The Japanese equity market has just reached a record high, overtaking its previous peak 34 years ago. Corporate governance reforms, the return of moderate inflation, accommodative monetary policy, inflows from international investors and the weak yen have all helped to fuel a strong rally in the land of the rising sun.

Several fund managers believe these factors will continue spurring on Japan’s equity market to new heights and that investors have plenty more to gain.

Jeremy Osborne, investment director of Fidelity Japan Trust, said: “Upbeat earnings results, including from index heavyweights, accompanied by share buyback announcements have served to galvanise market sentiment. And the broader shift in the economy to moderate inflation supports growth in wages and consumer spending, and investment.”

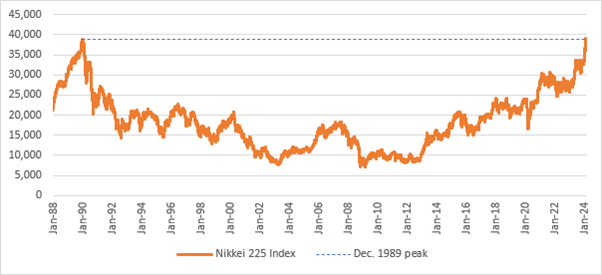

Nikkei 225 Index passes its December 1989 peak

Sources: Fidelity and Bloomberg, data to 22 Feb 2024

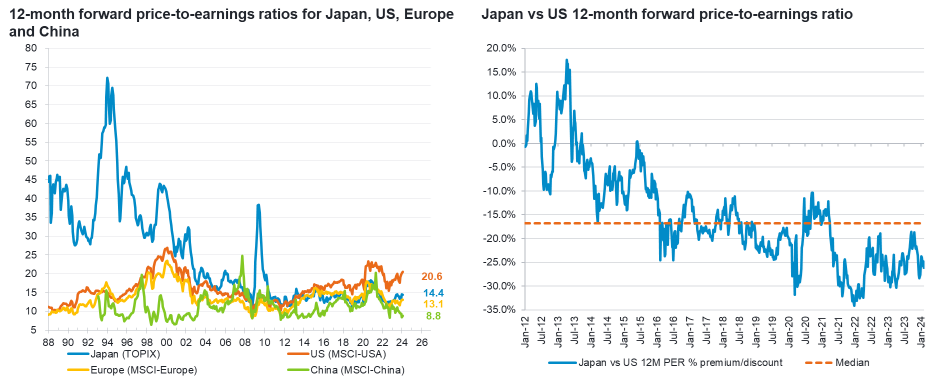

Valuations remain reasonable

Despite strong recent gains, Japan is nowhere near bubble territory, fund managers argue.

Osborne said: “Japanese equities traded on a forward price-to-earnings (P/E) multiple north of 50x during the bubble period [in 1989], so the current multiple of around 15x does not look expensive historically nor relative to other markets, especially considering current interest rates.

“Moreover, a sustained improvement in returns on equity (RoE) would support a higher price-to-book (PB) multiple, and the economic trend towards moderate inflation supports higher earnings-based valuations.”

Japanese equity valuations look reasonable compared to other major markets

Sources: Fidelity, Factset, Daiwa Securities as of 8 Feb 2024, Bloomberg as of 9 Feb 2024

The corporate governance revolution is gathering pace

The Tokyo Stock Exchange (TSE) has made concerted efforts to encourage shareholder-friendly behaviour, improve returns on capital and increase share prices – driving a corporate governance revolution that has a lot further to go, managers said.

“The TSE has taken an important step with its guidance on how companies should be managed around governance and capital allocation, and this directly encourages executives to make decisions that are conscious of stock prices,” Osborne noted.

The Tokyo Stock Exchange has published a list of companies that have disclosed plans to improve capital efficiency and so far, 49% of Prime market companies and 19% of Standard market ones have responded, he continued.

The TSE has also written to more than 2,000 companies to establish whether their existing operational and governance structures remain fit for purpose.

Osborne added: “As well as concrete measures to foster sustainable growth such as returns that exceed the cost of capital, the TSE also promotes essential initiatives such as research and development, human and capital investment, and realigning business portfolios to better allocate resources.”

In a sign that management teams are becoming more proactive, management buy-outs (MBOs) accelerated last year at their highest pace for a decade. As many as 26 MBOs were announced with a combined value of $2.4bn.

James Salter, manager of the Zennor Japan fund, pointed out that Japanese companies have ample cash reserves, which could be used to reward shareholders. “Unlike their Western counterparts, many of Japan's companies are awash with cash and able to meaningfully increase dividends,” he said. “More than half of Japanese companies listed on the Topix have net cash on their balance sheets compared to around 20%of companies on the S&P 500 and FTSE All Share.”

Shareholder engagement is spurring change

The Tokyo Stock Exchange is not the only institution advocating for reform. International asset managers are also engaging with Japanese companies.

Joe Bauernfreund, chief investment officer of Asset Value Investors (AVI) and manager of the £1bn AVI Global Trust, is one such manager. AVI has invested 20% of its portfolio in good quality Japanese companies with ample cash on their balance sheets – sometimes cash holdings have even exceeded the company’s market capitalisation.

AVI has engaged with management to encourage them to do more productive things with their cash such as paying dividends, buying back shares and investing for future growth, he explained.

Domestic demand should continue to support the stock market

Inflows are another factor that could fuel stock market rises. Japanese households invest just 11% of their financial assets in domestic equities, a lower threshold than savers in the US and Europe.

That could change with the expansion of the Nippon Individual Savings Account (NISA), and the return of inflation, which will make save haven cash deposits less attractive, Osborne explained. After decades of deflation, Japanese CPI was 3.2% last year.

Ample opportunities for active managers to uncover

Salter argued that Japan still offers “the possibility of significant alpha generation” because it is an under-researched market. As much as 50% of the market has no analyst coverage, he pointed out.

Bauernfreund agreed. “We can still find good quality businesses at modest valuations in overlooked areas of the market or with complicated structures,” he said. “As a value-minded manager focussed on inefficient markets, Japan has always intrigued us.”