Young investors will generally focus on growth strategies that usually pay little to no dividend, eschewing a payout today in return for the prospect of much greater growth in the future.

But dividends do have a place in a portfolio, both to be reinvested in more shares – a sometimes overlooked phenomenon known as compound interest, or for immediate cash required for nearer-term goals.

There are many different types of income strategies with some being more suitable for young investors than others. As such, below Trustnet asked experts which income funds would match their needs.

Both Nick Wood, head of investment fund research at Quilter Cheviot and Tom Sparke, investment manager at GDIM picked Redwheel Global Equity Income, a fairly new strategy that was launched in 2020.

The fund, run by Nick Clay and Andrew MacKirdy, is a mix of higher-quality companies at cheap valuations with steady dividend compounding. It has a strong weighting in consumer staples, with holdings such as drinks makers PepsiCo, Diageo and Ambev among the largest positions.

Although the portfolio is relatively new, Clay is well known to investors, having run several portfolios at BNY Mellon over his 20 years there before his exit in 2020, when he and his entire team switched to Redwheel.

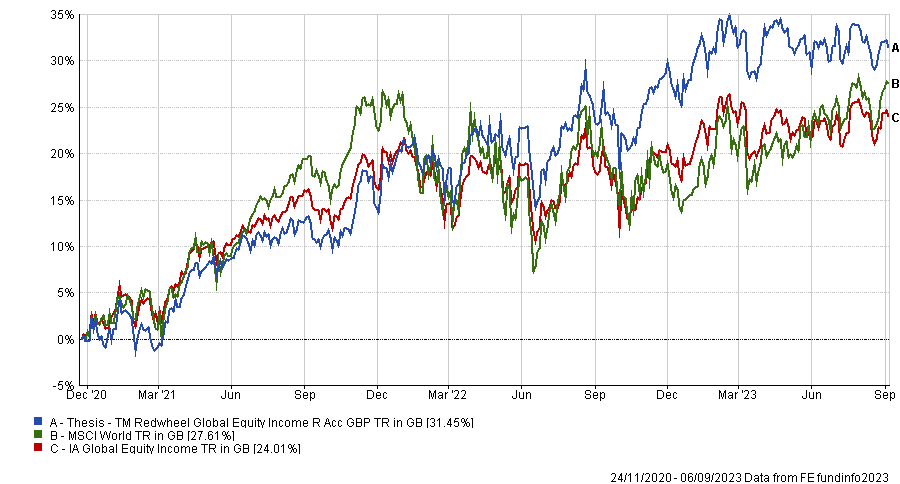

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Wood said: “Given the natural value bias, the fund performed well in 2022, but has lagged somewhat this year given the lack of exposure to the big three tech winners this year, namely Apple, Microsoft and Nvidia.”

For younger investors looking for an equity income strategy closer to home, Isaac Stell, fund research manager at Parmenion, suggested TB Evenlode Income.

He said: “The fund is run by the very experienced Hugh Yarrow and Ben Peters who together have defined and refined their approach to income investing throughout the years to deliver a fund that has produced very robust long-term returns with consistently lower than benchmark volatility.”

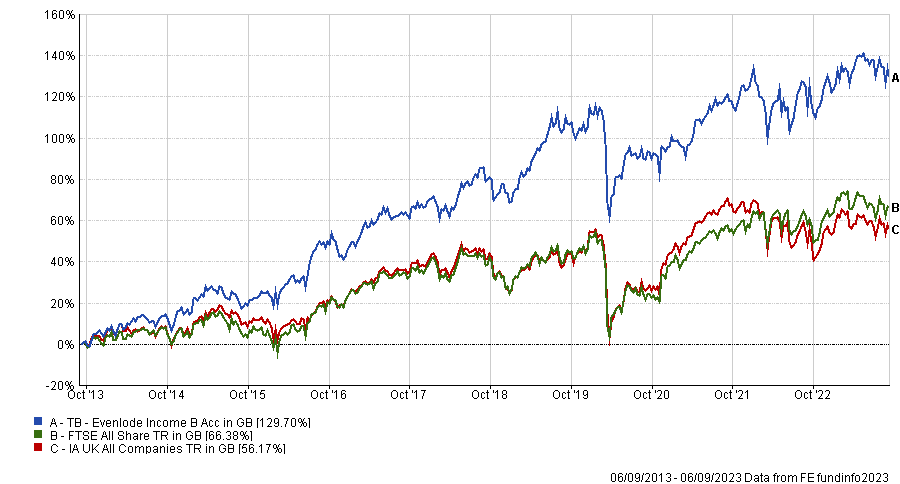

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

Despite the focus on income, the fund has a quality-growth approach, with the managers targeting companies with strong brands, robust economic moats and hard-to-replicate business models at reasonable valuations.

Stell added: “This should lead to more consistent earnings even in an economic downturn as the companies have a high free cash flow yield, which underpins consistent and growing dividend payments.”

For diversification purpose, Stell added the Schroders Asian Income fund, run by Richard Sennitt since 2001, as another option.

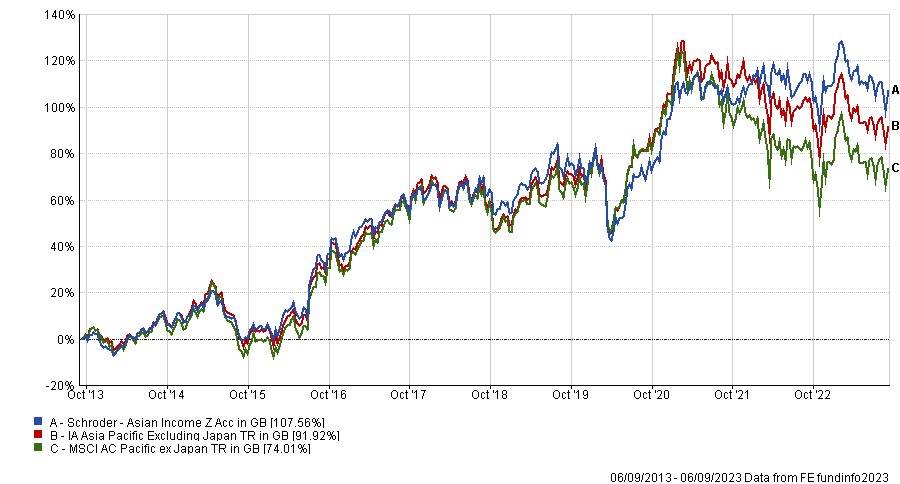

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

Stell said: “Much like the Evenlode fund, there is a quality bias inherent in the fund’s constituent companies.

“Whilst there is a focus on income, the managers take a more total return approach, preferring to favour companies with the potential to grow their dividends over the longer term.”

Alternatively, Wood said that Prusik Asian Equity Income is worth considering. The strategy aims to invest in companies with stable cash flows, high margins and good pricing power and an attractive up-front yield, with a bias to small- and mid-caps.

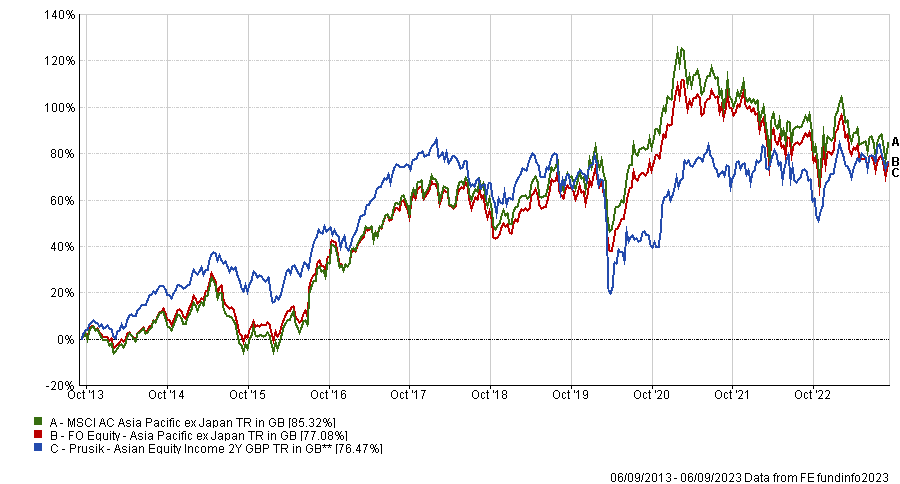

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

Wood added: “Whilst many investors will focus on higher growth companies in Asia and emerging markets, this fund provides some balance, and this has had no better demonstration than in 2021 and 2022 when the fund rose 8% and 14% respectively. This represented outperformance of 11% and 21% versus their Asia ex Japan index.”

The fund has a bias towards the industrials and financials sectors, with Hong Kong representing a significant proportion of the portfolio in terms of geography.

Lastly, for a multi-asset approach, Sparke picked the Aegon Diversified Monthly Income fund, which draws income from equities, bonds and alternative sources.

He said: “The fund has a generous yield at more than 5% currently and has only undertaken around half the volatility level of equity markets.

“The annual overall return per annum since the fund’s inception has been around 5%, which would make for an attractive compounded return over the longer term.”