Having previously looked at the equity investment styles that perform best in down markets, here we look at the assets that perform well at the end of the downward cycle.

The periods that qualified were: Iran’s invasion of Kuwait, with a bear market ending on 11 October 1990, the dot-com bubble, ending 9 October 2002, the Great Financial Crisis, ending 9 March 2009, Covid, ending 23 March 2020, and the supply-chain shock following Russia’s invasion of Ukraine, with its bear market ending on 12 October 2022.

We excluded the sectors without a long enough track record, as well as the IA Unclassified and IA Not Yet Assigned sectors.

Finally, we ran the average returns of the remaining sectors and colour-coded them by quartile. The result is the table below.

Source: Trustnet

While no IA sector emerged as a clear winner in all periods, bonds have been in the bottom quartiles more often than equities. This is likely because of momentum – recovering investors’ confidence drives a rally in equities.

UK gilts were among the worst performers after the dot-com bubble, the financial crisis and Covid, contending the bottom position in the list with the money market. While rushing for the exits and hiding in cash when things go wrong seems like the best option to limit losses, it also means leaving gains on the table in the following one to three years – this happened consistently throughout the five bear-market recovery periods.

Not only gilts performed poorly – the IA Sterling Corporate Bond, Sterling Strategic Bond and Specialist Bond sectors were also below average.

The next-worst category included those investments that are partially in debt strategies – multi-asset funds. Flexible investments remained a middle ground in all periods, solidly delivering average to slightly below-average returns, while the IA Mixed Investment 20-60% Shares and 40-85% Shares sectors have been marginally worse as they have more in bonds.

Commodities have consistently done quite well in the periods highlighted, especially after Covid, when they were among the best-performing asset classes. Infrastructure also held up relatively well, except for after the most recent bear market in 2022.

Moving to equities, global funds has proved a safe-enough bet as markets recovered, with similar results across IA Global, IA Global Equity Income and IA Global Emerging Markets. However, none of the three has ever shot the lights out.

The UK market has consistently kept up with rising momentum. The stand-out area has been UK smaller companies, usually remaining above-average and achieving a fantastic run one year after the Covid slump, although they couldn’t repeat that result in the first year after the Ukraine war started. The IA UK All Companies sector has done increasingly well as time went by, similarly to the domestic Equity Income sector.

The US has been slightly more volatile, with the IA North America reaching the top of the table in 1990 and US small-caps only marginally beating their UK counterparts, but they suffered hits after the dot-com bubble and the Ukraine war, respectively.

Further afield, Asia has held up well, while China had more extreme results – after a stellar run in the 1990s, it has gone from riches to rags more recently, turning into the worst performer one year after the invasion of Ukraine and the subsequent supply shocks.

The data in this study doesn’t show where to invest next, but is proof that market leaders change and not every rally in history was driven by the same asset class. Investors are better off remaining diversified as timing the markets is tough.