Close to 30,000 people have fallen for investment scams over the past year but the chances of being taken in by fraudsters can be lowered by watching out for several vital clues, according to Hargreaves Lansdown.

Data from Action Fraud shows 27,225 cases of investment fraud were reported in the UK between September 2023 and September 2024, with losses reaching £524.7m. A typical investment scam revolves around criminals contacting people out of the blue and convincing them to invest in schemes or products that are worthless or do not exist.

Victoria Hasler, head of fund research at Hargreaves Lansdown, said: “Remember how your granny always told you that if something seems too good to be true then it probably is? You’d do well to apply this advice to investments too.

“Advertisements promising enticingly high returns, or guaranteed returns, or straight-line returns make us very nervous. Why? Because they could be scams.”

Below, we look at these four clues in more detail to see how they can help investors avoid being taken in by investment scams.

Clue 1: Investments promising returns that are higher than historical averages

The first thing to keep in mind, according to Hasler, is to be cautious when someone tells that they can get returns much higher than the historical average over the long run.

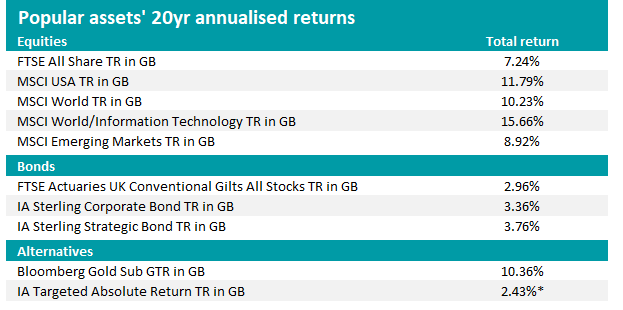

The below table shows the long-term annualised returns for some well-known assets to show the ballpark performance that investors can expect, keeping in mind that they will vary from year to year.

Source: FE Analytics to 30 Sep 2024. * 10yr annualised return

“If you are shown an investment and told it can achieve much higher returns than these then you might want to ask yourself why. We’re not saying that it’s impossible to get more than history might suggest, but a higher return is usually compensation for more risk,” Hasler said.

“You should also not panic if your investments return a lot more or less than these returns in any given year. Remember these are averages over 20-year periods and for any one year the returns are likely to be higher or lower than this.”

When presented with an investment opportunity, people should ask where exactly their money will be invested and then consult data like the above table to see if the promised returns seem realistic or not.

Clue 2: Investments with promised or guaranteed returns

“In this world nothing can be said to be certain, except death and taxes. So said Benjamin Franklin. He was referring to the American Constitution, but he could easily have been talking about investments,” Hasler continued.

“This one is easy – if anyone is absolutely, iron-clad guaranteeing you a return from anything other than cash, my advice would be to politely decline and run in the opposite direction as quickly as you can."

She pointed out that investments are not guaranteed; they compensate an investor for taking risk, but risk is always present. Even government bonds – seen as one of the safest assets – can (and occasionally do) default.

The closest to a risk-free investment is cash, but the returns on this are very low and, if savings are above the Financial Services Compensation Scheme’s £85,000 limit, remain at risk in the rare event of a bank collapse.

Clue 3: A journey that is too smooth

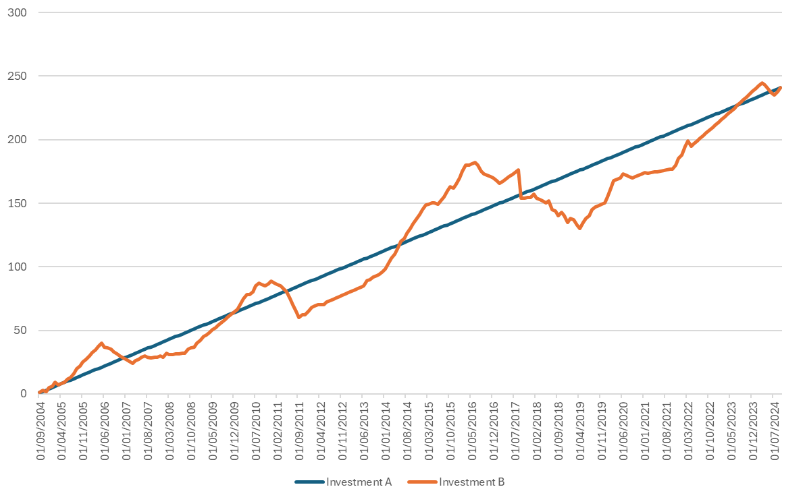

Hasler’s third clue to a scam is the promise that an investment has gone up in a smooth line. While investors hope that their investments will rise over the long run, this is never going to be in a straight line.

“Take a look at the historical return graph for the investment you are considering. Is the line going up in a straight or almost straight trajectory? Markets experience ups and downs, and your investments will too,” she said.

“If the return profile looks too good to be true, then it probably is. In the below illustrative chart, investment A may look attractive, but the path of investment B is a lot more realistic.”

Two hypothetical investments

Source: Hargreaves Lansdown

Clue 4: Bamboozingly complicated investments

The final guideline to avoiding potential investment scams is to not invest in something “horribly complicated” when there is a simple alternative.

Hasler said scammers often present very complicated investment strategies in the hope this will make them appear clever. However, if they cannot explain it in everyday language, then investors should avoid it.

“The problem is that if you don’t understand an investment, then it’s very difficult to tell if it is legitimate or a scam,” she concluded. “Does this rule mean that you could occasionally miss out on some good investments? Yes. Does it mean you also miss some horrible blow ups and scams? You bet.”