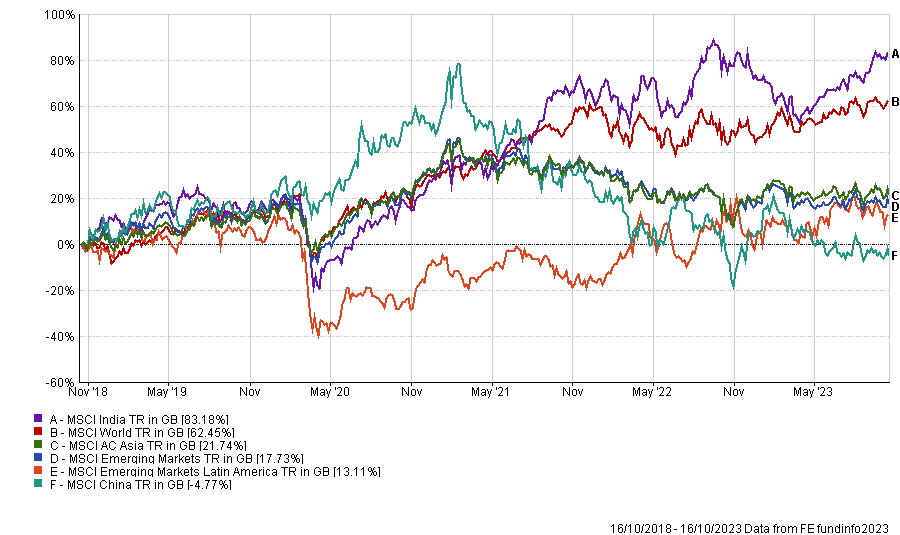

The past five years have been tough for emerging market equities, as they have significantly underperformed their peers from developed markets.

For instance, the MSCI World returned 62.5% in that period, whereas the MSCI Emerging Markets only made 13.1%.

While not matching the returns of the global index, some active funds in the IA Global Emerging Markets sector have rewarded investors for the risks they took.

Performance of indices over five years

Source: FE Analytics

For instance, £1,000 invested in Carmignac Portfolio Emergents in 2018 would now be worth £1,550.67 five years later.

The fund looks for quality companies across emerging markets with long-term growth prospects and sustainable profits. The portfolio is relatively concentrated, with the top 10 holdings accounting for more than 45%.

GQG Partners Emerging Markets Equity also served investors well, with the initial investment of £1,000 now worth £1,439.57 after five years. The fund, managed by FE fundinfo Alpha Manager Rajiv Jain, Brian Kersmanc and Sudarshan Murthy is relatively young, having been launched in 2017.

It also significantly differs from the benchmark as it is overweight India and Brazil, but underweight China.

The IA Global Emerging Markets funds that made the most of £1,000 over five years

Source: FE Analytics

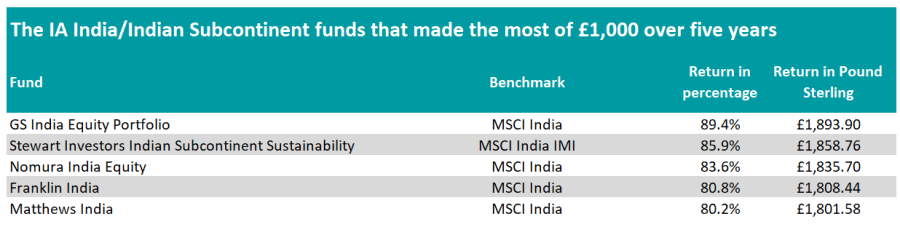

To get the highest possible returns in emerging markets, investors would have needed to focus on a specific market: India.

Several funds in the IA India/Indian Subcontinent sector, such as GS India Equity Portfolio and Stewart Investors Indian Subcontinent Sustainability would have returned more than a global index tracker over the past five years.

Analysts at Square Mile highlighted the explicit environmental, social and governance (ESG) factors in the investment process of the Stewart Investors’ fund as a key draw for investors that want to do good with their holdings.

They said: “The whole team follows a process that over time has evolved to explicitly include ESG factors. They pay particular attention to the owners and management teams in charge of such companies as they believe that a firm's ability to deliver long-term sustainable returns is closely correlated with the company's management culture.

“The impact of business practices on the local community and environment is important, but the team will consider a range of factors such as the quality of a company's financial positioning and sustainability of cash flows.”

The IA India/Indian Subcontinent funds that made the most of £1,000 over five years

Source: FE Analytics

Square Mile analysts also noted that the strategy can look and act differently from the index as it tries to address the risks that investors face when investing in this part of the world.

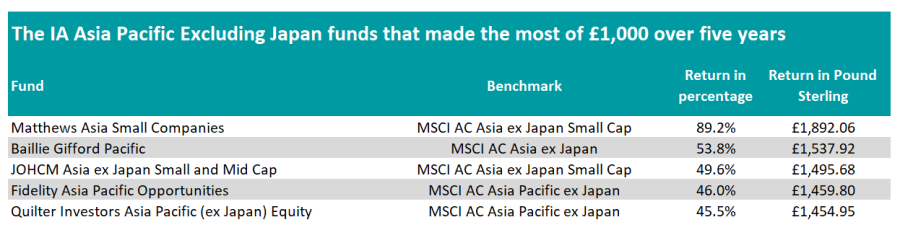

Funds in the IA Asia Pacific Excluding Japan sector provided roughly the same level of returns as their peers in the broader IA Global Emerging Markets sector.

One fund, however, would have made particularly good use of £1,000, returning 89.2% to investors for a total pot of £1,892.06 after five years and also outperforming the MSCI World.

Matthews Asia Small Companies buys companies with a market capitalisation of no more than $5bn across the Asia ex-Japan region and has more than 50% of its assets domiciled in either China, including Hong Kong and India.

Among the Asia funds focusing on large-caps, Baillie Gifford Pacific would have made the most of £1,000, turning it into £1,537.91. The managers focus on secular growth companies and aim to spot firms across the region that have the potential to double their share price over five years.

The IA Asia Pacific Excluding Japan funds that made the most of £1,000 over five years

Source: FE Analytics

Another of the most profitable funds in Asia has been Fidelity Asia Pacific Opportunities, which grew £1,000 to £1,459.80.

Analysts at FE Investments noted that Alpha Manager Anthony Srom has managed to perform in both rising and falling markets while avoiding large-index constituents.

They added: “We like that the manager has no deliberate style bias and that the focus is entirely on stock selection. Having said that, new positions typically exhibit a contrarian bias and he prefers to buy stocks that are under-owned and underappreciated by the market.

“Overall, the fund would be most suited to a portfolio with a long-term investment horizon as well as one that can tolerate high volatility.”

Another particularity of the fund is that it takes significant off-benchmark position, with Canadian miner Franco-Nevada or Dutch semiconductor firm ASML among the top 10 holdings.

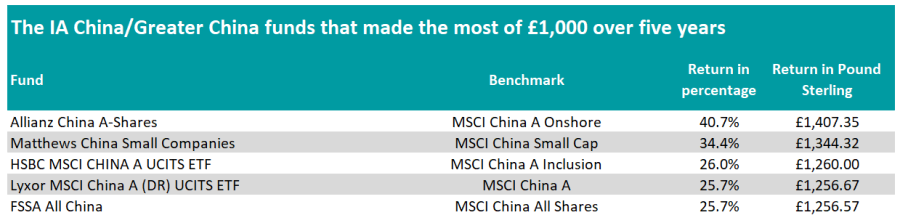

The past five years have been bleak for Chinese equities, with indices such as MSCI China falling by more than 4%.

Yet, Chinese equities are divided in different markets and China A-Shares provided some returns to investors. Those stocks are traded onshore on the Shanghai and Shenzhen stock exchanges and denominated in Yuan.

This market is more retail-driven and can be volatile, as retail investors tend to have shorter investment time horizons and buy or sell frequently.

The IA China/Greater China funds that made the most of £1,000 over five years

Source: FE Analytics

As a result, the fund that would have made the most money for investors across this period is a China A-Shares specialist, Allianz China A-Shares, which is up 40.7% over five years.

Two passive funds tracking China A-Shares indices, HSBC MSCI CHINA A UCITS ETF and Lyxor MSCI China A (DR) UCITS ETF, also made some returns for investors. The former turned the initial investment of £1,000 into £1,260 and the latter £1,256.67 over five years.

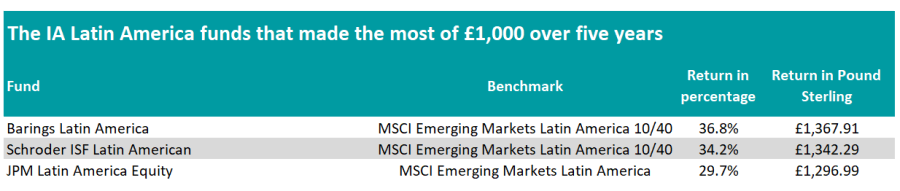

The IA Latin America funds that made the most of £1,000 over five years

Source: FE Analytics

Latin America is, with China, the sector where funds delivered the least for investors. Barings Latin America and Schroder ISF Latin American would have grown an investor’s £1,000 starting pot respectively £1,367.91 and £1,342.29 over the past half a decade.