Investors who have initiated a Trump trade – moving investment portfolios to align with a possible victory of Donald Trump against Joe Biden in the US elections – might have been taken aback as Biden withdrew from the presidential race on Sunday and supported Kamala Harris as the next democratic candidate, reinvigorating the democratic bid to the presidency.

For those who believe that Trump will still be the favourite, Trustnet recently published a guide of what to own for his return to the White House. While Harris’ entry might alter the course of the campaign, experts today believe the Trump trade has not run out of steam. In fact, albeit unpredictable, it’s still “logical” and might even work under a blue president.

Below is a list of funds for investing in the US, recommended by experts as the safest picks to navigate the current political uncertainty.

As a premise, investors shouldn’t change investment portfolios too drastically on the back of politics. As Ben Yearsley, director of Fairview Investing, put it: “Politics is so unpredictable – leave your portfolios largely alone.”

“Buying hedged Japan a decade ago was straightforward – it was obvious the yen was going to weaken, therefore you had to protect against that. But with Trump, it’s not the same,” he said.

“His policies of higher spending and tax cuts will lead to a bigger budget deficit and likely higher inflation, so it’s difficult to know which way to play this.”

Many US experts have recommended small- and mid-caps for the Trump trade, but because the equal-weighted S&P500 index has been left behind this year, as have small- and mid-cap indices, this is also the area where Yearsley would look – Trump or no Trump.

His picks were aligned with those recommended on Trustnet last week for the “Trump trade” – Artemis US Smaller Companies and De Lisle America.

While the former was already discussed here, the latter is a £164m strategy led by Richard De Lisle, who keeps a relatively low price-to-earnings ratio in the fund, which is overweight value by design.

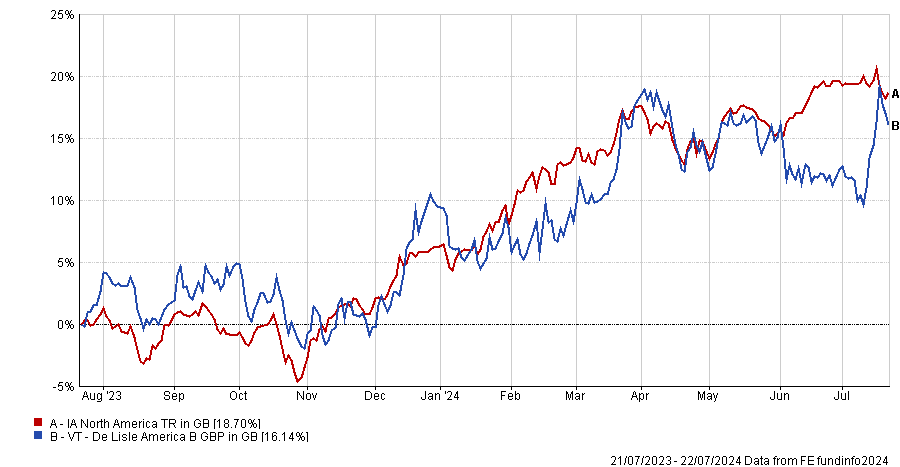

Performance of fund against sector and index over 1yr

Source: FE Analytics

The rotation into value and income stocks as well as smaller companies is only “logical”, according to Rob Morgan, chief analyst at Charles Stanley, because with Trump – still “the most likely frontrunner” –, the chance that Republicans will control both Congress and Senate, easing the passage of new legislation, remains high.

“We don’t necessarily see an unwind of the so-called Trump trade trend, at least for the time being, as it is co-mingled with the concurrent trend of better news on short-term inflationary pressures and the Fed’s now odds-on to cut interest rates in September,” he said.

“This also favours the smaller, more indebted and economically sensitive parts of the US market and, although intertwined with fiscal trends and economic policy, rests on other moving parts unrelated to political machinations. So essentially the market rotation could gather more momentum without a political angle to it.”

Morgan’s choice went to the Premier Miton US Opportunities and the Fidelity American Special Situations funds, both with “a distinctive value-led approach” and able to help to keep a portfolio “nicely balanced” with more growth-led or passive funds.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Premier Miton’s strategy is led by Hugh Grieves and Nick Ford, who were praised by FE Investments analysts for their “extensive knowledge, particularly in smaller- and medium-sized companies”.

They said: “The fund is a solid option as an active US-equity fund, providing exposure to the full spectrum of the US equity market and particularly smaller- and medium-sized companies at different points in the cycle”.

Fidelity American Special Situations has a FE fundinfo Crown Rating of five and is run by Alpha Manager Rosanna Burcheri, who has a strict valuation discipline and will buy cheap companies that demonstrate the ability to compound free cash flow, resulting in the share price reflecting this in due course.

FundCalibre managing director Darius McDermott remained in line with these picks and went for T. Rowe Price US Smaller Companies, Artemis US Smaller Companies, and Schroder US Mid Cap, adding to the list absolute return funds, designed to perform under various market conditions, that could serve as a defensive option amid market uncertainty, such as WS Ruffer Diversified Return and Janus Henderson Absolute Return.