It’s not just ghosts and ghouls that are causing fear this Halloween – financial markets are also giving us plenty of reasons to be spooked. From crumbling consumer confidence to rising debt burdens, the economic landscape is littered with eerie signs of instability.

The five charts below from M&G Investments' Bond Vigilantes reveal unsettling trends in global markets. While surface-level data may look reassuring, a deeper dive shows that the scariest threats could be the ones lurking just out of sight.

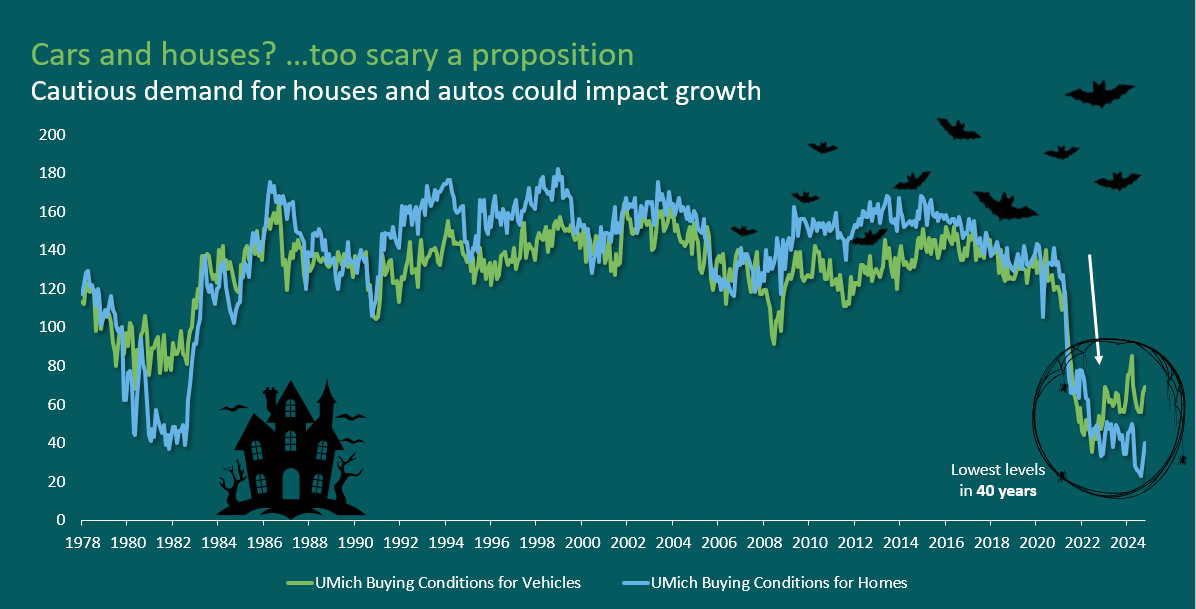

Cars and houses? … Too scary a proposition

According to University of Michigan surveys, consumers view this as the worst time in 40 years to buy a house or car – a worrying sign for consumer intent. Big purchases like these can be crucial drivers of economic growth and with buying intent so low, we could be underestimating the severity of the slowdown.

Sources: M&G, University of Michigan, Bloomberg, data to Oct 2024

As consumer intent wobbles, could the labour market be telling its own tale of uncertainty?

Employees frightened to quit; companies frightened to hire

The US labour market appears healthy, especially after September’s non-farm payrolls exceeded economists’ expectations and unemployment fell to 4.1%. However, beneath the surface, both hiring and quits rates have dropped to levels typically seen in recessions.

Sources: M&G, Bloomberg, data to Oct 2024

Companies are hesitant to hire full-time workers, and employees are reluctant to quit due to job security concerns and fewer opportunities available. These signs of weakness suggest that the effects of restrictive monetary policy may be more severe than the headline labour market numbers imply.

It may not be just the labour market – economic fragility is reverberating through the economy, driven by the enduring grip of monetary policy.

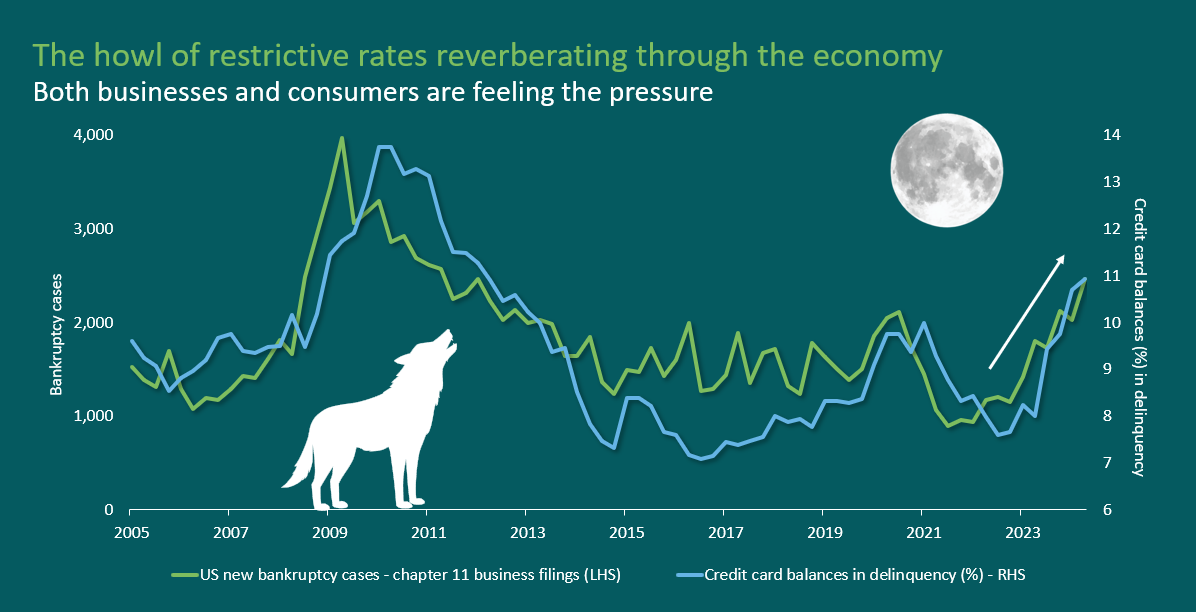

The howl of restrictive rates reverberating through the economy

Monetary policy was restrictive for a long time and since it works with a lag, its effects are only now becoming evident.

Although central banks have begun easing, policy remains more restrictive than what might be deemed neutral and this is impacting both businesses and consumers. In the US, Chapter 11 filings are rising steadily, while credit card delinquencies over 90 days are climbing to levels last seen following the global financial crisis.

Sources: M&G, Bloomberg, data to Oct 2024

Until monetary policy significantly loosens, these trends may continue to persist.

While economic and financial pressures mount, are all risks being priced into credit markets?

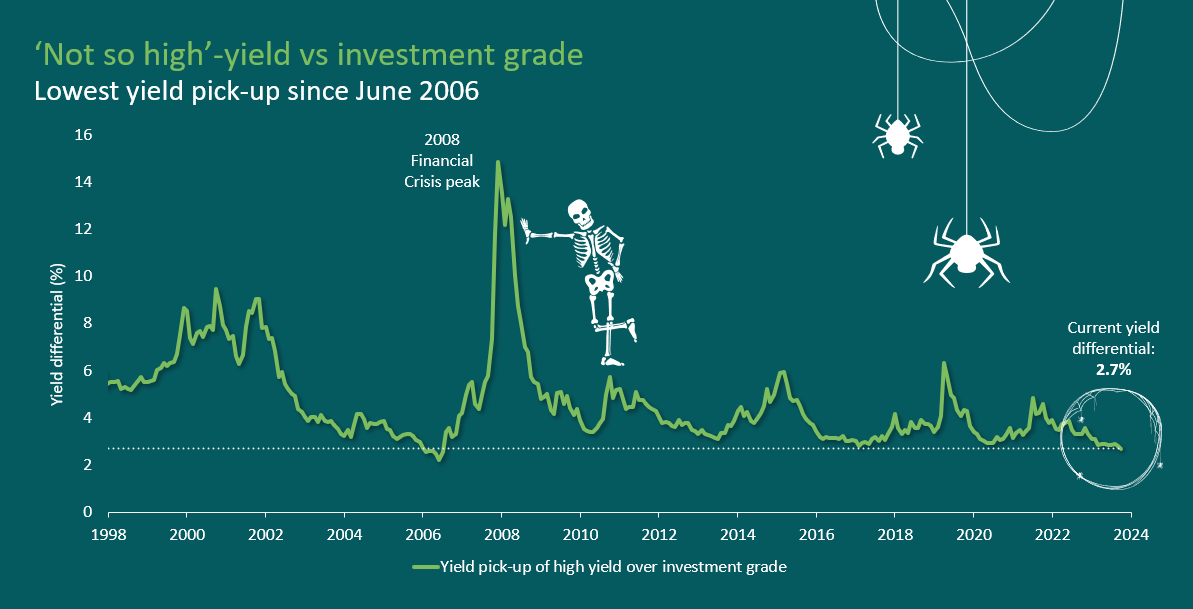

‘Not so high’-yield vs investment grade

Despite the unsettling warning signs, credit markets are pricing in minimal risk of a major slowdown, let alone a recession that could significantly impact credit fundamentals. In fact, the spread between investment grade and high-yield bonds has narrowed to just under 2.7% — the lowest level since 2006.

Could investors be underestimating the potential for economic turbulence ahead?

Sources: M&G, Bloomberg, data to Oct 2024

Beyond the bond markets, another haunting issue brews in the form of rising government debt…

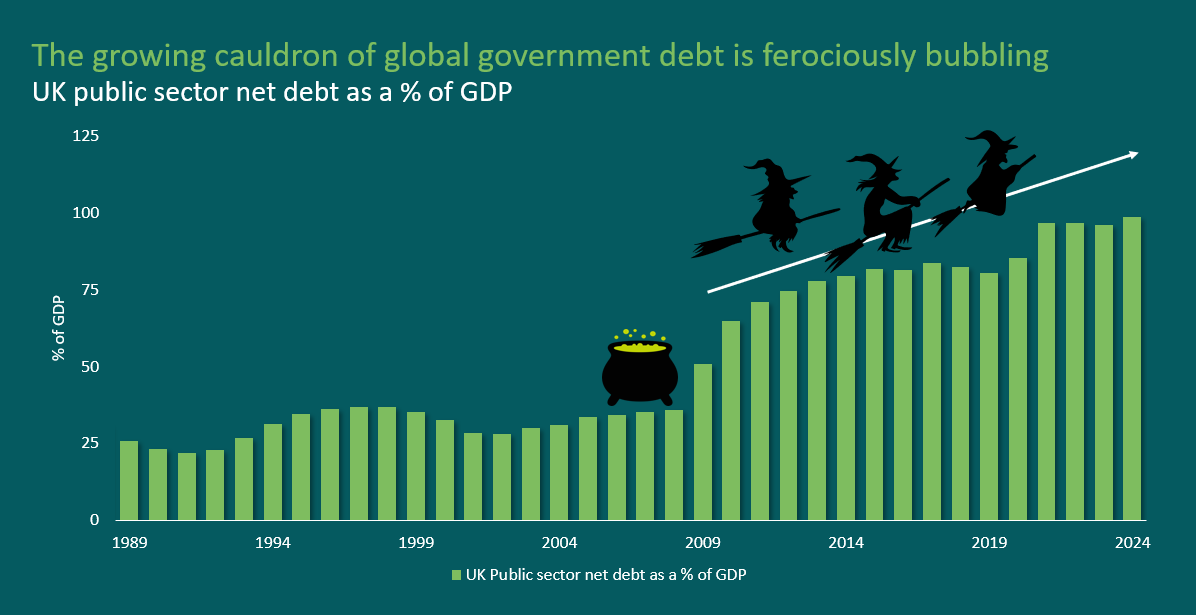

The growing cauldron of global government debt is ferociously bubbling

It’s no surprise that global government debt levels have been steadily rising, but it’s worth highlighting how concerning this trend is. In the UK, for example, public sector net debt as a percentage of GDP is alarmingly high.

Sources: M&G, Bloomberg, data to Oct 2024

High debt can impact growth by diverting government spending away from productive investments toward debt servicing. It may also force central banks to consider fiscal risks when raising interest rates, as aggressive hikes could destabilise public finances.

With current debt levels resembling those seen during recessions, will governments be able to respond when the next downturn hits?

Joe Sullivan-Bissett is a fixed income investment director at M&G Investments. The views expressed above should not be taken as investment advice.