JP Morgan Asset Management expects UK and European equities to outperform the US over the next 10-15 years and government bonds to nip at the heels of investment grade.

The asset manager anticipates that US large-cap equities will return 6.7% per annum for the next 10-15 years in dollar terms but for sterling investors, currency implications will reduce their gains to 5.9%. High valuations in the US will act as a 1.8% drag on returns over this long-term investment horizon.

On the other hand, the US should benefit from migration, productivity gains driven by artificial intelligence (AI) and stronger economic growth on the back of robust capital investment, technological advances and fiscal activism.

Even so, JP Morgan Asset Management’s projections are more optimistic than Vanguard and Goldman Sachs, who also announced their forecasts during the past week.

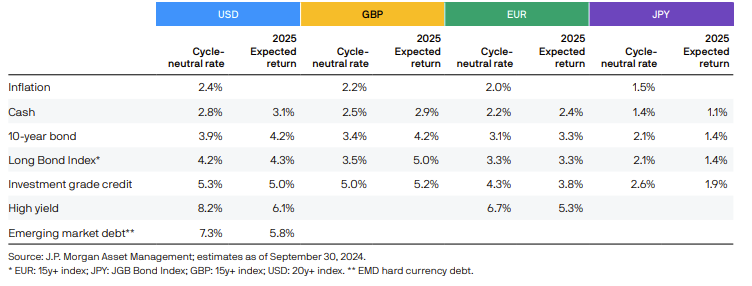

Vanguard expects unhedged US equities to return 4.2% in sterling terms over the next 10 years. Valuations are stretched and share prices are high compared to expected earnings, said Giulio Renzi Ricci, head of asset allocation, Europe.

Vanguard believes that US value and small-caps will significantly outperform growth stocks, reversing the dynamic of the past few years.

After exponential recent performance fuelled by mega-cap tech and AI exuberance, growth stocks now look expensive and are likely to deliver only 0.1%–2.1% on an annualised basis for the next decade, as the chart below illustrates.

Vanguard’s 10-year annualised nominal return and volatility forecasts for US equities

Source: Vanguard

Goldman Sachs expects the S&P 500 to return a measly 3% per annum because of high current valuations and the benchmark’s extreme concentration.

If market concentration was removed from the investment bank’s five-factor model, its return projection would rise to 7%, bringing its expectations into line with JP Morgan Asset Management.

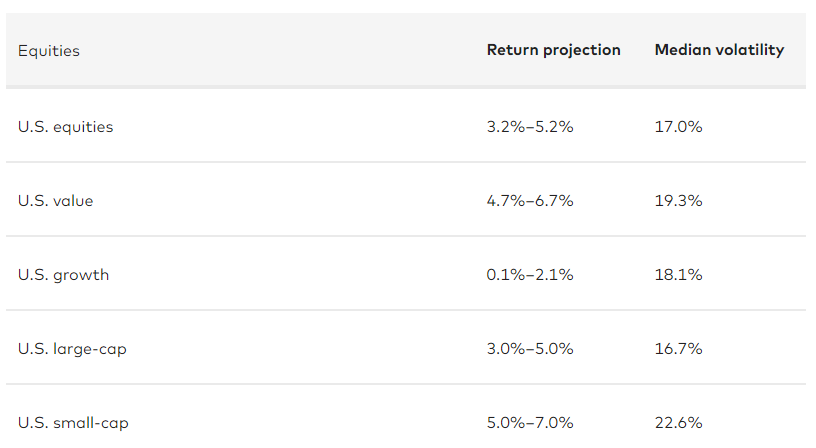

That would be at the optimistic end of forecasts from 21 asset managers, as the chart below illustrates. These managers’ 10-year return assumptions for US equities range from 4.4% to 7.4% with an average of 6%.

Asset managers’ forecasts for 10-year annualised returns from US equities

Source: Goldman Sachs Global Investment Research

The S&P 500’s 10 largest stocks now amount to 36% of the index, meaning the US equity market is close to its highest level of concentration in 100 years.

An extremely concentrated index reflects a less diversified set of risks so will probably be more volatile, said David Kostin, chief US equity strategist at Goldman Sachs.

The valuation premium for the S&P 500’s top 10 stocks – many of them mega-cap tech stocks – is the largest since the peak of the dot-com boom in 2000. They trade at a forward price-to-earnings ratio of 31x, compared to 19x for the other 490 stocks.

Concentration could dampen stock market returns over the long run if the largest companies falter. Historically, it has proven extremely difficult for companies to maintain high levels of sales growth and profit margins over sustained periods of time, Kostin said, not least because of government regulation.

Therefore, Goldman Sachs expects the equally weighted S&P 500 index to outperform its market-cap sibling in the coming decade by eight percentage points.

The UK and Europe should beat the US

JP Morgan Asset Management expects euro area equities to be the strongest regional performer, with annualised gains of 7.7% in sterling for the next 10-15 years. The UK won’t be far behind at 7%, while emerging markets follow at 6.4% in sterling terms.

Overall, global equities are likely to return 6.3% in sterling, with the US acting as a drag. Non-US markets offer more attractive valuations and should benefit from currency appreciation, JP Morgan Asset Management’s strategists said.

Vanguard also expects global developed markets ex-US to outperform and forecasts an even higher return of 7–9%. It thinks emerging markets will return 5.7%–7.7%.

Bonds versus equities

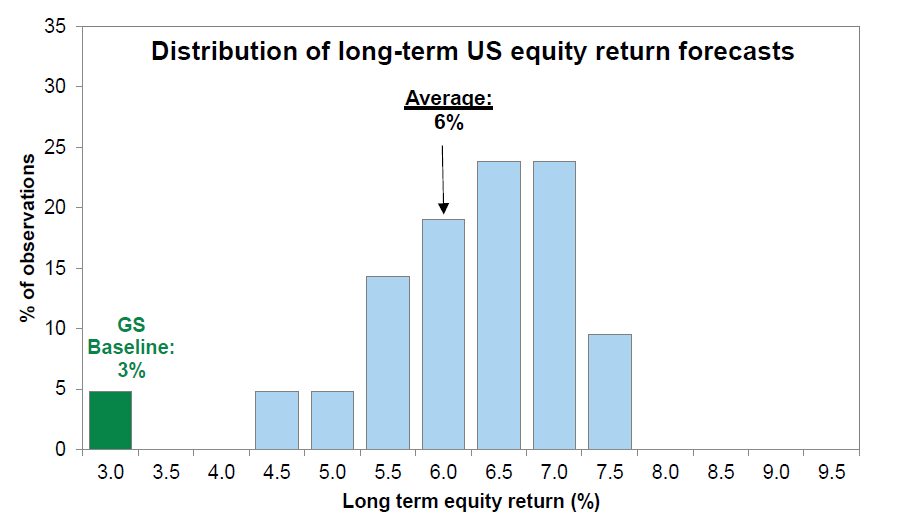

Given its low expectations for the US stock market, Goldman Sachs expects equities to lag 10-year US treasuries in the coming decade, as the chart below shows.

Probability that US equities will outperform government bonds and inflation, 2024-2034

Source: Goldman Sachs Global Investment Research

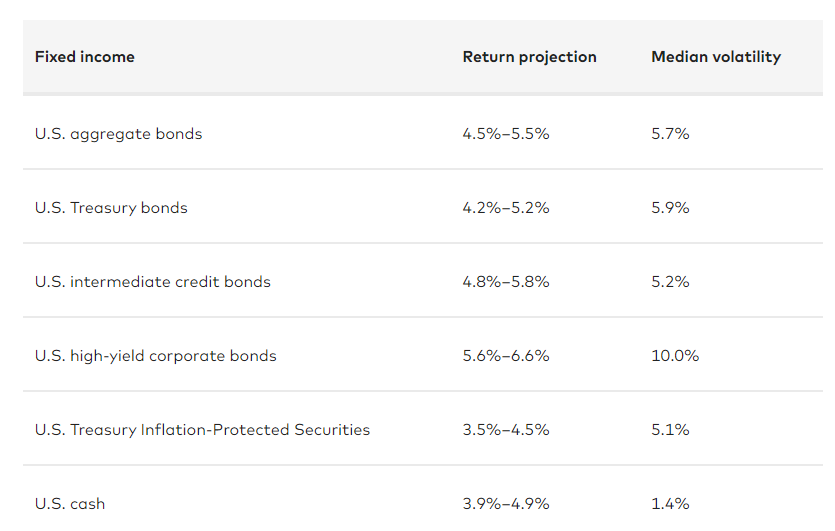

Vanguard however thinks the two asset classes will deliver broadly similar results and has forecast annual returns from US treasuries in the coming decade to be 4.2-5.2% versus 3.2-5.2% for US stocks.

Vanguard’s 10-year annualised nominal return and volatility forecasts for US fixed income

Source: Vanguard

JP Morgan Asset Management forecasts a 3% return from US intermediate treasuries, rising to 3.5% for long treasuries, both in sterling terms. The manager expects more from equities.

It also believes that a 60/40 stock/bond portfolio should return 5.5% per annum in sterling for the next 10-15 years.

Government versus corporate bonds

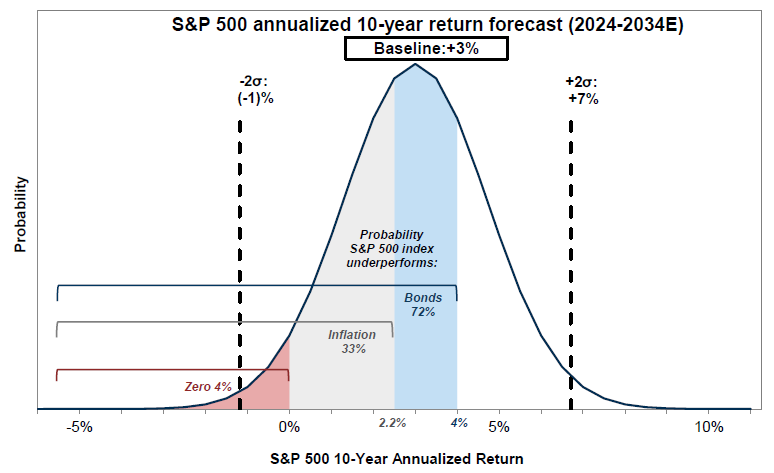

Government bonds are likely to give investment-grade corporate bonds a good run for their money in the coming decade.

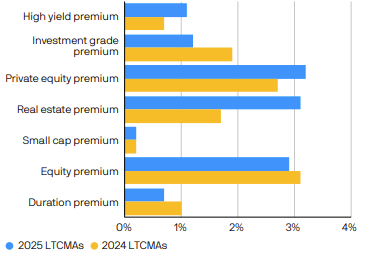

As the chart below shows, the risk premium for investment-grade bonds is shallow, reflecting tight spreads. It has dropped since JP Morgan Asset Management published last year’s set of long-term capital market assumptions (LTCMAs).

Return uplift (premia)

Source: JP Morgan Asset Management

JP Morgan Asset Management expects 10-year gilts to return 4.2% and 15-year gilts to deliver 5%. Slightly higher returns of 5.2% are available from UK investment-grade credit.

In Europe, 10-year government bonds should deliver 3.6% versus 4.2% for European investment-grade credit in sterling terms and 5.7% for European high-yield.

US intermediate Treasuries are expected to return 3%, compared to 4.2% for US investment-grade credit and 5.3% for high-yield; all these figures are unhedged and in sterling terms.

Vanguard believes that emerging market sovereign bonds will top the charts at 5.6%–6.6%.

JP Morgan Asset Management’s return assumptions for fixed income