Outside of certain overvalued pockets of the world, there are plenty of fairly priced opportunities and underestimated sectors, according to Jacob de Tusch-Lec, manager of the £1.5bn Artemis Global Income fund. When you know where to look, he argued, “actually, the world is quite cheap”.

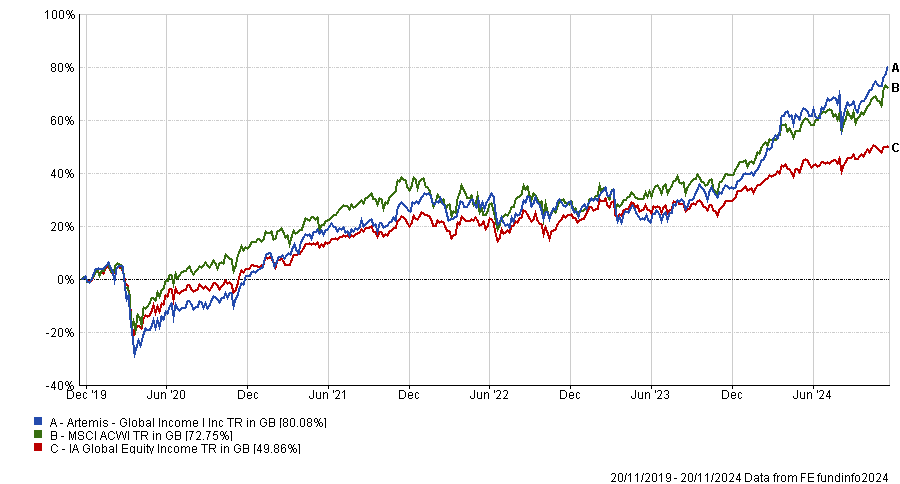

This philosophy has served de Tusch-Lec well, with his fund enjoying returns of 80.1% over five years, the third-best performance in the IA Global Equity income sector and surpassing the returns of the wider MSCI All Country World Index.

Performance of Artemis Global Income vs sector and benchmark over 5yrs

Source: FE Analytics

Source: FE Analytics

Below, de Tusch-Lec reflects on sectors and stocks with solid long-term growth potential that investors are still underestimating.

Banks

For de Tusch-Lec, banks are proving to be an attractive industry despite regulatory headwinds following the global financial crisis (GFC).

Since the GFC, de Tusch-Lec argued that banks have become so well-regulated and averse to lending they have effectively become flush with capital. As a result, they have been able to pay dividends and buy back their own shares in large quantities.

“We like banks because we think they are a lot safer and cheaper than people think,” de Tusch-Lec said.

HSBC, his third-largest holding, currently offers an attractive dividend yield of roughly 6.5%. Despite this, it trades well below book value.

Performance of HSBC over 5yrs

Source: Google Finance

Many European banks are valued at just 0.5x or 0.6x, which makes share buybacks value-enhancing. “You are essentially spending one pound or one euro to buy back something valued at 0.5x and when you cancel it, you have effectively made money out of nothing,” he explained.

“The biggest surprise is that we are ending 2024 and some banks have outperformed Microsoft. Who could have predicted that?”

Defence stocks

Capital expenditure is a major theme in the global equity income fund. Part of this allocation comes from defence-focused stocks, which have benefitted heavily from rising geopolitical tension. “Ukraine reminded Europe that war is at our doorstep,” de Tusch-Lec explained.

Moreover, he explained that defence stocks will continue to be relevant even if geopolitical conflicts begin to cool.

He said: “Hypothetically if the war stopped in Ukraine, does that mean countries wouldn’t spend on rebuilding inventory? No, it wouldn’t.”

Moreover, he noted defence spending was a major commitment of the UK’s recent budget. Chancellor Rachel Reeves pledged to spend at least 2.5% of GDP on defence and promised a further £2.9bn to the Ministry of Defence next year.

A great example of a stock playing on these trends is BAE Systems, the second-highest conviction holding in the portfolio.

Performance of stock over 5yrs

Source: Google Finance

Indeed, over the past half a decade, the stock has performed extremely well, surging in value by almost 125% with a 2.4% dividend yield.

The energy transition

The capex theme stretches beyond defence and into the energy transition.

“My argument is that there are things in society that we have not been spending enough money on in the past 20-30 years. We have spent more money on streaming services or lime scooters,” de Tusch-Lec said.

For example, the Western world has not invested enough in copper wiring, despite how crucial it will be for the next generation.

“You can call it a regime change. You could call it a Zeitgeist, but ultimately, we are now in a world where governments want to spend”, he said, and energy production will be a big beneficiary of that.

Italian copper cable manufacturer Prysmian has climbed by more than 210% in the past five years and de Tusch-Lec believes the stock is poised to take advantage of increasing demand for energy production and electricity.

Performance of Prysmian over 5yrs

Source: Google Finance

While he admitted that more investors are beginning to take note of the energy sector, it remains a very cyclical asset class. As a result, there are many businesses with great income at reasonable valuations.

“If we want to electrify our society, whether it’s electric vehicles, smart homes or even multi-story houses, there’s going to be much greater demand for these sorts of assets,” he explained.